UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

FOR ANNUAL AND TRANSITION REPORTS

PURSUANT TO SECTIONS 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Mark One)

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2007

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-15451

United Parcel Service, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 58-2480149 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| 55 Glenlake Parkway, N.E. Atlanta, Georgia | 30328 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

(404) 828-6000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Class B common stock, par value $.01 per share |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

Class A common stock, par value $.01 per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer”, “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. Check one:

Large accelerated filer þ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the class B common stock held by non-affiliates of the registrant was approximately $49,523,505,067 as of June 30, 2007. The registrant’s class A common stock is not listed on a national securities exchange or traded in an organized over-the-counter market, but each share of the registrant’s class A common stock is convertible into one share of the registrant’s class B common stock.

As of February 14, 2008, there were 342,043,020 outstanding shares of class A common stock and 692,320,301 outstanding shares of class B common stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its annual meeting of shareowners scheduled for May 8, 2008 are incorporated by reference into Part III of this report.

PART I

| Item 1. | Business |

Overview

United Parcel Service, Inc. (“UPS”) is the world’s largest package delivery company, a leader in the U.S. less-than-truckload industry, and a global leader in supply chain management. We were founded in 1907 as a private messenger and delivery service in Seattle, Washington. Today, we deliver packages each business day for 1.8 million shipping customers to 6.1 million consignees in over 200 countries and territories. In 2007, we delivered an average of 15.75 million pieces per day worldwide, or a total of 3.97 billion packages. Total revenue in 2007 was $49.7 billion.

Our primary business is the time-definite delivery of packages and documents worldwide. In recent years, we have extended our service portfolio to include less-than-truckload transportation, primarily in the U.S., and supply chain services. We report our operations in three segments: U.S. Domestic Package operations, International Package operations, and Supply Chain & Freight operations.

| • | U.S. Domestic Package. U.S. Domestic Package operations include the time-definite delivery of letters, documents, and packages throughout the United States. |

| • | International Package. International Package operations include delivery to more than 200 countries and territories worldwide, including shipments wholly outside the United States, as well as shipments with either origin or distribution outside the United States. |

| • | Supply Chain & Freight. Supply Chain & Freight includes our forwarding and logistics operations, UPS Freight, and other related business units. Our forwarding and logistics business provides services in more than 175 countries and territories worldwide, and includes supply chain design and management, freight distribution, customs brokerage, mail and consulting services. UPS Freight offers a variety of less-than-truckload (“LTL”) and truckload (“TL”) services to customers in North America. Other business units within this segment include Mail Boxes, Etc. (the franchisor of Mail Boxes, Etc. and The UPS Store) and UPS Capital. |

Transportation and Infrastructure. We operate a ground fleet approximately 100,000 vehicles, which reaches all business and residential zip codes in the contiguous U.S. We also operate an air fleet of about 600 aircraft, the ninth largest airline in the world. Our primary air hub is in Louisville, KY. Regional air hubs are located in Columbia, SC; Dallas, TX; Hartford, CT; Ontario, CA; Philadelphia, PA; and Rockford, IL. Our largest international air hub is in Cologne, Germany, with other regional international hubs in Hong Kong, Singapore, Taiwan, Miami, FL and Pampanga, Philippines.

We have established a global transportation infrastructure and a comprehensive portfolio of services. We support these services with advanced operational and customer-facing technology. Our supply chain solutions enable customers’ inventory to move more effectively. As a consequence, they can concentrate on their own core competencies.

Outlook. We believe that the following trends will allow us to continue to grow our business:

| • | Globalization of trade is a worldwide economic reality, which will continue to expand as trade barriers are eliminated and large consumer markets, in particular China, India and Europe, experience economic growth. |

| • | Package shipments will increase as a result of just-in-time inventory management, greater use of the Internet for ordering goods, and direct-to-consumer business models. |

| • | Outsourcing supply chain management is becoming more prevalent, as customers increasingly view effective management of their supply chains as a strategic advantage rather than a cost center. |

1

Our vision for the future is to synchronize the world of commerce, addressing the complexities of our customers’ supply chain needs. Our goal is to develop business solutions that create value and competitive advantages for our customers, enabling them to achieve supply chain efficiencies, better customer service for their customers and improved cash flow.

Operations

We believe that our integrated global network is the most extensive in the industry. It is the only network that handles all levels of service (air, ground, domestic, international, commercial, residential) through one integrated pickup and delivery service system.

U.S. Domestic Package

The U.S. business consists of air and ground delivery of small packages—up to 150 pounds in weight—and letters to and from all 50 states. It also provides guaranteed, time-definite delivery of certain heavy-weight packages. Substantially all of our U.S. small package delivery services are guaranteed.

This business is built on an integrated air and ground pick-up and delivery network. We believe that this model improves productivity and asset utilization, and provides the flexibility to transport packages using the most reliable and cost-effective transportation mode or combination of modes.

In 2006, we made the most significant upgrade ever to our U.S. ground package delivery network, accelerating the transit times for more than a half-million packages nationwide by one day or more. Additional lane enhancements were introduced in February 2008.

We believe that our broad product portfolio, reliable package delivery service, experienced and dedicated employees and unmatched, integrated air and ground network provide us with the advantages of reputation, service quality and economies of scale that differentiate us from our competitors. Our strategy is to increase domestic revenue through cross-selling services to our large and diverse customer base, to limit the rate of expense growth, and to employ technology-driven efficiencies to increase operating profit.

International Package

The International Package segment provides air and ground delivery of small packages and letters to 200 countries and territories around the world. Export services cross country boundaries; domestic services move shipments within a country’s borders. UPS’s global presence grew out of its highly refined U.S. domestic business.

| • | Europe is our largest region outside the United States—accounting for approximately half of our international revenue. In Europe we provide both express and domestic service, much like the service portfolio we offer in the U.S., and based on the same integrated network. |

| • | Through more than two dozen alliances with Asian delivery companies that supplement company-owned operations, we currently serve more than 40 Asia Pacific countries and territories. Two of the fastest growing economies in the world, China and India, are among our most promising opportunities. |

| • | Our Canadian operations include both domestic and import/export capabilities. We deliver to all addresses throughout Canada. We are also the largest air cargo carrier and a leading logistics provider in Latin America and the Caribbean. |

We have built a strong international presence through significant investments over several decades. Some of our recent acquisitions and investments include the following:

| • | In 2005, we acquired Stolica in Poland and Lynx Express in the United Kingdom. These acquisitions strengthened our European network, increasing package delivery density, and hence, productivity, in these geographic areas. |

2

| • | In 2006, to capitalize on growth opportunities across the whole of Europe, we completed the expansion of our automated package sorting hub at the Cologne/Bonn airport in Germany. The expansion doubled the hub’s sorting capacity to 110,000 packages per hour, largely through the use of new automation technology. |

| • | In 2007, we implemented the largest service expansion of our international shipping portfolio in more than a decade. UPS began offering customers three, rather than two, daily time-definite delivery options to and from the world’s most active trading markets, giving customers greater flexibility in managing their businesses. |

Growth in Asia is being driven by global demand, which is stimulating improved demographic and economic trends throughout the region, particularly in China and India. Over the last few years UPS has steadily increased air service between the U.S. and Asia.

| • | In 2005, UPS became the first U.S. airline to launch non-stop service between the U.S. and Guangzhou, which is located in one of China’s fastest growing manufacturing regions. We also launched express delivery service for customers within China. |

| • | In 2006, we added another three daily flights between Shanghai, China and the U.S., and another new flight between Qingdao, China and Incheon, Korea. We also began direct air service between Shanghai and Cologne. Those flights support international express volume into and out of China, which has seen dramatic growth in recent years. |

| • | In 2007, we added six daily flights between the U.S. and Nagoya, Japan. This new service complements our 78 weekly flights into and out of Tokyo and Osaka, Japan. These flights will connect to Shanghai in 2008, enhancing intra-Asia service. |

| • | In 2007, we also announced plans for a new air hub in Shanghai, the first constructed in China by a U.S. carrier. Scheduled to open in 2008, it will link all of China via Shanghai to UPS’s international network with direct service to the Americas, Europe and Asia. It also will connect points served in China by UPS. Once this hub is operational, we will have the ability to add an unlimited number of flights between the U.S. and Shanghai. |

The international package delivery market has been growing at a faster rate than that of the U.S., and our international package operations have historically been growing faster than the market. We plan to use our worldwide infrastructure and broad product portfolio to grow high-margin premium services. We will also implement cost, process and technology improvements in our international operations. We believe that both Europe and Asia offer significant opportunities for growth.

Supply Chain & Freight Segment

The Supply Chain & Freight segment consists of our forwarding and logistics capabilities as well as our freight business unit.

In recent years we extended our service portfolio into heavy air and ground forwarding through two acquisitions. In 2005 we acquired Menlo Worldwide Forwarding, which forms the basis for our time-definite, guaranteed air forwarding service. In the same year, we acquired Overnite Corp., a LTL service, which offers a full range of regional, inter-regional and long-haul LTL capabilities in all 50 states, Canada, Puerto Rico, Guam, the Virgin Islands and Mexico. Overnite Corp. was rebranded as UPS Freight in 2006.

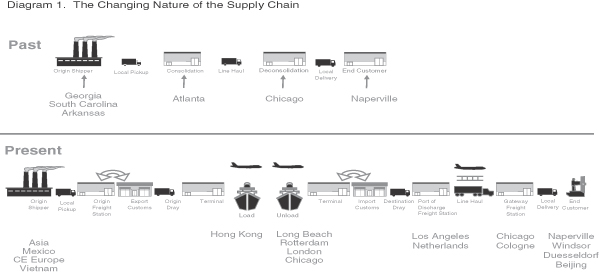

In today’s global economy, companies’ supply chains are growing increasingly complex, as shown in Diagram 1 below. Many of our customers, large and small, have outsourced all or part of their supply chains to streamline and gain efficiencies, to improve service, to support new business models and to strengthen their balance sheets.

3

This increasing complexity creates demand for a global service offering that incorporates transportation, distribution and international trade services with financial and information services. We believe that we can capitalize on this opportunity because:

| • | We manage supply chains in over 175 countries and territories, with about 35 million square feet of distribution space worldwide. |

| • | We focus on supply chain optimization, freight forwarding, international trade services and management-based solutions for our customers rather than solely on more traditional asset-based logistics such as warehouses and vehicle fleets. |

| • | We provide a broad range of transportation solutions to customers worldwide, including air, ocean and ground freight, as well as customs brokerage, and trade and materials management. |

| • | We provide service, information technology systems and distribution facilities adapted to the unique supply chains of specific industries such as healthcare, technology, and consumer/retail. We call this “configurable solutions.” In a configurable solution, multiple customers share standardized IT systems and processes as well as a common network of assets. A configurable solution is repeatable for multiple customers and has a transportation component. |

| • | We offer a portfolio of financial services that provides customers with short-term and long-term financing, secured lending, working capital, government guaranteed lending, letters of credit, global trade financing, credit cards and equipment leasing. |

Our growth strategy is to increase the number of customers benefiting from configurable supply chain solutions and to increase the amount of small package transportation from these customers. We intend to leverage our small package and freight customers through cross-selling the full complement of UPS services.

Products and Services

Our goal is to provide our customers with easy-to-use products and services. We seek to streamline their shipment processing and integrate critical transportation information into their own business processes, helping them create supply chain efficiencies, better serve their customers and improve their cash flows. These products and services support LTL and air freight shipments, as well as small package transportation. UPS offers a variety of technology solutions for automated shipping, visibility and billing. We believe we have the most comprehensive suite of such services in the industry.

4

Global Small Package. Our global small package portfolio consists of air and ground services for package delivery to over 200 countries, providing delivery within one-to-two business days to the world’s major business centers. We offer a spectrum of export and domestic services. Export services are those provided for packages crossing a country’s borders, while domestic services are for packages that stay within the borders of a single country. We provide domestic services in 23 major countries outside the United States. This portfolio includes guaranteed delivery options to major cities around the world. We handle packages that weigh up to 150 pounds and are up to 165 inches in combined length and girth. We offer same-day pickup of air and ground packages. We also offer worldwide customs clearance service for any mode of transportation.

Additional products that provide enhanced shipping, visibility, billing and returns services are available to customers who require customized package solutions.

Our enhanced, data-driven package pick-up and delivery technology is the basis for new services introduced in 2007. For example, UPS Delivery Intercept enables a shipper to reroute a package while it is in transit. And UPS Proactive Response provides support to customers who require even greater control of their shipments. Shipments sent using this service are constantly monitored from pickup to delivery, watching for problems or delays, at which point prearranged intervention steps commence.

We provide our customers with easy access to UPS. There are approximately 150,000 domestic and international access points to UPS. These include: nearly 40,000 branded drop-boxes, more than 1,000 UPS Customer Centers, over 5,800 independently owned and operated The UPS Store® and Mail Boxes Etc.® locations worldwide (over 4,400 in the U.S.), more than 2,400 alliance partner locations, in excess of 15,000 Authorized Shipping Outlets and commercial counters, and more than 85,000 UPS drivers who can accept packages given to them.

Supply Chain Services. Our freight forwarding and logistics businesses meet customers’ supply chain needs through a comprehensive portfolio of services, including:

| • | Freight Forwarding: international air, full container load (“FCL”) and less than container load (“LCL”) ocean, rail and ground freight for all size shipments utilizing UPS and other carriers, and multimodal transportation network management. |

| • | Logistics and Distribution: supply chain management, distribution center design, planning and management, order fulfillment, inventory management, receiving and shipping, critical parts logistics, reverse logistics and cross docking. |

| • | International Trade Management: customs brokerage and international trade consulting. |

| • | Industry-specific Solutions: for healthcare, retail, high tech, automotive, industrial manufacturing and government customers. |

| • |

UPS CapitalSM provides asset-based lending, global trade finance and export-import lending services. |

Freight Services. UPS Freight provides LTL services through a network of owned and leased service centers and carrier partnerships. UPS Freight also provides our customers with truckload and dedicated truckload transportation solutions. Since expanding into the freight transport market, we have enhanced our value proposition through improvements in technology, operations and the customer experience. These efforts have resulted in expanded market presence, despite a challenging economic environment. Significant service and reliability improvements for freight transportation enabled us to implement a no-fee, guaranteed delivery service in early 2008.

Technology

Technology is the backbone of everything we do at UPS. It is at the heart of customer access to the company.

| • | UPS.com processes over 15 million package tracking transactions daily. A growing number of those tracking requests now come from customers in countries that have wireless access to UPS tracking information. |

5

| • | Package tracking, pickup requests, rate quotes, account opening, wireless registration, drop-off locator, transit times and supply ordering services are all available at customers’ desktops or laptops. The site also displays full domestic and international service information and allows customers to process outbound shipments as well as return labels for their customers. |

| • | Businesses in a number of countries also can download UPS OnLine Tools SM to their own websites for direct use by their customers. This allows users to access the information they need without leaving our customers’ websites. |

| • | In 2007, we integrated all freight products, including international air freight forwarding shipments, into our small package visibility systems. Now a shipper can view the status of package and freight shipments from a single web page. |

Technology is also the foundation for process improvements within UPS that enhance productivity, improve efficiency and reduce costs. The most comprehensive improvement to our U.S. small package handling facilities was completed in 2007. This multi-year effort re-engineered our domestic business, based on a data-driven platform, and included software, hardware and process changes. It enables a package center to produce an optimized dispatch plan for every driver and detailed loading instructions for every vehicle before center employees handle any packages. This plan reduces mileage driven, resulting in substantial savings in fuel usage. The re-engineered system provides the basis for unique customer-focused services based on the customer-specific data which powers the system.

Sales and Marketing

The UPS worldwide sales organization is responsible for the complete spectrum of UPS products and services. This field sales organization consists primarily of locally based account executives assigned to our individual operating units. For our largest multi-shipping-site customers, we manage sales through an organization of regionally based account managers, reporting directly to executive management.

Our sales force also includes specialized groups that work with our general sales organization to support the sale of customer technology solutions, international package delivery, LTL and freight transportation, and warehousing and distribution services.

In 2007, we completed a major sales force reorganization to better align our sales resources and integrate with customer business processes. Our goal is to enhance the customer experience when dealing with the extensive scope of UPS capabilities, at any point in the shipping or supply chain management process.

Our worldwide marketing organization also supports global small package and our supply chain and freight businesses. Our corporate marketing function is engaged in market and customer research, brand management, rate-making and revenue management policy, new product development, product portfolio management, marketing alliances and e-commerce, including the non-technical aspects of our web presence. Advertising, public relations, and most formal marketing communications are centrally developed and controlled.

In addition to our corporate marketing group, field-based marketing personnel are assigned to our individual operating units and are primarily engaged in business planning, bid preparation and revenue management activities. These local marketing teams support the execution of corporate initiatives while also managing limited promotional and public relations activities pertinent to their local markets.

Employees

As of December 31, 2007, we had approximately 425,300 employees.

Approximately 246,000 of our employees are employed under a national master agreement and various supplemental agreements with local unions affiliated with the International Brotherhood of Teamsters

6

(“Teamsters”). These agreements run through July 31, 2008. At the end of 2007, UPS Teamster-represented employees ratified a new five-year labor contract which will take effect on August 1, 2008 and run through July 31, 2013.

We have approximately 2,900 pilots who are employed under a collective bargaining agreement with the Independent Pilots Association (“IPA”). The current contract becomes amendable at the end of 2011. Our airline mechanics are covered by a collective bargaining agreement with Teamsters Local 2727, which became amendable on November 1, 2006. We began formal negotiations with Teamsters Local 2727 in October 2006. In addition, the majority of our ground mechanics who are not employed under agreements with the Teamsters are employed under collective bargaining agreements with the International Association of Machinists and Aerospace Workers (approximately 2,900). These agreements run through July 31, 2009.

We believe that our relations with our employees are good. Every year we survey all our employees to determine their level of job satisfaction. Areas of concern receive management attention as we strive to keep UPS the employer of choice among our employees.

We consistently receive numerous awards and wide recognition as an employer-of-choice, resulting in part from our emphasis on diversity and corporate citizenship.

Competition

We are the largest package delivery company in the world, in terms of both revenue and volume. We offer a broad array of services in the package and freight delivery industry and, therefore, compete with many different local, regional, national and international companies. Our competitors include worldwide postal services, various motor carriers, express companies, freight forwarders, air couriers and others. Through our supply chain service offerings, we compete with a number of participants in the supply chain, financial services and information technology industries.

Competitive Strengths

Our competitive strengths include:

Integrated Global Network. We believe that our integrated global ground and air network is the most extensive in the industry. It is the only network that handles all levels of service (air, ground, domestic, international, commercial, residential) through a single pickup and delivery service system.

Our sophisticated engineering systems allow us to optimize our network efficiency and asset utilization on a daily basis. This unique, integrated global business model creates consistent and superior returns.

We believe we have the most comprehensive integrated delivery and information services portfolio of any carrier in Europe. In other regions of the world, we rely on both our own and local service providers’ capabilities to meet our service commitments.

Leading-edge Technology. We are a global leader in developing technology that helps our customers optimize their shipping and logistics business processes to lower costs, improve service and increase efficiency.

Technology powers virtually every service we offer and every operation we perform. Our technology initiatives are driven by our customers’ needs. We offer a variety of on-line service options that enable our customers to integrate UPS functionality into their own businesses not only to conveniently send, manage and track their shipments, but to provide their customers with better information services. We provide the infrastructure for an Internet presence that extends to tens of thousands of customers who have integrated UPS tools directly into their own web sites.

7

Broad, Portfolio of Services. Our portfolio of services enables customers to choose the delivery option that is most appropriate for their requirements. Increasingly, our customers benefit from business solutions that integrate many UPS services in addition to package delivery. For example, our supply chain services—such as freight forwarding, customs brokerage, order fulfillment, and returns management—help improve the efficiency of the supply chain management process.

Customer Relationships. We focus on building and maintaining long-term customer relationships. We serve 1.8 million pick-up customers and 6.1 million delivery customers daily. Cross-selling small package, supply chain and freight services across our customer base is an important growth mechanism for the company.

Brand Equity. We have built a leading and trusted brand in our industry—a brand that stands for quality service, reliability and product innovation. The distinctive appearance of our vehicles and the friendliness and helpfulness of our drivers are major contributors to our brand equity.

Distinctive Culture. We believe that the dedication of our employees results in large part from our distinctive “employee-owner” concept. Our employee stock ownership tradition dates from 1927, when our founders, who believed that employee stock ownership was a vital foundation for successful business, first offered stock to employees. To facilitate employee stock ownership, we maintain several stock-based compensation programs.

Our long-standing policy of “promotion from within” complements our tradition of employee ownership, and this policy reduces the need for us to hire managers and executive officers from outside UPS. The majority of our management team began their careers as full-time or part-time hourly UPS employees, and have spent their entire careers with us. Many of our executive officers have more than 30 years of service with UPS and have accumulated a meaningful ownership stake in our company. Therefore, our executive officers have a strong incentive to effectively manage UPS, which benefits all our shareowners.

Financial Strength. Our balance sheet reflects financial strength that few companies can match. As of December 31, 2007, we had a balance of cash and marketable securities of approximately $2.604 billion and shareowners’ equity of $12.183 billion. We carry long-term debt ratings of AA- / Aa2 from Standard & Poor’s and Moody’s, respectively, reflecting our strong capacity to service our obligations. Our financial strength gives us the resources to achieve global scale; to make investments in technology, transportation equipment and buildings; to pursue strategic opportunities which will facilitate our growth; and to return value to our shareowners in the form of increasing dividends and share repurchases.

Government Regulation

The U.S. Department of Homeland Security, through the Transportation Security Administration (“TSA”), the U.S. Department of Transportation (“DOT”) and the Federal Aviation Administration (“FAA”), regulates air transportation services.

The TSA regulates various security aspects of air cargo transportation in a manner consistent with the TSA mission statement to “protect[s] the Nation’s transportation systems to ensure freedom of movement for people and commerce.”

The DOT’s authority primarily relates to economic aspects of air transportation, such as discriminatory pricing, non-competitive practices, interlocking relations and cooperative agreements. The DOT also regulates, subject to the authority of the President of the United States, international routes, fares, rates and practices, and is authorized to investigate and take action against discriminatory treatment of U.S. air carriers abroad. We are subject to U.S. customs laws and related DOT regulations regarding the import and export of shipments to and from the U.S. In addition, our customs brokerage entities are subject to those same laws and regulations as they relate to the filing of documents on behalf of client importers and exporters.

8

The FAA’s authority primarily relates to safety aspects of air transportation, including aircraft standards and maintenance, personnel and ground facilities. In 1988, the FAA granted us an operating certificate, which remains in effect so long as we meet the operational requirements of federal aviation regulations.

FAA regulations mandate an aircraft corrosion control program, and aircraft inspection and repair at periodic intervals specified by approved programs and procedures, for all aircraft. Our total expenditures under these programs for 2007 were $15 million. The future cost of repairs pursuant to these programs may fluctuate. All mandated repairs have been completed, or are scheduled to be completed, within the timeframes specified by the FAA.

Our ground transportation of packages in the U.S. is subject to the DOT’s jurisdiction with respect to the regulation of routes and to both the DOT’s and the states’ jurisdiction with respect to the regulation of safety, insurance and hazardous materials.

We are subject to similar regulation in many non-U.S. jurisdictions. In addition, we are subject to non-U.S. government regulation of aviation rights involving non-U.S. jurisdictions, and non-U.S. customs regulation.

The Postal Reorganization Act of 1970 created the U.S. Postal Service as an independent establishment of the executive branch of the federal government, and vested the power to recommend domestic postal rates in a regulatory body, the Postal Rate Commission. We participate in the proceedings before the Postal Rate Commission in an attempt to secure fair postal rates for competitive services.

We are subject to numerous other laws and regulations in connection with our non-package businesses, including customs regulations, Food and Drug Administration regulation of our transportation of pharmaceuticals, and state and federal lending regulations.

Where You Can Find More Information

We make our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to these reports available free of charge through the investor relations page of our website, located at www.shareholder.com/ups, as soon as reasonably practicable after they are filed with or furnished to the SEC. Additional information about UPS is available at www.ups.com. Our sustainability report, which presents the highlights of our activities that support our commitment to acting responsibly and contributing to society, is available at www.sustainability.ups.com .

We have adopted a written Code of Business Conduct that applies to all of our directors, officers and employees, including our principal executive officer and senior financial officers. It is available in the governance section of the investor relations page of our website, located at www.shareholder.com/ups. In the event that we make changes in, or provide waivers from, the provisions of the Code of Business Conduct that the SEC requires us to disclose, we intend to disclose these events in the governance section of our investor relations website.

Our Corporate Governance Guidelines and the charters for our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee are also available in the governance section of the investor relations page of our website.

See Footnote 12 to our consolidated financial statements for financial information regarding our reporting segments and geographic areas in which we operate.

9

Executive Officers of the Registrant

| Name and Office |

Age | Principal Occupation and Employment For the Last Five Years | ||

| David P. Abney Senior Vice President, Chief Operating Officer, and President—UPS Airlines |

52 | Senior Vice President, Chief Operating Officer and President, UPS Airlines (2007 – present), Senior Vice President and President, UPS International (2003 – 2007), UPS/Fritz Companies Integration Manager (2001 – 2002). | ||

| David A. Barnes Senior Vice President and Chief Information Officer |

52 | Senior Vice President and Chief Information Officer (2005 – present), Corporate Information Services Portfolio Coordinator (2001 – 2004). | ||

| Daniel J. Brutto Senior Vice President and President, UPS International |

51 | Senior Vice President and President, UPS International (2008 – present), President, Global Freight Forwarding (2006-2007), Corporate Controller (2004 – 2006), Vice President (1997 – 2004). | ||

| D. Scott Davis Chairman and Chief Executive Officer |

56 | Chairman and Chief Executive Officer (2008 – present), Vice Chairman (2006 – 2007), Senior Vice President (2001-2007), Chief Financial Officer and Treasurer (2001 – 2007), Director (2006 – present). | ||

| Alan Gershenhorn Senior Vice President |

49 | Senior Vice President, Worldwide Sales and Marketing (2008 – present), Senior Vice President and President, UPS International (2007), President, UPS Supply Chain Solutions – Asia and Europe (2006), President, UPS Supply Chain Solutions – Shared Services (2005), President, United Parcel Service Canada, Ltd. (2002 – 2004). | ||

| Allen E. Hill Senior Vice President |

52 | Senior Vice President, Human Resources (2007 – present), Senior Vice President, Human Resources and Public Affairs (2006 – 2007), Senior Vice President, General Counsel and Corporate Secretary (2004 – 2006), Corporate Legal Department Manager (1995 – 2004). | ||

| Kurt P. Kuehn Senior Vice President, Chief Financial Officer and Treasurer |

53 | Senior Vice President, Chief Financial Officer and Treasurer (2008 – present), Senior Vice President, Worldwide Sales and Marketing (2004 – 2007), Vice President, Investor Relations (1999 – 2003). | ||

| Teri P. McClure Senior Vice President, General Counsel and Corporate Secretary |

44 | Senior Vice President, General Counsel and Corporate Secretary (2006 – present), Corporate Legal Department Manager (2005 – 2006), Compliance Department Manager (2004 – 2005), District Manager (2003 – 2005), and Vice President (1999 – 2003). | ||

10

| Name and Office |

Age | Principal Occupation and Employment For the Last Five Years | ||

| John J. McDevitt Senior Vice President |

49 | Senior Vice President, Global Transportation Services and Labor Relations (2005 – present), Senior Vice President, Strategic Integration (2003 – 2005), Air Region Manager (2000 – 2002). | ||

| Christine M. Owens Senior Vice President |

52 | Senior Vice President, Communications and Brand Management (2005 – present), Corporate Transportation Group Manager (2004 – 2005), Region Manager (1997 – 2004). | ||

| Robert E. Stoffel Senior Vice President |

52 | Senior Vice President, Engineering, Strategy and Supply Chain Distribution (2007 – present), Senior Vice President of Supply Chain Group (2004 – 2007), President, UPS Supply Chain Solutions, Inc. (2002 – 2003), Vice President, UPS Logistics Group, Inc. (2000 – 2002). | ||

| James F. Winestock Senior Vice President |

56 | Senior Vice President, U.S. Operations (2004 – present), Region Manager (1998 – 2003). | ||

| Item 1A. | Risk Factors |

Information about risk factors can be found in Item 7 of this report under the caption “Risk Factors”.

| Item 1B. | Unresolved Staff Comments |

Not applicable.

| Item 2. | Properties |

Operating Facilities

We own our headquarters, which are located in Atlanta, Georgia and consist of about 735,000 square feet of office space on an office campus, and our UPS Supply Chain Solutions group’s headquarters, which are located in Alpharetta, Georgia and consist of about 310,000 square feet of office space.

We also own our 27 principal U.S. package operating facilities, which have floor spaces that range from about 310,000 to 693,000 square feet. In addition, we have a 1.9 million square foot operating facility near Chicago, Illinois, which is designed to streamline shipments between East Coast and West Coast destinations, and we own or lease over 1,100 additional smaller package operating facilities in the U.S. The smaller of these facilities have vehicles and drivers stationed for the pickup of packages and facilities for the sorting, transfer and delivery of packages. The larger of these facilities also service our vehicles and equipment and employ specialized mechanical installations for the sorting and handling of packages.

We own or lease almost 600 facilities that support our international package operations and over 900 facilities that support our freight forwarding and logistics operations. Our freight forwarding and logistics operations maintain facilities with about 35 million square feet of floor space. We own and operate a logistics campus consisting of approximately 3.5 million square feet in Louisville, Kentucky.

UPS Freight operates approximately 270 service centers with a total of 6.3 million square feet of floor space. UPS Freight owns 200 of these service centers, while the remainder are occupied under operating lease agreements. The main offices of UPS Freight are located in Richmond, Virginia and consist of about 240,000 square feet of office space.

11

Our aircraft are operated in a hub and spokes pattern in the U.S. Our principal air hub in the U.S., known as Worldport, is located in Louisville, KY. The Worldport facility consists of over 4.1 million square feet and the site includes approximately 596 acres. We are able to sort over 300,000 packages per hour in the Worldport facility. We also have regional air hubs in Columbia, SC; Dallas, TX; Hartford, CT; Ontario, CA; Philadelphia, PA; and Rockford, IL. These hubs house facilities for the sorting, transfer and delivery of packages. Our European air hub is located in Cologne, Germany, and our Asia-Pacific air hub is located in Taipei, Taiwan. Our intra-Asia air hub is located at Clark Air Force Base in Pampanga, Philippines, our regional air hub in Canada is located in Hamilton, Ontario, and our regional air hub for Latin America and the Caribbean is in Miami, FL.

In 2007, work continued on our Worldport facility that will increase sorting capacity over the next five years by 37 percent to 416,000 packages per hour. The expansion involves the addition of two aircraft load / unload wings to the hub building, followed by the installation of high-speed conveyor and computer control systems. The overall size of the Worldport facility will increase by 1.1 million square feet to 5.2 million square feet, and the facility will be able to accommodate the Boeing 747-400 aircraft currently on order. The expansion will cost over $1 billion and is expected to be completed by 2010.

Over the past five years, UPS has invested about $600 million in China, including a successful transition to become the first wholly-owned foreign express carrier in the country. In 2007, UPS broke ground for the UPS International Air Hub at Pudong International Airport, which will be built on a parcel totaling 1 million square feet and will open during 2008. Rapid expansion is planned to a sorting capacity of 17,000 pieces per hour. The new hub will link all of China via Shanghai to UPS’s international network with direct service to the Americas, Europe and Asia. It also will connect points served in China by UPS through a dedicated service provided by Yangtze River Express, a Chinese all-cargo airline.

Our primary information technology operations are consolidated in a 435,000 square foot owned facility, the Ramapo Ridge facility, which is located on a 39-acre site in Mahwah, New Jersey. We also own a 175,000 square foot facility located on a 25-acre site in Alpharetta, Georgia, which serves as a backup to the main information technology operations facility in New Jersey. This facility provides production functions and backup capacity in the event that a power outage or other disaster incapacitates the main data center. It also helps us to meet our internal communication needs.

We believe that our facilities are adequate to support our current operations.

12

Fleet

Aircraft

The following table shows information about our aircraft fleet as of December 31, 2007:

| Description |

Owned and Capital Leases |

Short-term Leased or Chartered From Others |

On Order |

Under Option | ||||

| McDonnell-Douglas DC-8-71 |

20 | — | — | — | ||||

| McDonnell-Douglas DC-8-73 |

26 | — | — | — | ||||

| Boeing 727-100 |

8 | — | — | — | ||||

| Boeing 727-200 |

2 | — | — | — | ||||

| Boeing 747-100 |

7 | — | — | — | ||||

| Boeing 747-200 |

4 | — | — | — | ||||

| Boeing 747-400F |

3 | — | 9 | — | ||||

| Boeing 747-400BCF |

— | — | 2 | — | ||||

| Boeing 757-200 |

75 | — | — | — | ||||

| Boeing 767-300 |

32 | — | 27 | — | ||||

| Boeing MD-11 |

38 | — | — | — | ||||

| Airbus A300-600 |

53 | — | — | — | ||||

| Other |

— | 311 | — | — | ||||

| Total |

268 | 311 | 38 | — | ||||

We maintain an inventory of spare engines and parts for each aircraft.

All of the aircraft we own meet Stage III federal noise regulations and can operate at airports that have aircraft noise restrictions. We became the first major airline to successfully operate a 100% Stage III fleet more than three years in advance of the date required by federal regulations.

During 2007, we placed into service 10 Boeing MD-11 aircraft and 3 Boeing 747-400F aircraft. In February 2007, we announced an order for 27 Boeing 767-300ER freighters to be delivered between 2009 and 2012. We also have firm commitments to purchase nine Boeing 747-400F aircraft scheduled for delivery between 2008 and 2010 and two Boeing 747-400BCF aircraft scheduled for delivery during 2008. Also, during 2007 we sold 21 727-100 aircraft, with eight remaining to be sold in 2008. In addition, we terminated the agreement to purchase 10 Airbus A380-800 freighter aircraft including the options to purchase 10 additional A380-800 aircraft.

Vehicles

We operate a ground fleet of approximately 100,000 package cars, vans, tractors and motorcycles. Our ground support fleet consists of over 26,000 pieces of equipment designed specifically to support our aircraft fleet, ranging from non-powered container dollies and racks to powered aircraft main deck loaders and cargo tractors. We also have about 41,000 containers used to transport cargo in our aircraft.

Safety

We promote safety throughout our operations. Our Automotive Fleet Safety Program is built with the following components:

| • | Selection. Five out of every six drivers come from our part-time ranks. Therefore, many of our new drivers are familiar with our philosophies, policies, practices and training programs. |

13

| • | Training. Training is the cornerstone of our Fleet Safety Program. Our approach starts with training the trainer. All trainers are certified to ensure that they have the skills and motivation to effectively train novice drivers. A new driver’s employment includes extensive classroom and on-line training as well as on-road training, followed by three safety training rides integrated into his or her training cycle. |

| • | Responsibility. Our operations managers are responsible for their drivers’ safety records. We investigate every accident. If we determine that an accident could have been prevented, we retrain the driver. |

| • | Preventive Maintenance. An integral part of our Fleet Safety Program is a comprehensive Preventive Maintenance Program. Our fleet is tracked by computer to ensure that each vehicle is serviced before a breakdown or accident is likely to occur. |

| • | Honor Plan. A well-defined safe driver honor plan recognizes and rewards our drivers when they achieve success. We have over 4,450 drivers who have driven for 25 years or more without an avoidable accident. |

Our workplace safety program is built upon a comprehensive health and safety process. The foundation of this process is our employee-management health and safety committees. The workplace safety process focuses on employee conditioning and safety-related habits. Our employee co-chaired health and safety committees complete comprehensive facility audits and injury analyses, and recommend facility and work process changes.

| Item 3. | Legal Proceedings |

We are a defendant in a number of lawsuits filed in state and federal courts containing various class-action allegations under state wage-and-hour laws. In one of these cases, Marlo v. UPS, which has been certified as a class action in a California federal court, plaintiffs allege that they improperly were denied overtime, and seek penalties for missed meal and rest periods, and interest and attorneys’ fees. Plaintiffs purport to represent a class of 1,200 full-time supervisors. In August 2005, the court granted summary judgment in favor of UPS on all claims, and plaintiff appealed the ruling. In October 2007, the appeals court reversed the lower court’s ruling. We have denied any liability with respect to these claims and intend to vigorously defend ourselves in this case. At this time, we have not determined the amount of any liability that may result from this matter or whether such liability, if any, would have a material adverse effect on our financial condition, results of operations, or liquidity.

In another case, Cornn v. UPS, which was certified as a class action in a California federal court, plaintiffs allege that they were improperly denied wages and/or overtime and meal and rest periods. Plaintiffs purport to represent a class of approximately 23,600 drivers and seek back wages, penalties, interest and attorneys’ fees. UPS settled this matter in full for a total payment of $87 million in the second quarter of 2007. The settlement had no impact on our 2007 operating results as it was accrued for previously during the third quarter of 2006.

In another case, Hohider v. UPS, which in July 2007 was certified as a class action in a Pennsylvania federal court, plaintiffs have challenged certain aspects of the Company’s interactive process for assessing requests for reasonable accommodation under the Americans with Disabilities Act. Plaintiffs purport to represent a class of over 35,000 current and former employees, and seek backpay, compensatory and punitive damages, as well as attorneys’ fees. In August 2007, the Third Circuit Court of Appeals granted the Company’s Petition to hear the appeal of the trial court’s recent certification order. The appeal will likely take one year. At this time, we have not determined the amount of any liability that may result from this matter or whether such liability, if any, would have a material adverse effect on our financial condition, results of operations, or liquidity.

UPS and Mail Boxes Etc., Inc. are defendants in various lawsuits brought by franchisees who operate Mail Boxes Etc. centers and The UPS Store locations. These lawsuits relate to the re-branding of Mail Boxes Etc. centers to The UPS Store, the The UPS Store business model, the representations made in connection with the rebranding and the sale of The UPS Store franchises, and UPS’s sale of services in the franchisees’ territories.

14

We have denied any liability with respect to these claims and intend to defend ourselves vigorously. At this time, we have not determined the amount of any liability that may result from these matters or whether such liability, if any, would have a material adverse effect on our financial condition, results of operations, or liquidity.

UPS and UPS Freight, along with several other companies involved in the LTL freight business, have been named as defendants in numerous putative class-action lawsuits filed since July 30, 2007 in courts across the nation. The cases have been consolidated for pretrial purposes in a Multi-District Litigation proceeding in the United States District Court for the Northern District of Georgia. The lawsuits allege that the defendants conspired to fix fuel surcharge rates, and they seek injunctive relief, treble damages and attorneys’ fees. We intend to defend against these suits vigorously. These cases are at a preliminary stage and at this time, we have not determined the amount of any liability that may result from this matter or whether such liability, if any, would have a material adverse effect on our financial condition, results of operations, or liquidity.

We are a defendant in various other lawsuits that arose in the normal course of business. We believe that the eventual resolution of these cases will not have a material adverse effect on our financial condition, results of operations, or liquidity.

Other Matters

We received grand jury subpoenas from the Antitrust Division of the U.S. Department of Justice (“DOJ”) regarding the DOJ’s investigations into air cargo pricing practices in July 2006 and into freight forwarding pricing practices in December 2007. In October 2007, we received information requests from the European Commission and the New Zealand Commerce Commission relating to investigations of freight forwarding pricing practices. We are cooperating with these investigations.

| Item 4. | Submission of Matters to a Vote of Security Holders |

None

15

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Our Class A common stock is not listed on a national securities exchange or traded in an organized over-the-counter market, but each share of our Class A common stock is convertible into one share of our Class B common stock.

The following is a summary of our Class B common stock price activity and dividend information for 2007 and 2006. Our Class B common stock is listed on the New York Stock Exchange under the symbol “UPS.”

| High | Low | Close | Dividends Declared | |||||||||

| 2007: |

||||||||||||

| First Quarter |

$ | 75.98 | $ | 68.66 | $ | 70.10 | $ | 0.42 | ||||

| Second Quarter |

$ | 74.48 | $ | 69.54 | $ | 73.00 | $ | 0.42 | ||||

| Third Quarter |

$ | 78.99 | $ | 72.70 | $ | 75.10 | $ | 0.42 | ||||

| Fourth Quarter |

$ | 77.00 | $ | 70.00 | $ | 70.72 | $ | 0.42 | ||||

| 2006: |

||||||||||||

| First Quarter |

$ | 80.16 | $ | 72.74 | $ | 79.38 | $ | 0.38 | ||||

| Second Quarter |

$ | 83.99 | $ | 77.55 | $ | 82.33 | $ | 0.38 | ||||

| Third Quarter |

$ | 83.00 | $ | 65.50 | $ | 71.94 | $ | 0.38 | ||||

| Fourth Quarter |

$ | 79.72 | $ | 71.95 | $ | 74.98 | $ | 0.38 | ||||

As of January 31, 2008, there were 171,519 and 17,454 record holders of Class A and Class B common stock, respectively.

The policy of our Board of Directors is to declare dividends each year out of current earnings. The declaration of future dividends is subject to the discretion of the Board of Directors in light of all relevant facts, including earnings, general business conditions and working capital requirements.

On January 31, 2008, our Board declared a dividend of $0.45 per share, which is payable on March 4, 2008 to shareowners of record on February 11, 2008.

On October 30, 2007, the Board of Directors approved an increase in our share repurchase authorization to $2.0 billion, which replaced the remaining amount available under our February 2007 share repurchase authorization. In January 2008, the Board of Directors approved an increase in our share repurchase authorization to $10.0 billion, as part of a new financial policy. Unless terminated earlier, the program will expire when we have purchased all shares authorized for repurchase under the program.

A summary of repurchases of our Class A and Class B common stock during the fourth quarter of 2007 is as follows (in millions, except per share amounts):

| Total Number of Shares Purchased(1) |

Average Price Paid Per Share(1) |

Total Number of Shares Purchased as Part of Publicly Announced Program |

Approximate Dollar Value of Shares that May Yet be Purchased Under the Program (as of month-end) | |||||||

| October 1—October 31, 2007 |

2.1 | $ | 75.58 | 2.1 | $ | 60 | ||||

| November 1—November 30, 2007 |

3.8 | 72.19 | 3.8 | 1,725 | ||||||

| December 1—December 31, 2007 |

2.2 | 73.04 | 2.2 | 1,566 | ||||||

| Total October 1—December 31, 2007 |

8.1 | $ | 73.31 | 8.1 | $ | 1,566 | ||||

| (1) | Includes shares repurchased through our publicly announced share repurchase program and shares tendered to pay the exercise price and tax withholding on employee stock options. |

16

Shareowner Return Performance Graph

The following Performance Graph and related information shall not be deemed “soliciting material” or to be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or Securities Exchange Act of 1934, each as amended, except to the extent that the Company specifically incorporates such information by reference into such filing.

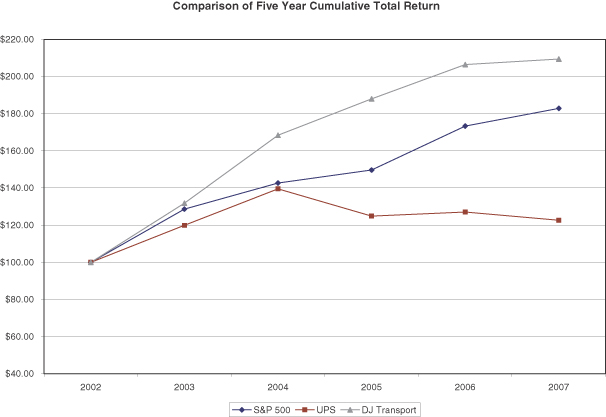

The following graph shows a five-year comparison of cumulative total shareowners’ returns for our class B common stock, the S&P 500 Index, and the Dow Jones Transportation Average. The comparison of the total cumulative return on investment, which is the change in the quarterly stock price plus reinvested dividends for each of the quarterly periods, assumes that $100 was invested on December 31, 2002 in the S&P 500 Index, the Dow Jones Transportation Average, and the class B common stock of United Parcel Service, Inc.

| 12/31/02 | 12/31/03 | 12/31/04 | 12/31/05 | 12/31/06 | 12/31/07 | |||||||||||||

| United Parcel Service, Inc. |

$ | 100.00 | $ | 119.89 | $ | 139.55 | $ | 124.88 | $ | 127.08 | $ | 122.64 | ||||||

| S&P 500 Index |

$ | 100.00 | $ | 128.68 | $ | 142.68 | $ | 149.69 | $ | 173.33 | $ | 182.85 | ||||||

| Dow Jones Transportation Average |

$ | 100.00 | $ | 131.84 | $ | 168.39 | $ | 188.00 | $ | 206.46 | $ | 209.40 | ||||||

Securities Authorized for Issuance under Equity Compensation Plans

The following table provides information as of December 31, 2007 regarding compensation plans under which our Class A common stock is authorized for issuance. These plans do not authorize the issuance of our Class B common stock.

17

EQUITY COMPENSATION PLANS

| Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) |

Weighted-average exercise price of outstanding options, warrants and rights (b) |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) | |||||

| Plan category |

|||||||

| Equity compensation plans approved by security holders |

33,493,586 | $ | 36.12 | 44,589,843 | |||

| Equity compensation plans not approved by security holders |

— | N/A | — | ||||

| Total |

33,493,586 | $ | 36.12 | 44,589,843 | |||

Our shareowners have approved the United Parcel Service, Inc. Incentive Compensation Plan and the United Parcel Service, Inc. Discounted Employee Stock Purchase Plan. The material features of each of these plans are described in Note 11 to our consolidated financial statements included in this Form 10-K.

18

| Item 6. | Selected Financial Data |

The following table sets forth selected financial data for each of the five years in the period ended December 31, 2007 (amounts in millions, except per share amounts). This financial data should be read together with our consolidated financial statements and related notes, Management’s Discussion and Analysis of Financial Condition and Results of Operations, and other financial data appearing elsewhere in this report.

| Years Ended December 31, | ||||||||||||||||||||

| 2007 | 2006 | 2005 | 2004 | 2003 | ||||||||||||||||

| Selected Income Statement Data |

||||||||||||||||||||

| Revenue: |

||||||||||||||||||||

| U.S. Domestic Package |

$ | 30,985 | $ | 30,456 | $ | 28,610 | $ | 26,960 | $ | 25,362 | ||||||||||

| International Package |

10,281 | 9,089 | 7,977 | 6,809 | 5,609 | |||||||||||||||

| Supply Chain & Freight |

8,426 | 8,002 | 5,994 | 2,813 | 2,514 | |||||||||||||||

| Total revenue |

49,692 | 47,547 | 42,581 | 36,582 | 33,485 | |||||||||||||||

| Operating expenses: |

||||||||||||||||||||

| Compensation and benefits |

31,745 | 24,421 | 22,517 | 20,823 | 19,251 | |||||||||||||||

| Other |

17,369 | 16,491 | 13,921 | 10,770 | 9,789 | |||||||||||||||

| Total operating expenses |

49,114 | 40,912 | 36,438 | 31,593 | 29,040 | |||||||||||||||

| Operating profit (loss): |

||||||||||||||||||||

| U.S. Domestic Package |

(1,531 | ) | 4,923 | 4,493 | 3,702 | 3,657 | ||||||||||||||

| International Package |

1,831 | 1,710 | 1,494 | 1,149 | 732 | |||||||||||||||

| Supply Chain and Freight |

278 | 2 | 156 | 138 | 56 | |||||||||||||||

| Total operating profit |

578 | 6,635 | 6,143 | 4,989 | 4,445 | |||||||||||||||

| Other income (expense): |

||||||||||||||||||||

| Investment income |

99 | 86 | 104 | 82 | 18 | |||||||||||||||

| Interest expense |

(246 | ) | (211 | ) | (172 | ) | (149 | ) | (121 | ) | ||||||||||

| Gain on redemption of long-term debt |

— | — | — | — | 28 | |||||||||||||||

| Income before income taxes |

431 | 6,510 | 6,075 | 4,922 | 4,370 | |||||||||||||||

| Income tax expense |

(49 | ) | (2,308 | ) | (2,205 | ) | (1,589 | ) | (1,472 | ) | ||||||||||

| Net income |

$ | 382 | $ | 4,202 | $ | 3,870 | $ | 3,333 | $ | 2,898 | ||||||||||

| Per share amounts: |

||||||||||||||||||||

| Basic earnings per share |

$ | 0.36 | $ | 3.87 | $ | 3.48 | $ | 2.95 | $ | 2.57 | ||||||||||

| Diluted earnings per share |

$ | 0.36 | $ | 3.86 | $ | 3.47 | $ | 2.93 | $ | 2.55 | ||||||||||

| Dividends declared per share |

$ | 1.68 | $ | 1.52 | $ | 1.32 | $ | 1.12 | $ | 0.92 | ||||||||||

| Weighted average shares outstanding: |

||||||||||||||||||||

| Basic |

1,057 | 1,085 | 1,113 | 1,129 | 1,128 | |||||||||||||||

| Diluted |

1,063 | 1,089 | 1,116 | 1,137 | 1,138 | |||||||||||||||

| As of December 31, | ||||||||||||||||||||

| 2007 | 2006 | 2005 | 2004 | 2003 | ||||||||||||||||

| Selected Balance Sheet Data |

||||||||||||||||||||

| Cash and marketable securities |

$ | 2,604 | $ | 1,983 | $ | 3,041 | $ | 5,197 | $ | 3,952 | ||||||||||

| Total assets |

39,042 | 33,210 | 34,947 | 32,847 | 29,734 | |||||||||||||||

| Long-term debt |

7,506 | 3,133 | 3,159 | 3,261 | 3,149 | |||||||||||||||

| Shareowners’ equity |

12,183 | 15,482 | 16,884 | 16,378 | 14,852 | |||||||||||||||

19

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Operations

The following tables set forth information showing the change in revenue, average daily package volume, and average revenue per piece, both in dollars or amounts and in percentage terms:

| Year Ended December 31, |

Change | ||||||||||||

| 2007 | 2006 | $ | % | ||||||||||

| Revenue (in millions): |

|||||||||||||

| U.S. Domestic Package: |

|||||||||||||

| Next Day Air |

$ | 6,738 | $ | 6,778 | $ | (40 | ) | (0.6 | )% | ||||

| Deferred |

3,359 | 3,424 | (65 | ) | (1.9 | ) | |||||||

| Ground |

20,888 | 20,254 | 634 | 3.1 | |||||||||

| Total U.S. Domestic Package |

30,985 | 30,456 | 529 | 1.7 | |||||||||

| International Package: |

|||||||||||||

| Domestic |

2,177 | 1,950 | 227 | 11.6 | |||||||||

| Export |

7,488 | 6,554 | 934 | 14.3 | |||||||||

| Cargo |

616 | 585 | 31 | 5.3 | |||||||||

| Total International Package |

10,281 | 9,089 | 1,192 | 13.1 | |||||||||

| Supply Chain & Freight: |

|||||||||||||

| Forwarding and Logistics |

5,911 | 5,681 | 230 | 4.0 | |||||||||

| Freight |

2,108 | 1,952 | 156 | 8.0 | |||||||||

| Other |

407 | 369 | 38 | 10.3 | |||||||||

| Total Supply Chain & Freight |

8,426 | 8,002 | 424 | 5.3 | |||||||||

| Consolidated |

$ | 49,692 | $ | 47,547 | $ | 2,145 | 4.5 | % | |||||

| Average Daily Package Volume (in thousands): | # | ||||||||||||

| U.S. Domestic Package: |

|||||||||||||

| Next Day Air |

1,277 | 1,267 | 10 | 0.8 | % | ||||||||

| Deferred |

974 | 993 | (19 | ) | (1.9 | ) | |||||||

| Ground |

11,606 | 11,537 | 69 | 0.6 | |||||||||

| Total U.S. Domestic Package |

13,857 | 13,797 | 60 | 0.4 | |||||||||

| International Package: |

|||||||||||||

| Domestic |

1,132 | 1,108 | 24 | 2.2 | |||||||||

| Export |

761 | 689 | 72 | 10.4 | |||||||||

| Total International Package |

1,893 | 1,797 | 96 | 5.3 | |||||||||

| Consolidated |

15,750 | 15,594 | 156 | 1.0 | % | ||||||||

| Operating days in period |

252 | 253 | |||||||||||

| Average Revenue Per Piece: | $ | ||||||||||||

| U.S. Domestic Package: |

|||||||||||||

| Next Day Air |

$ | 20.94 | $ | 21.14 | $ | (0.20 | ) | (0.9 | )% | ||||

| Deferred |

13.69 | 13.63 | 0.06 | 0.4 | |||||||||

| Ground |

7.14 | 6.94 | 0.20 | 2.9 | |||||||||

| Total U.S. Domestic Package |

8.87 | 8.73 | 0.14 | 1.6 | |||||||||

| International Package: |

|||||||||||||

| Domestic |

7.63 | 6.96 | 0.67 | 9.6 | |||||||||

| Export |

39.05 | 37.60 | 1.45 | 3.9 | |||||||||

| Total International Package |

20.26 | 18.70 | 1.56 | 8.3 | |||||||||

| Consolidated |

$ | 10.24 | $ | 9.88 | $ | 0.36 | 3.6 | % | |||||

20

| Year Ended December 31, |

Change | ||||||||||||

| 2006 | 2005 | $ | % | ||||||||||

| Revenue (in millions): |

|||||||||||||

| U.S. Domestic Package: |

|||||||||||||

| Next Day Air |

$ | 6,778 | $ | 6,381 | $ | 397 | 6.2 | % | |||||

| Deferred |

3,424 | 3,258 | 166 | 5.1 | |||||||||

| Ground |

20,254 | 18,971 | 1,283 | 6.8 | |||||||||

| Total U.S. Domestic Package |

30,456 | 28,610 | 1,846 | 6.5 | |||||||||

| International Package: |

|||||||||||||

| Domestic |

1,950 | 1,588 | 362 | 22.8 | |||||||||

| Export |

6,554 | 5,856 | 698 | 11.9 | |||||||||

| Cargo |

585 | 533 | 52 | 9.8 | |||||||||

| Total International Package |

9,089 | 7,977 | 1,112 | 13.9 | |||||||||

| Supply Chain & Freight: |

|||||||||||||

| Forwarding and Logistics |

5,681 | 4,859 | 822 | 16.9 | |||||||||

| UPS Freight |

1,952 | 797 | 1,155 | 144.9 | |||||||||

| Other |

369 | 338 | 31 | 9.2 | |||||||||

| Total Supply Chain & Freight |

8,002 | 5,994 | 2,008 | 33.5 | |||||||||

| Consolidated |

$ | 47,547 | $ | 42,581 | $ | 4,966 | 11.7 | % | |||||

| Average Daily Package Volume (in thousands): | # | ||||||||||||

| U.S. Domestic Package: |

|||||||||||||

| Next Day Air |

1,267 | 1,228 | 39 | 3.2 | % | ||||||||

| Deferred |

993 | 946 | 47 | 5.0 | |||||||||

| Ground |

11,537 | 11,044 | 493 | 4.5 | |||||||||

| Total U.S. Domestic Package |

13,797 | 13,218 | 579 | 4.4 | |||||||||

| International Package: |

|||||||||||||

| Domestic |

1,108 | 916 | 192 | 21.0 | |||||||||

| Export |

689 | 616 | 73 | 11.9 | |||||||||

| Total International Package |

1,797 | 1,532 | 265 | 17.3 | |||||||||

| Consolidated |

15,594 | 14,750 | 844 | 5.7 | % | ||||||||

| Operating days in period |

253 | 254 | |||||||||||

| Average Revenue Per Piece: | $ | ||||||||||||

| U.S. Domestic Package: |

|||||||||||||

| Next Day Air |

$ | 21.14 | $ | 20.46 | $ | 0.68 | 3.3 | % | |||||

| Deferred |

13.63 | 13.56 | 0.07 | 0.5 | |||||||||

| Ground |

6.94 | 6.76 | 0.18 | 2.7 | |||||||||

| Total U.S. Domestic Package |

8.73 | 8.52 | 0.21 | 2.5 | |||||||||

| International Package: |

|||||||||||||

| Domestic |

6.96 | 6.83 | 0.13 | 1.9 | |||||||||

| Export |

37.60 | 37.43 | 0.17 | 0.5 | |||||||||

| Total International Package |

18.70 | 19.13 | (0.43 | ) | (2.2 | ) | |||||||

| Consolidated |

$ | 9.88 | $ | 9.62 | $ | 0.26 | 2.7 | % | |||||

21

The following tables set forth information showing the change in UPS Freight’s less-than-truckload (“LTL”) revenue, shipments, and gross weight hauled, both in dollars or amounts and in percentage terms:

| Year Ended December 31, |

Change | ||||||||||||

| 2007 | 2006 | $ | % | ||||||||||

| LTL revenue (in millions) |

$ | 2,013 | $ | 1,831 | $ | 182 | 9.9 | % | |||||

| LTL revenue per LTL hundredweight |

$ | 17.41 | $ | 15.93 | $ | 1.48 | 9.3 | % | |||||

| LTL shipments (in thousands) |

10,481 | 9,638 | 843 | 8.7 | % | ||||||||

| LTL shipments per day (in thousands) |

41.4 | 38.2 | 3.2 | 8.3 | % | ||||||||

| LTL gross weight hauled (in millions of pounds) |

11,560 | 11,498 | 62 | 0.5 | % | ||||||||

| LTL weight per shipment |

1,103 | 1,193 | (90 | ) | (7.5 | )% | |||||||

| Operating days in period |

253 | 252 | |||||||||||

| Year Ended December 31, |

Change | ||||||||||||

| 2006 | 2005 | $ | % | ||||||||||

| LTL revenue (in millions) |

$ | 1,831 | $ | 754 | $ | 1,077 | 142.8 | % | |||||

| LTL revenue per LTL hundredweight |

$ | 15.93 | $ | 15.53 | $ | 0.40 | 2.6 | % | |||||

| LTL shipments (in thousands) |

9,638 | 4,113 | 5,525 | 134.3 | % | ||||||||

| LTL shipments per day (in thousands) |

38.2 | 40.7 | (2.5 | ) | (6.1 | )% | |||||||

| LTL gross weight hauled (in millions of pounds) |

11,498 | 4,855 | 6,643 | 136.8 | % | ||||||||

| LTL weight per shipment |

1,193 | 1,180 | 13 | 1.1 | % | ||||||||

| Operating days in period |

252 | 101 | |||||||||||

Overnite Corp., now known as UPS Freight, was acquired on August 5, 2005. The information presented above reflects the performance of UPS Freight for the period subsequent to the date of acquisition.

Operating Profit and Margin

The following tables set forth information showing the change in operating profit (loss), both in dollars (in millions) and in percentage terms, for each reporting segment:

| Year Ended December 31, |

Change | |||||||||||||

| 2007 | 2006 | $ | % | |||||||||||

| Reporting Segment |

||||||||||||||

| U.S. Domestic Package |

$ | (1,531 | ) | $ | 4,923 | $ | (6,454 | ) | N/A | |||||

| International Package |

1,831 | 1,710 | 121 | 7.1 | % | |||||||||

| Supply Chain & Freight |

278 | 2 | 276 | N/A | ||||||||||

| Consolidated Operating Profit |

$ | 578 | $ | 6,635 | $ | (6,057 | ) | (91.3 | )% | |||||

| Year Ended December 31, |

Change | |||||||||||||

| 2006 | 2005 | $ | % | |||||||||||

| Reporting Segment |

||||||||||||||

| U.S. Domestic Package |

$ | 4,923 | $ | 4,493 | $ | 430 | 9.6 | % | ||||||

| International Package |

1,710 | 1,494 | 216 | 14.5 | ||||||||||

| Supply Chain & Freight |

2 | 156 | (154 | ) | (98.7 | ) | ||||||||

| Consolidated Operating Profit |

$ | 6,635 | $ | 6,143 | $ | 492 | 8.0 | % | ||||||

22

The following table sets forth information showing the operating margin for each reporting segment:

| Year Ended December 31, | |||||||||

| 2007 | 2006 | 2005 | |||||||

| Reporting Segment |

|||||||||

| U.S. Domestic Package |

(4.9 | )% | 16.2 | % | 15.7 | % | |||

| International Package |

17.8 | % | 18.8 | % | 18.7 | % | |||

| Supply Chain & Freight |

3.3 | % | 0.0 | % | 2.6 | % | |||

| Consolidated Operating Margin |

1.2 | % | 14.0 | % | 14.4 | % | |||

U.S. Domestic Package Operations

2007 compared to 2006

U.S. Domestic Package revenue increased $529 million, or 1.7%, in 2007, due to a 1.6% improvement in revenue per piece and a 0.4% increase in average daily package volume. Next Day Air volume increased 0.8% and Ground volume increased 0.6% for the year, largely as a result of a solid peak season in the fourth quarter, when our Next Day Air volume rose 2.2% and Ground volume increased 1.5%. Deferred air volume declined 1.9% in 2007. Our domestic air and ground products have been impacted by the slowing U.S. economy and weak small package market in 2007. Trends in U.S. industrial production and business-to-consumer shipments in 2007 have not been favorable to the overall small package market, which places pressure on our domestic package volume.

The increase in overall revenue per piece of 1.6% in 2007 resulted primarily from a rate increase that took effect earlier in the year, but was negatively impacted by lower fuel surcharge revenue and an unfavorable shift in product mix. Next Day Air revenue per piece declined 0.9%, and was negatively impacted by strong growth in our lower-yielding Next Day Air Saver products. Deferred revenue per piece increased only 0.4%. The change in revenue per piece for all our air products was negatively impacted by a lower fuel surcharge rate (discussed further below). Ground revenue per piece increased 2.9%, primarily due to the rate increase, but was also impacted slightly by a higher fuel surcharge due to higher diesel fuel prices in 2007 compared with 2006. Overall product mix reduced revenue per piece, as our premium air products suffered volume declines while our ground volume grew 0.6%.

Consistent with the practice in previous years, a rate increase took effect on January 1, 2007. We increased the base rates 6.9% on UPS Next Day Air, UPS 2nd Day Air, and UPS 3 Day Select, and 4.9% on UPS Ground. Other pricing changes included a $0.10 increase in the residential surcharge, and a $0.75 increase in the charge for undeliverable packages after three delivery attempts.

In January 2007, we modified the fuel surcharge on domestic air services by reducing the index used to determine the fuel surcharge by 2%. This fuel surcharge continues to be based on the U.S. Energy Department’s Gulf Coast spot price for a gallon of kerosene-type jet fuel. Based on published rates, the average fuel surcharge on domestic air products was 12.17% in 2007, a decline from the 14.02% in 2006, primarily due to the 2% reduction in the index. The ground fuel surcharge rate continues to fluctuate based on the U.S. Energy Department’s On-Highway Diesel Fuel Price. Based on published rates, the average fuel surcharge on domestic ground products was 4.30% in 2007, an increase from 4.13% in 2006, due to higher diesel fuel prices. As a result of the air products index rate reduction and fuel market price movements, total domestic fuel surcharge revenue decreased by $110 million in 2007.

U.S. Domestic Package incurred an operating loss of $1.531 billion in 2007, compared with a $4.923 billion operating profit in 2006, largely due to a $6.100 billion charge related to our withdrawal from the Central States, Southeast and Southwest Areas Pension Fund (“Central States Pension Fund”). Additionally, Domestic Package operating results were negatively impacted by low revenue growth, an aircraft impairment charge, and a special voluntary separation opportunity (“SVSO”) charge. The aircraft impairment and SVSO charges reduced domestic operating profit by $159 million and $53 million, respectively. These factors were partially offset by cost controls, including, among other categories, lower self-insurance expense. The expense associated with our self-insurance

23

accruals for workers’ compensation claims, automotive liability and general business liabilities declined as a result of several factors. The Central States Pension Fund withdrawal, aircraft impairment, and SVSO charges, as well as the impact of lower self-insurance expense, are discussed further in the “Operating Expenses” section.

2006 compared to 2005

U.S. Domestic Package revenue increased $1.846 billion, or 6.5%, for the year, with average daily package volume up 4.4%. Volume gains were realized across all products primarily due to a solid U.S. economy, strong small package market and continuing efforts to generate new volume. Overall domestic volume growth moderated in the latter half of 2006 compared with 2005, due to slower overall economic growth in the U.S. and a downturn in industrial production during the fourth quarter.

Pricing remained firm as overall revenue per piece was up 2.5% for the year. Ground revenue per piece increased 2.7% and Next Day Air revenue per piece increased 3.3% for the year, primarily due to the impact of a rate increase that took effect in 2006 and the impact of an increased fuel surcharge rate in 2006 compared to 2005. Deferred revenue per piece increased 0.5% for the year for the same reasons, but was adversely affected by the growth in lighter weight, lower revenue packages.