United States Securities and Exchange Commission

Washington, D.C. 20549

NOTICE OF EXEMPT SOLICITATION

Pursuant to Rule 14a-103

United States Securities and Exchange Commission

Washington, D.C. 20549

NOTICE OF EXEMPT SOLICITATION

Pursuant to Rule 14a-103

Name of the Registrant: United Parcel Service Inc.

Name of persons relying on exemption: The Shareholder Commons, Inc.

Address of persons relying on exemption: PO Box 7545, Wilmington, Delaware 19803-7545

Written materials are submitted pursuant to Rule 14a-6(g) (1) promulgated under the Securities Exchange Act of 1934. Submission is not required of this filer under the terms of the Rule but is made voluntarily in the interest of public disclosure and consideration of these important issues.

BALANCING CLIMATE MITIGATION AND FINANCIAL RETURNS:

A REBUTTAL TO THE UPS BOARD

WE URGE SHAREHOLDERS TO VOTE “FOR” ITEM 8 OF THE UPS PROXY

The Shareholder Commons urges you to vote “FOR” Item 8 on the proxy, the shareholder proposal requesting that the Board of United Parcel Service Inc. (“UPS” or the “Company”) commission and publish a report on greenhouse gas (GHG) emissions that addresses its prioritization of its financial performance over mitigating the broader economic risks of climate change and any consequent threat to the portfolios of its diversified shareholders.

The Shareholder Commons is a non-profit organization that works with investors to stop portfolio companies from prioritizing enterprise value when doing so threatens the value of investors’ diversified portfolios.

A. The Proposal

The Proposal asks for a report on the extent to which UPS, in addressing its GHG emissions, is prioritizing its own financial returns and how such prioritization may lead to costs and risks that threaten the interests of shareholders who rely on a thriving economy to support their diversified portfolios’ value:

RESOLVED, shareholders ask the board to commission and publish a report on (1) the extent (if any) to which Company decisions involving greenhouse-gas emissions reduction prioritize Company financial performance over the environmental costs and risks of climate change and (2) the manner in which any consequent environmental costs and risks threaten returns of diversified shareholders who rely on a stable and productive economy.

For the diversified investors who make up a large portion of UPS shareholders, the cost of climate change may very well outweigh any profits the Company receives from decisions that lead to more GHG emissions than UPS might otherwise produce. The Proposal asks UPS to explain how it balances these competing interests so that shareholders can understand the true cost Company decisions impose on them. UPS’s own disclosures reveal that this tension is not in question.

SUPPORTING THE PROPOSAL SIGNALS THAT YOU WANT TO UNDERSTAND HOW UPS’S FOCUS ON ITS OWN FINANCIAL RETURNS MAY BE HARMING DIVERSIFIED INVESTORS.

Voting “FOR” Item 8 does not constitute a criticism of UPS’s business decisions or efforts to date. Indeed, management may believe it has a mandate to prioritize enterprise value over carbon reduction. The requested report is intended to allow shareholders to understand whether that is the case, and if so, how UPS is striking the balance on shareholders’ behalf between its enterprise value and the economy on which diversified investment portfolios rely.

Without the report the Proposal requests, shareholders will not be equipped to understand the true cost of Company decisions with respect to greenhouse gas reduction goals and capital allocation. Furthermore, diversified investors and the fiduciaries who vote on their behalf will not have the information required to determine the effects Company decisions have on shareholders’ investment portfolios.

| B. | The Proposal will help UPS and its shareholders navigate the difficult balance between maximizing enterprise value and limiting the risks and costs associated with climate change |

Transportation and energy infrastructure still rely on fossil fuels. As such, a global logistics leader such as UPS must continue to emit GHG in the near term to provide services that are critical to its customers and the world’s economy.

| 2 |

Despite this reality, UPS has exhibited leadership in reducing and disclosing GHG. However, as with any for-profit business enterprise, UPS's ambition to improve its environmental impact may face perceived constraints on the extent to which such improvements threaten profitability. For example, maximally reducing carbon footprint may increase prices, resulting in lost sales. Alternatively, the reinvestment of profits necessary to achieve a more rapid reduction in emissions might not yield the financial return the Company targets.

If UPS management seeks to optimize the financial value of the Company for shareholders, they may feel constrained to trade off emissions reductions for profits. Unfortunately for shareholders, UPS appears to have made this trade-off, limiting the extent of its carbon reduction efforts to preserve current enterprise value, as demonstrated by the following shortcomings:

1. UPS’s announced goals fail to align with the recommended path to necessary GHG reduction

UPS has set GHG reduction goals that are far below the bar corporations must meet to provide the best reasonable chance of limiting global warming to 1.5℃ as contemplated by the Paris Agreement;1 staying within this boundary could prevent the much more severe effects that would follow an increase of 2.0℃ or more, as the Intergovernmental Panel on Climate Change details.2

UPS discloses the following goals designed to reach “carbon neutrality” by 2050:3

| · | By 2025: |

| § | 25% renewable electricity for facilities |

| § | 40% alternative fuel purchases as a percent of total ground fuel |

| · | By 2035: |

| § | 30% sustainable aviation fuel |

| § | 100% renewable electricity for facilities |

| § | 50% reduction in CO2 per package delivered for global small package (2010 baseline)4 |

| · | By 2050: |

| § | Carbon neutrality |

UPS’s 2050 headline of “carbon neutrality” obscures the extent to which UPS plans to reduce the emissions in its value chain. In fact, the Company’s reporting suggests it may only be addressing its own emissions, not those of its suppliers or customers. Its disclosure states:

_____________________________

1 https://unfccc.int/process-and-meetings/the-paris-agreement/the-paris-agreement

2 https://www.ipcc.ch/sr15/chapter/spm/

3 https://about.ups.com/content/dam/upsstories/assets/reporting/sustainability-2021/2020_UPS_TCFD_Report_081921.pdf

4 Id.

| 3 |

“These milestones are set to help UPS reach the overall goal of being carbon neutral by 2050. Basically, this means that all UPS’s actions that release emissions are becoming cleaner and more efficient every day.”5

Furthermore, it is not clear what percentage of this “neutrality” comes from actual emissions reductions, rather than the use of offsets, which are credits a company may use by funding activity that otherwise reduces atmospheric concentration.6 Many offsetting schemes such as tree-planting initiatives have proved to be more magical thinking than panacea.7

Finally, UPS provides no overall interim targets for emissions reductions or neutrality. These omissions call into question UPS’s commitment to Paris Agreement-aligned practices, although UPS is not different from most other large corporations in this respect.8

The mileposts UPS provides apply to isolated, cherry-picked parts of its business, and simply fail to provide insight into the likelihood that UPS is anywhere close to doing its fair share to mitigate the risk to the world’s economy of increasing atmospheric GHG concentration.9

We are not alone in believing UPS is doing far less than necessary, as the views of other well-recognized organizations and advisories demonstrate. Ceres, an organization known for establishing the path necessary for corporations to act in line with the Paris Agreement, recommends that companies set targets that will enable them to reach 50 percent reductions in absolute emissions by 2030:

_____________________________

5 https://about.ups.com/us/en/our-stories/innovation-driven/a-deeper-dive--sustainability-at-ups-.html (Emphasis added.)

6 In fact, the Company previously did set absolute reduction targets, which do not rely upon offsets; in 2015, it set an absolute emissions reduction target of 12 percent across its ground operations. By 2020, its absolute ground-based emissions had risen 13.2 percent. See UPS GRI Content Index (“GRI Report”), Section 302. In response to this development, UPS shifted to long-term targets that eschewed absolute emission-reduction measurements: “We have broadened our planning horizons to focus on carbon neutrality by 2050.” Id. (emphasis added).

7 Kate Yoder, “Does planting trees actually help the climate? Here’s what we know.” Grist (March 29, 2022), available at https://grist.org/science/does-planting-trees-actually-help-climate-change/.

8 See Corporate Climate Responsibility Monitor, available at https://newclimate.org/wp-content/uploads/2022/02/CorporateClimateResponsibilityMonitor2022.pdf (defining “good practice” for carbon neutrality goals as including specific interim emission reduction targets, with the first target no more than five years out, and covering upstream and downstream emissions).

9 Nor is it clear that the listed milestones will reflect “best practice.” For example, it is not clear what method UPS will use to determine that it has met the goals of 25% and 100% renewable electricity in its facilities; its current reports on Scope 2 emissions (i.e., electricity used at its facilities) use the market-based method (which relies on UPS’s specification of source within its supply contracts), even though the location-based method of calculation (which looks to the average intensity on the grid from which the user draws) generates a higher amount of emissions. See GRI Report, Appendix B. https://about.ups.com/content/dam/upsstories/assets/reporting/sustainability-2021/2020_UPS_GRI_Content_Index_081921v2.pdf. The NewClimate Institute recommends using the higher of these two measurements to avoid misleading reporting. See supra, n.7.

| 4 |

Set targets for Scope 1, Scope 2 and Scope 3 GHG emissions reduction with clear and ambitious short and medium-term milestones to limit warming to 1.5 ºC and achieve at least a 50% reduction in absolute emissions by 2030.10

The Boston Consulting Group called for similar ambitions specifically from the transportation and logistics industry:

But the few goals that companies [in the transportation and logistics industry] have established are too low: transportation companies are targeting, on average, a 30% emissions reduction by 2030, whereas the 1.5°C scenario requires a 50% drop across the industry by that year and a 100% decrease by 2050.11

Despite these recommendations, UPS has not even met the low average of its industry with respect to a 2030 goal, let alone the 100 percent reduction goal for 2050.

We believe there is a significant gap between UPS’s publicly disclosed goals and the goals promoted by respected organizations with deep climate expertise. This gap suggests that UPS has chosen not to take steps most likely to help mitigate the economy-wide risks associated with climate change. A reasonable explanation for this decision is that the Company approach to carbon reduction does not prioritize economy-wide risk mitigation, but instead focuses on the risks to its own business.

2. UPS’s risk-management processes focus on the effect climate change has on its business, not the impact its emissions have on the climate or the economy

UPS reports on how it assesses climate risk based on the model promulgated by the Taskforce on Climate-Related Financial Disclosures (the “TCFD Report”).12 In the TCFD Report, UPS describes what it sees as climate-related risks:

UPS acknowledges that our operations are and will be directly affected by the physical and transitional risks created by climate change. Although climate-related risks and opportunities are integrated into our overall risk management matrix, a more thorough analysis will be completed to project monetary values and time horizons on climate change risks. This analysis will be completed in the near future.

_____________________________

10 https://roadmap2030.ceres.org/ai-expectation/ghg-emissions-reduction-and-carbon-removal

11 https://www.bcg.com/publications/2020/climate-action-pays-off-in-transportation-and-logistics

12 https://about.ups.com/content/dam/upsstories/assets/reporting/sustainability-2021/2020_UPS_TCFD_Report_081921.pdf

| 5 |

Severe weather conditions or other natural or manmade disasters, including storms, floods, fires and earthquakes have in the past and may in the future disrupt our business and result in decreased revenues. Customers may reduce shipments or our costs to operate our business may increase, either of which could have a material adverse effect on us. Any such event affecting one of our major facilities could result in a significant interruption in or disruption of our business. As we complete future climate-related scenarios, more defined risks and opportunities in our business strategy and financial planning may be identified.13

As this excerpt illustrates, in analyzing the risks associated with climate change, UPS only examines costs it may internalize. It does not have a system in place to mitigate the risks its GHG emissions pose to the economy, other companies, or its investors who have diversified portfolios.

This focus on risks posed to UPS, rather than risks that UPS’s emissions impose on the economy, is reiterated in the section of the TCFD Report in which it describes the process management uses to identify climate risk:

Risks, including climate change, are assessed at both a Company level and an asset level and managed through a matrix which was developed to quickly estimate risk severity on the basis of relative likelihood and operational impact. Risks to the network and supporting processes are evaluated and mitigated based on both asset cost and impact to the network’s functionality, inclusive of facilities and equipment. Extensive risk-scenario planning is conducted within the air and ground networks to evaluate potential disruption in key operating facilities from a variety of risk sources, including climate change issues related to weather and/or natural disasters and change in governmental policies. UPS’s Business Continuity Group ensures that alternative plans are in place for when disruptions occur. Because of UPS’s unique network, risks often generate opportunities. UPS has designed its extensive network capabilities to minimize the impact of climate change disruptions affecting certain locations. This allows UPS to capitalize on its abilities in those affected locations.14

3. UPS does not explain how its capital allocation decisions factor in its GHG reduction strategy

In its most recent earnings call, UPS disclosed that its 2022 capital budget would be $5.5 billion and that $1 billion of that would “support our carbon-neutral goals,”15 which suggests that more than 80 percent of its capital (which includes $4.7 billion allocated to aircraft, vehicles, buildings, and facilities) is allocated to projects that do not support carbon neutrality.

At the same time, UPS announced a target rate of return on invested capital of more than 30 percent,16 leaving unanswered the question of whether UPS could have allocated more of its capital budget to climate-oriented investments but chose not to do so to preserve its targeted return rate.

_____________________________

13 TCFD Report, Items 2(a) and (b) (emphasis added).

14 TCFD Report, Item 3(a) (emphasis added).

15 UPS 2021 Q4 earnings call transcript, available at https://www.fool.com/earnings/call-transcripts/2022/02/01/united-parcel-service-ups-q4-2021-earnings-call-tr/

16 UPS 2021 Q4 Earnings call slide presentation, p 11, available at https://investors.ups.com/_assets/_8393ab2ff553e5eddda5f6811b733b48/ups/db/1111/10553/file/4Q21+Earnings+Deck+Final.pdf

| 6 |

Additionally, while UPS announced it is targeting $6 billion in payments to shareholders through dividends and share repurchases in 2022, it did not explain whether any of that cash could instead be used to reduce UPS’s carbon footprint, nor what the effect on diversified shareholders might be if it fails to deliver on its emissions-reduction goals. The report the Proposal requests would answer those questions.

4. UPS’s political influence activities do not to align with a goal of meeting the Paris Agreement

UPS has an executive who sits on the Board of the U.S. Chamber of Commerce, which opposes legislation to address the climate crisis.17 A recent report detailed the organization’s 20-year campaign to deny the climate crisis.18

UPS is also apparently19 a member of the American Legislative Council (“ALEC”), an organization driving a current campaign to have states boycott businesses that address climate change.20

C. Climate change threatens the returns of UPS’s diversified investors

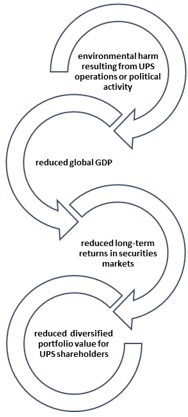

As shown in Figure 1, UPS’s choices that harm the environment threaten its diversified shareholders’ financial returns, even if those decisions might benefit UPS financially.

_____________________________

17 https://grist.org/accountability/report-corporations-are-tanking-americas-best-shot-at-fighting-climate-change/

18 Cole Triedman, Chamber of Obstruction: The U.S. Chamber of Commerce’s’ Shifting Discourses on Climate Change, 1989-2009, Brown University Climate and Development Lab (2021).

19 UPS does not disclose its membership in tax-exempt organizations but was reported to be a member of ALEC in a shareholder proposal filed last year. See Notice of 2021 Annual Meeting of Shareowners and Proxy Statement, Proposal 5, available at https://www.sec.gov/Archives/edgar/data/1090727/000120677421000883/ups_courtesy-pdf.pdf.

20 Kate Aronoff, The Conservative Plot Against Green Investment, The New Republic, (Jan. 4, 2022), available at https://newrepublic.com/article/164916/alec-esg-fossil-fuel-investment.

| 7 |

FIGURE 1

UPS’s disclosures suggest that its strategy and capital allocation are not on track to ensure that its GHG emissions are in line with the Paris Agreement. Given the Company’s operational focus on enterprise value and limited allocation of capital toward carbon neutrality, shareholders must ask UPS critical questions: Is UPS improving its own financial value by doing less than it should to address climate change? If so, how does that affect its diversified shareholders?

Investors must ask these critical questions because a healthy economy is a far greater value driver to their portfolios than is the enterprise value of any one company within those portfolios: systematic factors explain 75-94 percent of average portfolio return.21 More specifically, as Figure 1 illustrates, if carbon emissions stay on the current trajectory rather than aligning with the Paris Agreement, there is a significant risk that GDP will be 10 percent less in 2050,22 creating a corresponding 10 percent threat to diversified portfolios.23

_____________________________

21 Jon Lukomnik and James P. Hawley, Moving Beyond Modern Portfolio Theory: Investing that Matters (April 30, 2021) Routledge.

22 Swiss Re Institute, The Economics of Climate Change: No Action Not an Option (April 2021) (Up to 9.7% loss of global GDP by mid-century if temperature increase rises on current trajectory rather than Paris Agreement goal) available at https://www.swissre.com/dam/jcr:e73ee7c3-7f83-4c17-a2b8-8ef23a8d3312/swiss-re-institute-expertise-publication-economics-of-climate-change.pdf.

23 Principles for Responsible Investment & UNEP Finance Initiative, Universal Ownership: Why Environmental Externalities Matter to Institutional Investors, Appendix IV, https://www.unepfi.org/fileadmin/documents/universal_ownership_full.pdf.

| 8 |

D. In its opposition statement, UPS either fails to understand or refuses to acknowledge the point

UPS may be making decisions regarding its climate goals, risk management structures, capital allocation, and political activity that prioritize enterprise value over the impact its GHG emissions have on the climate and, by extension, its diversified shareholders’ portfolios.

UPS’s statement opposing the Proposal does not contemplate the trade-offs the Proposal seeks to address. In fact, UPS seems to deny the trade-off exists:

We believe that seeking to maximize shareholder value necessarily takes into account the interests of all stakeholders.

In other words, the Board is relying on the premise that by focusing on the risks that environmental concerns pose to UPS, it can fully address the risks its operations and political activity pose to environmental health and the diversified shareholders who rely upon it.

As we have shown, this idea of full alignment is a fantasy, and shareholders know it. PRI, an investor initiative whose members have $89 trillion in assets under management, recently issued a report (the “PRI Report”) that explained how the interests of a diversified shareholder and a portfolio company can diverge in precisely the ways described above:

| · | A company strengthening its position by externalising costs onto others. The net result for the [diversified] investor can be negative when the costs across the rest of the portfolio (or market/economy) outweigh the gains to the company; |

| · | A company or sector securing regulation that favours its interests over others. This can impair broader economic returns when such regulation hinders the development of other, more economic companies or sectors…24 |

_____________________________

24 Active Ownership 2.0: The Evolution Stewardship Urgently Needs, PRI (2019) (emphasis added), available at https://www.unpri.org/download?ac=9721. See also Addressing Climate as a Systemic Risk: A call to action for U.S. financial regulators, Ceres (June 1, 2020), available at https://www.ceres.org/resources/reports/addressing-climate-systemic-risk. (“The SEC should make clear that consideration of material environmental, social and governance (ESG) risk factors, such as climate change, to portfolio value is consistent with investor fiduciary duty.”) Ceres is a non-profit organization with a network of investors with more than $29 trillion under management.

| 9 |

This is what happens when UPS decides to limit GHG reduction efforts to maintain a 30 percent return on invested capital or to support trade associations that hinder climate regulation.

Highlighting this divergence of interests is not an indictment of UPS’s Board or management. It is simply an honest description of the current state of affairs. If UPS refuses to acknowledge these plain facts, there is little chance it will be able to work constructively with its shareholders to strike the right balance.

E. Why you should vote “FOR” the Proposal

Voting “FOR” the Proposal will signal to UPS that shareholders want to understand whether the Company is putting the global environment (and thus their diversified portfolios) at risk in order to improve UPS’s financial performance.

Additionally:

| · | UPS’s business contributes to increased GHG concentrations in the atmosphere, and thus ti increasing global temperatures, which create an economy-wide risk that poses a threat to diversified shareholders. |

| · | UPS disclosures show that it is not taking the actions that are required of corporations seeking to be part of the solution to climate change risk. In fact, UPS is allocating more than 80 percent of its capital budget to projects that do not support carbon neutrality. |

| · | UPS’s decision-makers—who are heavily compensated in equity—do not share the same broad market risk as UPS’s diversified shareholders. |

| · | The Proposal only asks for an analysis, not a change in practice. Any trade-offs of economy-wide risk for narrow Company financial gain must be explained, so that shareholders can reach informed views about UPS’s balance between promoting internal financial return and maintaining the economic health that supports their diversified portfolios. |

Conclusion

Vote “FOR” Item 8

By voting “FOR” Item 8, shareholders can urge UPS to account directly for the environmental impacts of its operations and political activities, which directly affect diversified shareholders’ returns. Such a report will aid the UPS Board and management to authentically serve the needs of shareholders while preventing the dangerous implications to shareholders and others of a narrow focus on financial return.

The Shareholder Commons urges you to vote FOR Item 8 on the proxy, the Shareholder Proposal requesting a report on external environmental costs at the UPS Inc. Annual Meeting on May 5, 2022.

| 10 |

For questions regarding the UPS Inc., Proposal submitted by Myra Young, please contact Sara E. Murphy, The Shareholder Commons at +1.202.578.0261 or via email at sara@theshareholdercommons.com.

THE FOREGOING INFORMATION MAY BE DISSEMINATED TO SHAREHOLDERS VIA TELEPHONE, U.S. MAIL, E-MAIL, CERTAIN WEBSITES, AND CERTAIN SOCIAL MEDIA VENUES, AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE OR AS A SOLICITATION OF AUTHORITY TO VOTE YOUR PROXY.

PROXY CARDS WILL NOT BE ACCEPTED BY FILER NOR BY THE SHAREHOLDER COMMONS.

TO VOTE YOUR PROXY FOLLOW THE INSTRUCTIONS ON YOUR PROXY CARD.

11