DEF 14A0001090727false00010907272022-01-012022-12-31iso4217:USD00010907272021-01-012021-12-310001090727ups:AbneyMember2020-01-012020-12-310001090727ups:TomeMember2020-01-012020-12-3100010907272020-01-012020-12-310001090727ecd:PeoMemberups:DeductionsMember2022-01-012022-12-310001090727ecd:PeoMemberups:AdditionsMember2022-01-012022-12-310001090727ecd:PeoMemberups:DeductionsMember2021-01-012021-12-310001090727ecd:PeoMemberups:AdditionsMember2021-01-012021-12-310001090727ecd:PeoMemberups:DeductionsMemberups:TomeMember2020-01-012020-12-310001090727ecd:PeoMemberups:AdditionsMemberups:TomeMember2020-01-012020-12-310001090727ecd:PeoMemberups:DeductionsMemberups:AbneyMember2020-01-012020-12-310001090727ecd:PeoMemberups:AdditionsMemberups:AbneyMember2020-01-012020-12-310001090727ecd:PeoMemberups:DeductionsForStockAwardsGrantedMember2022-01-012022-12-310001090727ecd:PeoMemberups:DeductionsForStockAwardsGrantedMember2021-01-012021-12-310001090727ecd:PeoMemberups:TomeMemberups:DeductionsForStockAwardsGrantedMember2020-01-012020-12-310001090727ecd:PeoMemberups:DeductionsForStockAwardsGrantedMemberups:AbneyMember2020-01-012020-12-310001090727ecd:PeoMemberups:DeductionsForOptionAwardsGrantedMember2022-01-012022-12-310001090727ecd:PeoMemberups:DeductionsForOptionAwardsGrantedMember2021-01-012021-12-310001090727ecd:PeoMemberups:TomeMemberups:DeductionsForOptionAwardsGrantedMember2020-01-012020-12-310001090727ecd:PeoMemberups:DeductionsForOptionAwardsGrantedMemberups:AbneyMember2020-01-012020-12-310001090727ecd:PeoMemberups:DeductionsForChangeInAccumulatedBenefitsUnderPensionPlansMember2022-01-012022-12-310001090727ecd:PeoMemberups:DeductionsForChangeInAccumulatedBenefitsUnderPensionPlansMember2021-01-012021-12-310001090727ecd:PeoMemberups:TomeMemberups:DeductionsForChangeInAccumulatedBenefitsUnderPensionPlansMember2020-01-012020-12-310001090727ecd:PeoMemberups:DeductionsForChangeInAccumulatedBenefitsUnderPensionPlansMemberups:AbneyMember2020-01-012020-12-310001090727ecd:PeoMemberups:AdditionsForServiceCostForDefinedBenefitPensionPlansMember2022-01-012022-12-310001090727ecd:PeoMemberups:AdditionsForServiceCostForDefinedBenefitPensionPlansMember2021-01-012021-12-310001090727ecd:PeoMemberups:TomeMemberups:AdditionsForServiceCostForDefinedBenefitPensionPlansMember2020-01-012020-12-310001090727ecd:PeoMemberups:AdditionsForServiceCostForDefinedBenefitPensionPlansMemberups:AbneyMember2020-01-012020-12-310001090727ecd:PeoMemberups:EquityAwardsGrantedDuringTheYearMember2022-01-012022-12-310001090727ecd:PeoMemberups:EquityAwardsGrantedInPriorYearsUnvestedMember2022-01-012022-12-310001090727ecd:PeoMemberups:EquityAwardsGrantedDuringTheYearVestedMember2022-01-012022-12-310001090727ecd:PeoMemberups:EquityAwardsGrantedInPriorYearsVestedMember2022-01-012022-12-310001090727ecd:PeoMemberups:EquityAwardAdjustmentsMember2022-01-012022-12-310001090727ecd:PeoMemberups:EquityAwardsGrantedDuringTheYearMember2021-01-012021-12-310001090727ecd:PeoMemberups:EquityAwardsGrantedInPriorYearsUnvestedMember2021-01-012021-12-310001090727ecd:PeoMemberups:EquityAwardsGrantedDuringTheYearVestedMember2021-01-012021-12-310001090727ecd:PeoMemberups:EquityAwardsGrantedInPriorYearsVestedMember2021-01-012021-12-310001090727ecd:PeoMemberups:EquityAwardAdjustmentsMember2021-01-012021-12-310001090727ecd:PeoMemberups:TomeMemberups:EquityAwardsGrantedDuringTheYearMember2020-01-012020-12-310001090727ecd:PeoMemberups:EquityAwardsGrantedInPriorYearsUnvestedMemberups:TomeMember2020-01-012020-12-310001090727ecd:PeoMemberups:TomeMemberups:EquityAwardsGrantedDuringTheYearVestedMember2020-01-012020-12-310001090727ecd:PeoMemberups:TomeMemberups:EquityAwardsGrantedInPriorYearsVestedMember2020-01-012020-12-310001090727ecd:PeoMemberups:TomeMemberups:EquityAwardAdjustmentsMember2020-01-012020-12-310001090727ecd:PeoMemberups:EquityAwardsGrantedDuringTheYearMemberups:AbneyMember2020-01-012020-12-310001090727ecd:PeoMemberups:EquityAwardsGrantedInPriorYearsUnvestedMemberups:AbneyMember2020-01-012020-12-310001090727ecd:PeoMemberups:EquityAwardsGrantedDuringTheYearVestedMemberups:AbneyMember2020-01-012020-12-310001090727ecd:PeoMemberups:EquityAwardsGrantedInPriorYearsVestedMemberups:AbneyMember2020-01-012020-12-310001090727ecd:PeoMemberups:EquityAwardAdjustmentsMemberups:AbneyMember2020-01-012020-12-310001090727ups:DeductionsMemberecd:NonPeoNeoMember2022-01-012022-12-310001090727ups:AdditionsMemberecd:NonPeoNeoMember2022-01-012022-12-310001090727ups:DeductionsMemberecd:NonPeoNeoMember2021-01-012021-12-310001090727ups:AdditionsMemberecd:NonPeoNeoMember2021-01-012021-12-310001090727ups:DeductionsMemberecd:NonPeoNeoMember2020-01-012020-12-310001090727ups:AdditionsMemberecd:NonPeoNeoMember2020-01-012020-12-310001090727ecd:NonPeoNeoMemberups:DeductionsForStockAwardsGrantedMember2022-01-012022-12-310001090727ecd:NonPeoNeoMemberups:DeductionsForStockAwardsGrantedMember2021-01-012021-12-310001090727ecd:NonPeoNeoMemberups:DeductionsForStockAwardsGrantedMember2020-01-012020-12-310001090727ecd:NonPeoNeoMemberups:DeductionsForOptionAwardsGrantedMember2022-01-012022-12-310001090727ecd:NonPeoNeoMemberups:DeductionsForOptionAwardsGrantedMember2021-01-012021-12-310001090727ecd:NonPeoNeoMemberups:DeductionsForOptionAwardsGrantedMember2020-01-012020-12-310001090727ecd:NonPeoNeoMemberups:DeductionsForChangeInAccumulatedBenefitsUnderPensionPlansMember2022-01-012022-12-310001090727ecd:NonPeoNeoMemberups:DeductionsForChangeInAccumulatedBenefitsUnderPensionPlansMember2021-01-012021-12-310001090727ecd:NonPeoNeoMemberups:DeductionsForChangeInAccumulatedBenefitsUnderPensionPlansMember2020-01-012020-12-310001090727ecd:NonPeoNeoMemberups:AdditionsForServiceCostForDefinedBenefitPensionPlansMember2022-01-012022-12-310001090727ecd:NonPeoNeoMemberups:AdditionsForServiceCostForDefinedBenefitPensionPlansMember2021-01-012021-12-310001090727ecd:NonPeoNeoMemberups:AdditionsForServiceCostForDefinedBenefitPensionPlansMember2020-01-012020-12-310001090727ecd:NonPeoNeoMemberups:EquityAwardsGrantedDuringTheYearMember2022-01-012022-12-310001090727ups:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001090727ecd:NonPeoNeoMemberups:EquityAwardsGrantedDuringTheYearVestedMember2022-01-012022-12-310001090727ecd:NonPeoNeoMemberups:EquityAwardsGrantedInPriorYearsVestedMember2022-01-012022-12-310001090727ecd:NonPeoNeoMemberups:EquityAwardAdjustmentsMember2022-01-012022-12-310001090727ecd:NonPeoNeoMemberups:EquityAwardsGrantedDuringTheYearMember2021-01-012021-12-310001090727ups:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001090727ecd:NonPeoNeoMemberups:EquityAwardsGrantedDuringTheYearVestedMember2021-01-012021-12-310001090727ecd:NonPeoNeoMemberups:EquityAwardsGrantedInPriorYearsVestedMember2021-01-012021-12-310001090727ecd:NonPeoNeoMemberups:EquityAwardAdjustmentsMember2021-01-012021-12-310001090727ecd:NonPeoNeoMemberups:EquityAwardsGrantedDuringTheYearMember2020-01-012020-12-310001090727ups:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2020-01-012020-12-310001090727ecd:NonPeoNeoMemberups:EquityAwardsGrantedDuringTheYearVestedMember2020-01-012020-12-310001090727ecd:NonPeoNeoMemberups:EquityAwardsGrantedInPriorYearsVestedMember2020-01-012020-12-310001090727ecd:NonPeoNeoMemberups:EquityAwardAdjustmentsMember2020-01-012020-12-310001090727ecd:NonPeoNeoMember12022-01-012022-12-3100010907272ecd:NonPeoNeoMember2022-01-012022-12-3100010907273ecd:NonPeoNeoMember2022-01-012022-12-3100010907274ecd:NonPeoNeoMember2022-01-012022-12-3100010907275ecd:NonPeoNeoMember2022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| | | | | | | | | | | |

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| | | | | |

CHECK THE APPROPRIATE BOX: |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☑ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

United Parcel Service, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | |

PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): |

☑ | No fee required |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Table of Contents

| | | | | |

| |

| |

| |

| |

| |

| |

| | |

| |

| |

| |

| |

| | |

| |

| |

| |

| |

Proposal 8 — Shareowner Proposal Requesting the Board Prepare a Report on How the Company is Addressing the Impact of its Climate Change Strategy on Relevant Stakeholders Consistent with the “Just Transition” Guidelines | |

Proposal 9 — Shareowner Proposal Requesting the Board Prepare a Report on Risks or Costs Caused by State Policies Restricting Reproductive Rights | |

Proposal 10 — Shareowner Proposal Requesting the Board Prepare a Report on the Impact of the Company’s DE&I Policies on Civil Rights, Non-Discrimination and Returns to Merit, and the Company’s Business | |

| |

| | |

| |

| | |

| |

| |

| |

| |

| |

| |

| | | | | |

United Parcel Service, Inc.

55 Glenlake Parkway, N.E.

Atlanta, GA 30328 March 20, 2023 Dear Fellow Shareowners: | |

|

It is my pleasure to invite you to the 2023 Annual Meeting of Shareowners. This is your opportunity to share your views with the Company and the board. We value your feedback and take it into account as we execute our board responsibilities.

UPS achieved a number of important milestones in 2022. We celebrated the Company’s 115th anniversary and successfully implemented the Company’s Customer First, People Led, Innovation Driven strategy. This resulted in revenue of over $100 billion for the first time in our 115-year history! The Company also reached its consolidated operating margin and return on invested capital goals one year earlier than originally anticipated, confirming management’s successful execution of its Better not Bigger strategic framework, including efforts to optimize operations and improve the Company’s cost structure.

These results were delivered through a relentless focus on outstanding customer service, facilitated by the hard work and dedication of approximately 536,000 UPSers around the globe. The Company continued to create value for its customers and shareowners, even during a challenging operating environment, and despite evolving competitive pressures. Because of this success, we were able to return over $8.6 billion to shareowners in 2022 through dividends and share repurchases.

The board understands that short-term operational and financial results alone are not enough. I am proud to be affiliated with a Company that also has a long history of environmental and social responsibility and a culture of doing the right thing. Furthermore, our board has implemented a number of governance measures to enhance its oversight of matters important to key stakeholders, including our customers, investors, employees and communities. We have a diverse board, which facilitates better decision-making and contributes to the success of our Company. We also continue to oversee the Company’s progress towards its environmental and social goals. This commitment to good governance practices is an important driver of long-term value creation for shareowners. The information in this Proxy Statement and the Company’s other disclosures provide a glimpse into how this culture has helped the Company thrive and execute its strategy with a sense of purpose.

Finally, it is with regret that I am announcing Ann Livermore’s retirement from the board at the Annual Meeting. When Ann joined the board in 1997, UPS was a private company. Ann has ably served on every committee of the board during her tenure and has been highly effective serving as chair of the Compensation and Human Capital Committee since 2013. She is a role model for countless women in the business community, and a leader on our board. On behalf of the entire board, I want to thank Ann for her exemplary service.

In closing, I want to encourage all my fellow shareowners to vote. As we approach the Annual Meeting, please contact us with any questions or feedback at 404-828-6059.

On behalf of the entire Board of Directors, thank you for your continued support.

William Johnson

UPS Board Chair

| | | | | | | | |

4 | | Notice of Annual Meeting of Shareowners and 2023 Proxy Statement |

| | | | | |

| Notice of Annual Meeting UNITED PARCEL SERVICE, INC. 55 Glenlake Parkway, N.E., Atlanta, Georgia 30328 |

•Date and Time: May 4, 2023, 8:00 a.m. Eastern Time

•Place: The United Parcel Service, Inc. 2023 Annual Meeting of shareowners will be held exclusively online via webcast at: www.virtualshareholdermeeting.com/UPS2023.

•Record Date: March 9, 2023

•Distribution Date: A Notice of Internet Availability of Proxy Materials or the Proxy Statement is first being sent to shareowners on or about March 20, 2023.

•Voting: Holders of class A common stock are entitled to 10 votes per share; holders of class B common stock are entitled to one vote per share. Your vote is important. Please vote as soon as possible through the Internet, by telephone or by signing and returning your proxy card (if you received a paper copy of the proxy card). Your voting options are described on the Notice of Internet Availability of Proxy Materials, voting instruction form and/or proxy card. Brokers are not permitted to vote on certain proposals and may not vote on any of the proposals unless you provide voting instructions. Voting your shares will help to ensure that your interests are represented at the meeting.

•Attending the Meeting: You or your proxy holder can participate, vote and ask questions at the meeting by visiting www.virtualshareholdermeeting.com/UPS2023 and using your 16-digit control number found on your proxy card, voting instruction form or Notice of Internet Availability of Proxy Materials. Shareowners who do not receive a 16-digit control number should consult their voting instruction form or Notice of Internet Availability of Proxy Materials and may need to request a legal proxy from their bank, broker or other nominee in advance of the meeting in order to participate. For more information, see page 93. Important Notice Regarding the Availability of Proxy Materials for the Shareowner Meeting to be Held on May 4, 2023: The Proxy Statement and our 2022 Annual Report are available at www.proxyvote.com. Questions? Call 404-828-6059 (option 2).

| | | | | | | | |

| | |

| | By order of the Board of Directors |

| | Norman M. Brothers, Jr.

Secretary

Atlanta, Georgia

March 20, 2023 |

| | |

| United Parcel Service, Inc. 2023 Annual Meeting of Shareowners |

| Items of Business |

| | | | | | | | | | | |

| Voting Choices | Board Voting

Recommendations | Page |

| Company Proposals: | | | |

1.Elect 12 director nominees named in the Proxy Statement to serve until the 2024 Annual Meeting and until their respective successors are elected and qualified | •Vote for all nominees •Vote against all nominees •Vote for some nominees and against others •Abstain from voting on one or more nominees | FOR

EACH

NOMINEE | |

2. Advisory vote to approve named executive officer compensation | •Vote for the proposal •Vote against the proposal •Abstain from voting on the proposal | FOR | |

| 3. Advisory vote on the frequency of future advisory votes to approve named executive officer compensation | •Vote for an advisory vote every year •Vote for an advisory vote every two years •Vote for an advisory vote every three years •Abstain from voting on the proposal | EVERY YEAR | |

4. Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2023 | •Vote for ratification •Vote against ratification •Abstain from voting on the proposal | FOR | |

| Shareowner Proposals: | | | |

5. - 11. Advisory votes on 7 shareowner proposals, only if properly presented | •Vote for each proposal •Vote against each proposal •Abstain from voting on the proposals | AGAINST

EACH

PROPOSAL | |

| | | | | | | | |

6 | | Notice of Annual Meeting of Shareowners and 2023 Proxy Statement |

| | | | | |

| Proxy Statement UNITED PARCEL SERVICE, INC. 55 Glenlake Parkway, N.E., Atlanta, Georgia 30328 |

This Proxy Statement contains important information about the 2023 Annual Meeting of Shareowners (the “Annual Meeting”). We are providing these proxy materials to you because our Board of Directors is soliciting your proxy to vote your shares at the Annual Meeting. The Annual Meeting will be held online only on May 4, 2023, at 8:00 a.m. Eastern Time, at www.virtualshareholdermeeting.com/UPS2023. Shareowners can participate, ask questions and vote during the meeting through this website.

All properly executed written proxies, and all properly completed proxies submitted through the Internet or by telephone, that are delivered pursuant to this solicitation will be voted at the Annual Meeting in accordance with the directions given in the proxy, unless the proxy is revoked prior to the completion of voting at the meeting. Only owners of record of shares of the Company’s common stock as of the close of business on March 9, 2023 (the “Record Date”) are entitled to notice of, and to vote at, the Annual Meeting (or any adjournment or postponement of the Annual Meeting). We are first mailing this Proxy Statement on or about March 20, 2023.

Proxy Statement Summary

The following summary highlights key information contained elsewhere in this Proxy Statement.

Some of our key governance policies and practices include:

•A diverse and independent board; all our directors are independent, other than our Chief Executive Officer (“CEO”);

•An independent Board Chair who is highly engaged and experienced;

•Executive sessions of our independent directors at each board meeting;

•Annual elections for all directors; majority voting in uncontested director elections;

•Full board engagement in the strategic planning process, including an in-depth annual strategy review and overseeing progress throughout the year;

•A Risk Committee consisting entirely of independent members that is responsible for oversight of enterprise risks, including cybersecurity risks;

•Regular evaluations of governance policies and practices, making changes when appropriate; including recently delegating additional cybersecurity oversight responsibilities to the Risk Committee, delegating additional human capital oversight responsibilities to the

Compensation and Human Capital Committee, and adopting a director overboarding policy;

•Regular engagement with stakeholders on environmental, social and governance (“ESG”) matters; during this proxy season management contacted holders of over 47% of our class B common stock to discuss sustainability goals and initiatives, commitments to social justice and executive compensation matters;

•Annual board and committee self-evaluations, including one-on-one director discussions with the independent Board Chair;

•Comprehensive director orientation program;

•Robust stock ownership guidelines, including a target ownership of eight times annual salary for the CEO, five times annual salary for other executive officers and five times the annual retainer for directors; and

•Restrictions on executive officers and directors hedging or pledging their ownership in UPS stock.

Highlights

92% Independent 61 years Average age 7.9 years Average tenure

42% Female 33% Ethnically diverse

Summary information about our director nominees is below. As a group, we believe our 12 director nominees have the appropriate skills and experience to effectively oversee and constructively challenge management’s performance in the execution of our strategy. Ann Livermore, who has served as a director since 1997, is not up for re-election at the 2023 Annual Meeting. We thank Ann for her years of dedicated service and for her significant contributions to UPS. For more information about our director nominees, see page 22. | | | | | | | | | | | |

| Name | Director

Since | Principal Occupation | Committee(s) |

| Independent Directors | |

| Rodney Adkins | 2013 | Former Senior Vice President, International Business Machines Corporation | –Risk (Chair) –Compensation and Human Capital |

| Eva Boratto | 2020 | Chief Financial Officer, Opentrons Labworks, Inc. | –Audit (Chair) |

| Michael Burns | 2005 | Former Chairman, President and Chief Executive Officer, Dana Incorporated | –Audit |

| Wayne Hewett | 2020 | Senior Advisor to Permira, and Non-Executive Chairman of Cambrex Corporation | –Audit |

| Angela Hwang | 2020 | Chief Commercial Officer and President, Pfizer Biopharmaceuticals Business, Pfizer, Inc. | –Audit |

| Kate Johnson | 2020 | President and Chief Executive Officer, Lumen Technologies, Inc. | –Nominating and Corporate Governance –Risk |

William Johnson(1) | 2009 | Former Chairman, President and Chief Executive Officer, H.J. Heinz Company | –Nominating and Corporate Governance (Chair) –Executive |

| Franck Moison | 2017 | Former Vice Chairman, Colgate-Palmolive Company | –Nominating and Corporate Governance –Risk |

| Christiana Smith Shi | 2018 | Former President, Direct-to-Consumer, Nike, Inc. | –Compensation and Human Capital –Risk |

| Russell Stokes | 2020 | President and Chief Executive Officer, Commercial Engines and Services, GE Aerospace | –Compensation and Human Capital –Nominating and Corporate Governance |

| Kevin Warsh | 2012 | Former Member of the Board of Governors of the Federal Reserve System, Distinguished Visiting Fellow, Hoover Institution, Stanford University | –Compensation and Human Capital –Nominating and Corporate Governance |

| Non-Independent Director | |

| Carol Tomé | 2003 | UPS Chief Executive Officer | –Executive (Chair) |

(1)Independent Board Chair

| | | | | | | | |

8 | | Notice of Annual Meeting of Shareowners and 2023 Proxy Statement |

| | | | | | | | |

9 | | Notice of Annual Meeting of Shareowners and 2023 Proxy Statement |

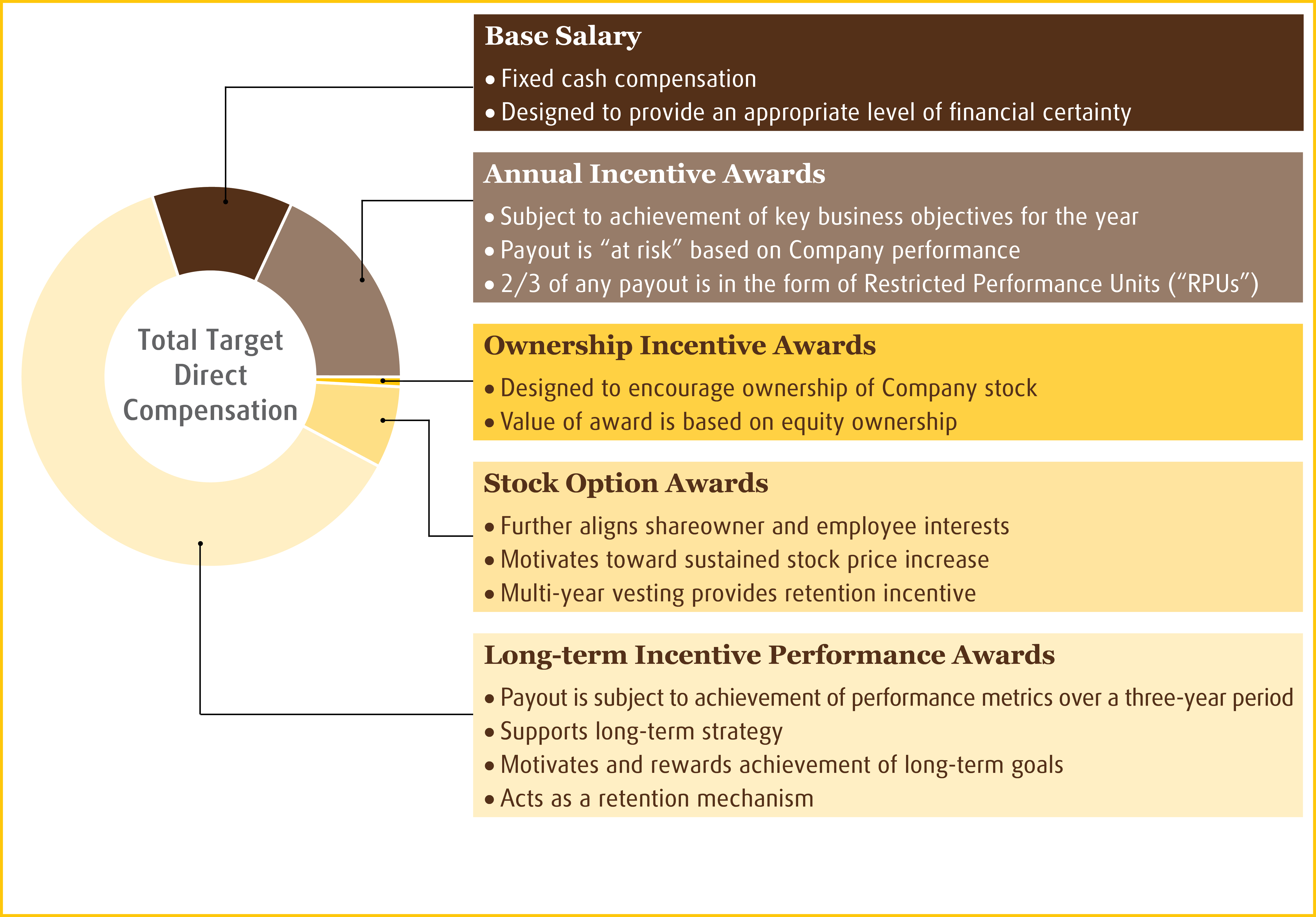

Compensation Practices

A significant portion of executive compensation is at-risk and tied to Company performance. This aligns executive decision-making with the long-term interests of our shareowners. We also have a longstanding owner-manager culture. Compensation practices that support these principles include:

•A balanced mix of cash and equity, providing a degree of financial certainty and appropriate incentives to retain and motivate executives;

•Performance incentive equity awards which vest over multiple years, furthering both retention and incentive goals;

•Multiple distinct goals for annual and long-term performance incentive awards, avoiding overemphasis on any one metric and mitigating excessive risk-taking;

•Long-term performance incentive awards with a three-year performance period;

•Stock option awards that vest over a five-year period and only provide value if our stock price increases;

•Incentive compensation plans that include clawback provisions;

•Incentive compensation plan awards require a “double trigger” — both a change in control and a termination of employment — to accelerate vesting; and

•No tax gross-ups on equity awards or golden parachute excise taxes.

2022 Compensation Actions

Key 2022 compensation decisions affecting our executive officers included:

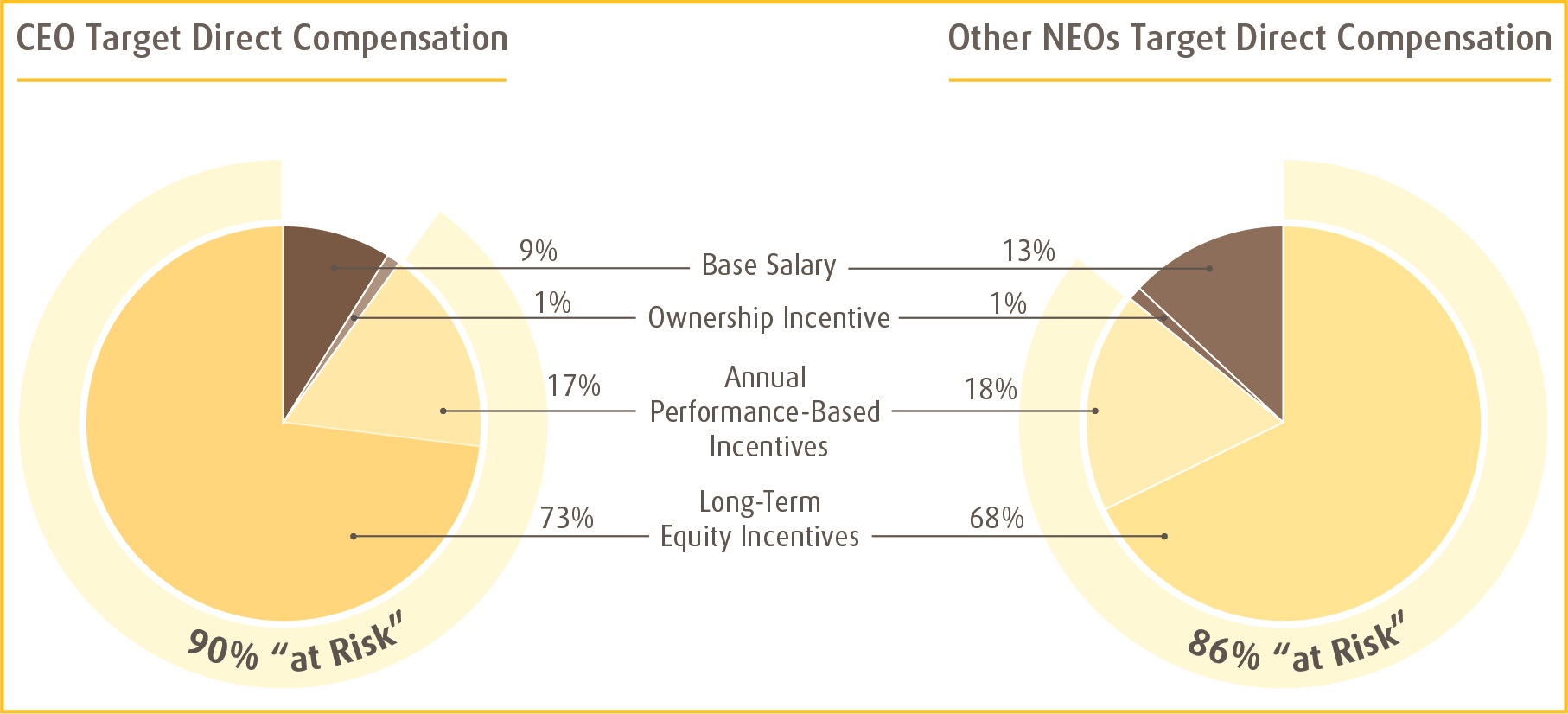

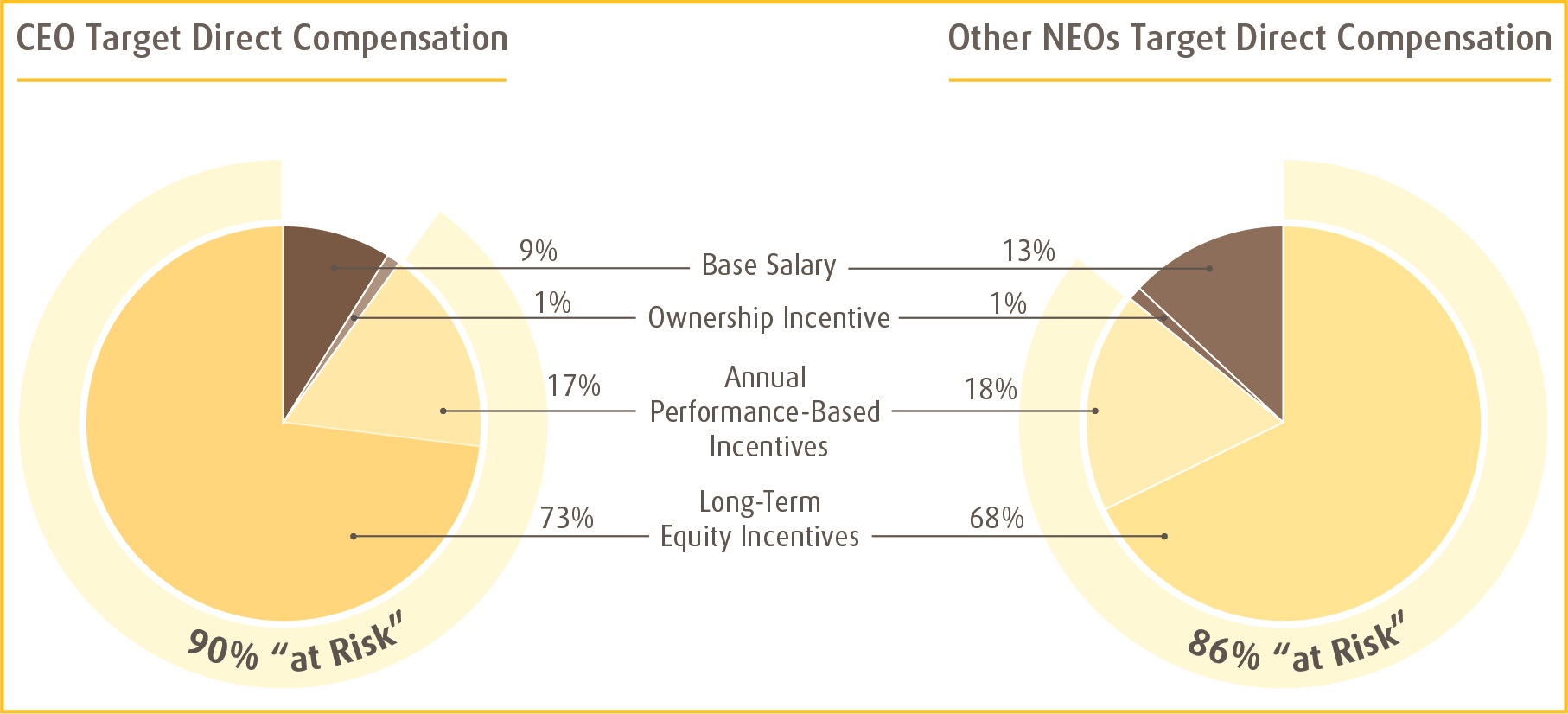

•Most total direct compensation was performance-based and considered “at risk” (90% for the CEO and 86% for all other named executive officers (“NEOs”) as a group), page 35;

•Base salary increases as a result of the annual salary review process, page 37;

•Bifurcated performance period for the annual incentive awards in light of continued economic uncertainty due to the COVID-19 pandemic, page 38;

•Annual incentive awards were earned at target, page 40; and

•Previously granted 2020 Long-Term Incentive Performance (“LTIP”) awards, which had three-year performance goals ending in 2022, were earned above target, page 43.

For a discussion of important decisions made by the Compensation and Human Capital Committee during 2022 that will impact compensation in future years, see page 40.

| | |

| Say on Pay Vote and Say on Pay Voting Frequency |

We maintain executive compensation programs that support the long-term interests of our shareowners. We provide shareowners the opportunity to vote annually, on an advisory basis, to approve the compensation of our NEOs, as described in the Compensation Discussion and Analysis section and in the compensation tables and accompanying narrative disclosure in this Proxy Statement. For more information, see page 65. The board recommends you vote FOR the advisory vote to approve NEO compensation.

In addition, the Dodd-Frank Act and Section 14A of the Exchange Act requires us to provide shareowners with the opportunity to indicate, on an advisory basis at least once every six years, their preferences as to the frequency of future advisory votes to approve NEO compensation. Beginning in 2020, we voluntarily began providing shareowners with an annual say on pay vote. For more information, see page 66. The board recommends that you vote for future advisory votes to approve NEO compensation to be held EVERY YEAR.

| | |

| Ratify the Appointment of the Independent Registered Public Accounting Firm |

The Audit Committee of the Board of Directors has appointed Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2023. The board recommends you vote FOR the ratification of the appointment of Deloitte & Touche LLP. For more information, see page 69. For the reasons described in this Proxy Statement, the board recommends you vote AGAINST the shareowner proposals. Information about these proposals starts on page 72. | | | | | | | | |

10 | | Notice of Annual Meeting of Shareowners and 2023 Proxy Statement |

The Board of Directors is accountable to shareholders and operates within a governance structure that we believe provides appropriate checks and balances to create long-term value. The board’s responsibilities include:

•Establishing an appropriate corporate governance structure;

•Supporting and overseeing management in setting long-term strategic goals and applicable measures of value-creation;

•Providing oversight on the identification and management of materials risks;

•Establishing appropriate executive compensation structures; and

•Monitoring business issues that have the potential to significantly impact the Company’s long-term value.

We regularly review and update our corporate governance policies and practices in response to the evolving needs of our business, shareowner and other stakeholder feedback, regulatory changes, and other corporate developments. Following is an overview of our corporate governance structure and processes, including key aspects of our board operations.

Selecting Director Nominees

Maintaining a board of individuals independent of management, with the appropriate skills and experience, and of the highest personal character, integrity and ethical standards, is critical to the proper functioning of the board. The Nominating and Corporate Governance Committee seeks to promote

diversity in the boardroom with respect to gender, age, ethnicity, skills, experience, perspectives, and other factors. Our directors’ biographies beginning on page 22 highlight factors that the board considered when nominating these individuals. | | | | | |

| 1 | Board Composition Review |

| | The board’s annual self-evaluation helps the Nominating and Corporate Governance Committee identify needs by assessing areas where additional diversity, perspectives, expertise, skills or experience may be desired. The Nominating and Corporate Governance Committee also conducts regular in-depth board composition reviews. |

| 2 | Candidate Identification |

| | The Nominating and Corporate Governance Committee uses a variety of sources to identify a diverse pool of potential candidates. Sources include board members, members of management, independent consultants and shareowner recommendations. Prospective candidates are evaluated after taking into account feedback from consultants, management and board members, candidate background and qualification reviews, and open discussions between the Nominating and Corporate Governance Committee and the full board. This process allows for active and ongoing consideration of potential directors with a focus on long-term Company strategy. |

| 3 | Shortlisted Candidates |

| | The Nominating and Corporate Governance Committee maintains a diverse list of potential director candidates according to desired skills, experiences and backgrounds. The list is reviewed at each Nominating and Corporate Governance Committee meeting and updated as appropriate. Each candidate is evaluated to ensure that existing and planned future commitments would not materially interfere with expected responsibilities to the Company. |

| 4 | Recommendation, Nomination and Election |

| | Candidates recommended by the Nominating and Corporate Governance Committee and approved by the board are nominated for election. Directors are elected annually. |

| Result: | 5 new independent directors added since 2020; 42% director refreshment since 2020. |

| | |

| Shareowner Recommendations, Nominations and Proxy Access |

Shareowner recommended director candidates are considered on the same basis as recommendations from other sources. Shareowners can recommend a candidate by writing to the following address: UPS Corporate Secretary, 55 Glenlake Parkway, N.E., Atlanta, Georgia 30328. Submissions must contain the prospective candidate’s name and a detailed description of the experience, qualifications, attributes and skills that make the individual a suitable director candidate. We also provide proxy access for shareowner director nominees. A single shareowner,

or group of up to 20 shareowners, that has owned at least 3 percent of UPS’s outstanding stock continuously for at least three years, may include up to 20 percent of the board seats or two directors (whichever is greater), as director nominees in UPS’s proxy materials for an annual meeting of shareowners. Our Bylaws set forth the requirements for the formal shareowner nomination process for director candidates. For additional information, see page 97. Board Leadership Structure

Based on the periodic evaluation and recommendation of the Nominating and Corporate Governance Committee, the board determines the most appropriate board leadership structure, including who should serve as Board Chair, and whether the roles of Board Chair and CEO should be separated or combined. In making this determination, the board evaluates a number of factors, including professional experience, operational responsibilities and corporate governance developments, into account.

Beginning in October 2020, in connection with Carol Tomé’s election as CEO, the board determined that it was in the best interests of the Company to enable Carol to focus on leading the Company, and separated the roles of Chair and CEO. Bill Johnson, who had been serving as our independent Lead Director, was appointed Board Chair.

Bill has served on our board since 2009 and served as independent Lead Director from 2016 until October 2020. He has deep institutional knowledge of the Company and provides strong continuity of leadership. He devotes significant time to understanding our business and communicating with the CEO, and other directors, between meetings. He

draws on his extensive knowledge of our business, industry, strategic priorities and competitive developments to set the board’s agendas in collaboration with the CEO, and he seeks to ensure that board meetings are productive and interactions with the directors facilitate a useful exchange of viewpoints. Carol is available to all directors between meetings and meets regularly with the Board Chair, and with the directors individually and as a group, to receive feedback from the board. Bill’s collaboration with Carol allows the board to focus attention on the issues of greatest importance to the Company and its shareowners and our CEO to focus primarily on leading the Company.

Furthermore, all the members of each of the Audit Committee, the Compensation and Human Capital Committee, the Nominating and Corporate Governance Committee and the Risk Committee are independent. Each committee is led by a chairperson who sets the meeting agendas and reports to the full board on the committee’s work. Additionally, the independent directors meet in executive session without management present at each board meeting, as described below.

Executive Sessions of Independent Directors

Directors hold executive sessions without management present at each regular board meeting. The Board Chair determines the agenda and presides at each session. The Board Chair generally invites the CEO to join a portion of the executive session to

receive feedback from the board and when deemed appropriate otherwise. In addition, during the year the Board Chair meets individually with each director to discuss issues that are important to the board and to solicit and provide further feedback.

| | | | | | | | |

12 | | Notice of Annual Meeting of Shareowners and 2023 Proxy Statement |

Board and Committee Evaluations

The board’s performance is critical to our long-term success and the protection of stakeholders’ interests. The board employs both an ongoing informal and a formal annual process to evaluate its performance and the contributions of individual directors to the successful execution of the board’s obligations. The Board Chair frequently considers the performance of the board and the board’s committees and has

informal discussions about individual director contributions to the board. The Board Chair shares feedback from these discussions with the full board and with individual board members. In addition, during 2022 the Board Chair met individually with each director to discuss overall board effectiveness and performance and potential 2023 board agenda items.

| | |

| Formal Evaluation Process |

| | | | | |

| 1 | Detailed Formal Annual Evaluation Process |

| | The Board of Directors, Audit Committee, Compensation and Human Capital Committee, Nominating and Corporate Governance Committee, and Risk Committee each conduct an annual self-assessment. The Nominating and Corporate Governance Committee oversees the annual board assessment process and the implementation of the annual committee self-assessments. |

| 2 | Questionnaires |

| | All board and committee members complete a detailed confidential questionnaire each year. The questionnaire provides for quantitative ratings in key areas, including overall board effectiveness, meeting effectiveness, access to information, information format, board committee structure, access to management, succession planning, meeting dialogue, communication with the CEO, operational reporting, financial oversight, capital structure and financing, capital spending, long-term strategic planning, risk oversight, crisis management and time management. The questionnaire also allows directors to provide written feedback and make detailed anonymous comments. |

| 3 | Review |

| | The results of the committee self-assessments are reviewed by each committee and discussed with the full board. The Nominating and Corporate Governance Committee Chair reviews the results of committee self-assessments and discusses the responses with the chairs of the other board committees as appropriate. The Nominating and Corporate Governance Committee Chair also reviews and discusses the board evaluation results with the full board. |

| 4 | Follow-up |

| | Matters requiring follow-up are addressed by the Nominating and Corporate Governance Committee Chair or the chairs of the other committees as appropriate. |

Result | Feedback from evaluations has led to several improvements in board operations, including the format and delivery of board meeting materials, board meeting agendas and recurring topics, strategic planning and oversight, director recruitment practices and orientation, allocation of responsibilities among the board’s committees and succession planning. |

Board Refreshment and Succession

| | | | | |

| |

7.9 years nominee average tenure |

Newer directors (< 3 years) | |

Medium-tenured directors (3-10 years) | |

Longer-tenured directors (> 10 years) | |

| |

The Nominating and Corporate Governance Committee regularly evaluates board composition and necessary skills as our business evolves over

time. We seek a balance of knowledge and experience that comes from longer-term board service with new ideas and perspectives that can come from newer directors. Since 2020, we have added five new directors, and have had four directors retire. The average tenure of the director nominees reflects an appropriate balance between different perspectives brought by newer and long-serving directors.

Board Oversight of Strategic Planning

The board’s responsibilities include oversight of strategic planning. Effective oversight requires a high level of constructive engagement between management and the board. The board leverages its substantial experience and expertise and is fully engaged in the Company’s strategic planning process. Management develops and prioritizes strategic plans on an annual basis. Management then reviews these plans with the board on an annual basis, along with the Company’s challenges, opportunities, industry dynamics, and legal, regulatory and governance developments, and other factors.

Management provides the board comprehensive updates throughout the year regarding progress on the Company’s strategic plans. Management also provides regular updates regarding the achievement of the Company’s financial and other goals. In addition, the CEO communicates regularly with the board on important business opportunities, financial and operational performance matters, risks and other developments such as sustainability, human capital, labor and customer relations, both during and outside the regular board meeting cycle.

Management Development and Succession Planning

Succession planning and talent development are important at all levels within our organization. The board oversees management’s emergency and long-term succession plans at the executive officer level, most importantly the CEO position. The board annually reviews succession plans for senior management including the CEO, all in the context of the Company’s overall business strategy and with a focus on risk management. More broadly, the board and the Compensation and Human Capital Committee are regularly updated on key talent indicators for the overall workforce, including diversity, recruiting and development programs.

The board’s succession planning activities are ongoing and strategic and are supported by board committees and independent third-party consultants as needed. In

addition, the CEO annually provides an assessment to the board of senior leaders and their potential to succeed at key senior management positions. As a part of this process, potential leaders interact with board members through formal presentations and during informal events.

We also utilize a formal director engagement program in which directors meet with individual executive officers, visit Company operations, participate in employee events and receive in-depth subject matter updates outside of the regular board meeting process. These additional engagements encourage the ongoing exchange of ideas and information between directors and management, facilitate the board’s oversight responsibilities, and support management development and succession planning efforts.

| | | | | | | | |

14 | | Notice of Annual Meeting of Shareowners and 2023 Proxy Statement |

Risk Oversight

Risk management oversight is an essential board responsibility. The board regularly discusses our most significant risks and how these risks are being managed. The Company’s enterprise risk management process is designed to identify potential events that may affect the achievement of the Company’s objectives or have a material adverse effect on the Company. The board reviews periodic assessments from this process and participates in the Company’s annual risk survey. The board has delegated to its standing committees specific risk oversight responsibilities as set out below and receives regular reports from the committees on appropriate areas of risk management.

| | | | | | | | | | | |

| Risk Committee | Audit Committee | Compensation and Human

Capital Committee | Nominating and Corporate

Governance Committee |

| Oversees management’s identification and evaluation of strategic enterprise risks, including risks associated with intellectual property, operations, privacy, technology, information security, cybersecurity and cyber incident response, and business continuity. | Oversees policies with respect to financial risk assessment, including guidelines to govern the process by which major financial and accounting risk assessment and management is undertaken. | Considers risks associated with compensation policies and practices, with respect to both executive compensation and compensation generally, and considers other human capital risks. | Considers risks related to certain ESG matters, including succession planning, political contributions and lobbying, sustainability and stakeholder engagement related risks. |

The Company’s Chief Legal and Compliance Officer, Chief Digital and Technology Officer, Chief Information Security Officer, and the Vice President of Compliance and Internal Audit each meet individually with the Risk Committee on a regular basis. The Chair of the Risk Committee also meets frequently with the Chief Digital and Technology Officer between meetings.

The Risk Committee updates the board annually on the Company’s enterprise risk management survey and risk assessment results. The board provides feedback to the Company about significant enterprise risks and assesses the Company’s identification of its most significant risk areas. The Risk Committee also coordinates with the Audit Committee, including through periodic joint meetings, to enable the Audit Committee to perform its risk related responsibilities.

In 2022, the Risk Committee’s charter was updated to provide additional clarity around the Committee’s cybersecurity oversight responsibilities. In addition to reviewing the Company’s approach to cybersecurity risk assessment and mitigation, the Risk Committee;

•annually reviews the Company’s cybersecurity insurance program;

•at each meeting is briefed by the Chief Information Security Officer on cybersecurity risks, compliance, cybersecurity training programs, risk mitigation activities, key information security projects, opportunities and industry developments;

•reviews at least annually the Company’s cybersecurity budget;

•reviews at each meeting the results of various internal cybersecurity audits; and

•reviews periodic independent third-party assessments and audits of the Company’s cybersecurity programs.

The Risk Committee also periodically receives briefings by outside experts on cybersecurity matters, and individual Risk Committee members have participated in various cybersecurity training programs.

The Audit Committee has additional risk assessment and risk oversight responsibilities, specifically with respect to financial risk assessment. The Chief Legal and Compliance Officer, CEO, Chief Financial Officer and Vice President of Compliance and Internal Audit each meet individually with the Audit Committee on a regular basis.

In addition, the Company’s Chief Legal and Compliance Officer reports directly to our CEO, providing visibility into the Company’s risk profile. The board believes that the work undertaken by its committees, together with the work of the full board and the Company’s senior management, enables effective oversight of the Company’s management of risk.

Stakeholder Engagement

Maintaining open and honest dialogs with our stakeholders is an important component of our corporate culture. Our management team participates in numerous investor meetings throughout the year to discuss our business, strategy and financial results. This includes in-person, telephone and webcast conferences, as well as key site visits.

In addition, each year we undertake an ESG stakeholder outreach program in which we discuss progress on our ESG journey. This year we contacted holders of over 47% of our class B common stock as a part of this program. Engagement provides us with the opportunity to understand issues of significant

importance to stakeholders and to receive feedback on our practices and disclosures. Similarly, it provides us with an opportunity to discuss how management believes its actions are aligned with long-term value creation.

We also proactively correspond with other key stakeholders throughout the year. We share feedback from our financial and ESG engagements with the board, the Compensation and Human Capital Committee, and the Nominating and Corporate Governance Committee as appropriate.

| | | | | | | | | | | | | | |

| | | | |

| | |

| | | | |

We consider the views of our shareowners and other stakeholders when evaluating our ESG policies and practices; for example, in recent years we have: | | The Compensation and Human Capital Committee considers shareowner feedback, along with the market information and analysis provided by its independent compensation consultant, when making decisions about our executive compensation programs. We have: |

| | | | |

| | | | |

•Announced a number of environmental, social and human capital goals, including a carbon neutral by 2050 goal; •Accelerated our sustainability reporting; •Increased disclosures around individual director racial, ethnic and gender diversity; •Increased our commitments to diversity, equity and inclusion, volunteerism and charitable giving; •Separated the Board Chair and CEO roles; •Appointed an independent Board Chair; •Increased board diversity; •Committed to expanding reporting on lobbying activities; •Revised the Risk Committee charter to specifically identify cybersecurity oversight responsibilities; and •Revised the Compensation and Human Capital Committee charter to include oversight of performance and talent management, diversity, equity and inclusion, work culture and employee development and retention. | | •Updated the peer group for executive and director compensation market comparisons; •Enhanced the competitiveness of our performance-based annual compensation program; •Eliminated single-trigger equity vesting following a change in control; •Added relative total shareowner return as a component of our Long-Term Incentive Plan awards; •Adopted performance metrics under incentive compensation plans better designed to tie payouts to increases in shareowner value; •Provided additional detail around the performance measures used for our annual and long-term incentive plans; •Eliminated tax gross-ups; •Entered into protective covenant agreements in favor of UPS with certain executive officers; and •Added an individual payout cap to our annual incentive plan. |

| | | | |

| | | | | | | | |

16 | | Notice of Annual Meeting of Shareowners and 2023 Proxy Statement |

Political Contributions and Lobbying

Responsible participation in the political process is important to our success and the protection and creation of shareowner value. We participate in this process in accordance with good corporate governance practices. Our Political Contributions Policy (“policy”) is summarized below and is available at www.investors.ups.com. In addition, we have recently committed to expanding our reporting around lobbying and trade association memberships.

•The Nominating and Corporate Governance Committee oversees the policy;

•Corporate political contributions are restricted;

•We publish a semi-annual political contribution report on our investor relations website; and

•Eligible employees can make political contributions through a Company-sponsored political action committee (“UPSPAC”). UPSPAC is organized and operated on a voluntary, nonpartisan basis and is registered with the Federal Election Commission.

•Political contributions are made in a legal, ethical and transparent manner that best represents the interests of stakeholders.

•Political and lobbying activities require prior approval of the UPS Public Affairs department and are subject to review (and in some cases prior approval) by the Nominating and Corporate Governance Committee.

•Senior management works with Public Affairs on furthering our business objectives and protecting and enhancing shareowner value.

•The Chief Corporate Affairs Officer reviews political and lobbying activities and regularly reports to the board and the Nominating and Corporate Governance Committee.

| | |

| Lobbying and Trade Associations |

•Public Affairs coordinates our lobbying activities, including engagements with federal, state, and local governments. UPS is also a member of a variety of trade associations that engage in lobbying.

•Lobbying activities require prior approval of Public Affairs.

•The Nominating and Corporate Governance Committee regularly reviews UPS’s participation in trade associations that engage in lobbying to determine if our involvement is consistent with

UPS business objectives and whether participation exposes the Company to excessive risk.

•Lobbying activities are governed by comprehensive policies and practices designed to facilitate compliance with laws and regulations, including those relating to the lobbying of government officials, the duty to track and report lobbying activities, and the obligation to treat lobbying costs and expenses as nondeductible for tax purposes.

| | |

| Political Activity Transparency |

•We believe we are transparent in our political activities.

•We publish a semi-annual political contribution report, which is reviewed and approved by the Nominating and Corporate Governance Committee.

•The report provides:

–Amounts and recipients of any federal and state Company political contributions in the United States (if any such expenditures are made); and

–The names of trade associations that receive $50,000 or more and that use a portion of the payment for political contributions, as reported by the trade association to the Company.

•The report is available on our investor relations website at www.investors.ups.com.

•We also publicly file a federal Lobbying Disclosure Act Report each quarter, providing information on activities associated with influencing legislation through communications with any member or employee of a legislative body, or with any covered executive branch official. This report discloses expenditures for the quarter, describes the specific pieces of legislation that were the topic of communications, and identifies the individuals who lobbied on behalf of UPS. UPS files similar publicly available periodic reports with state agencies reflecting state lobbying activities.

Sustainability

We are the world’s premier package delivery company and a leading provider of global supply chain management solutions. We offer a broad range of industry-leading products and services through our extensive global presence. Our services include transportation and delivery, distribution, contract logistics, ocean freight, air freight, customs brokerage and insurance.

We operate one of the largest airlines and one of the largest fleets of alternative fuel vehicles under a global UPS brand that stands for quality and reliability. We deliver packages each business day for approximately 1.6 million shipping customers to 1.1 million delivery recipients in over 220 countries and territories. In 2022, we delivered an average of 24.3 million packages per day, totaling 6.2 billion packages during the year. Our success depends on economic stability, global trade and a society that welcomes opportunity. We understand the importance of acting responsibly as a business, an employer and a corporate citizen.

The board regularly considers economic, environmental and social sustainability risks and opportunities as part of its involvement in UPS’s strategic planning process. The board also regularly reviews the effectiveness of our risk management and due diligence processes related to material sustainability topics. The board delegates authority for day-to-day management of sustainability matters to management. Our Chief Corporate Affairs and Sustainability Officer reports directly to the Company’s CEO and regularly reports to the board regarding sustainability strategies, priorities, goals and performance. In addition, the board is regularly briefed on issues of concern for customers, unions, employees, retirees, investors, governmental entities and other stakeholders. For additional information on board oversight, see page 14. Each year we publish corporate sustainability reports showcasing the goals, recent achievements and challenges of our commitment to balancing the economic, environmental and social aspects of our business. In response to stakeholder interest, we are accelerating the timing of these reports to more closely align with our Annual Meeting.

Following is a list of key goals discussed in more detail in these reports:

| | | | | | | | |

| By 2025: |

| | |

| •30% women in full-time management globally •40% ethnically diverse full-time management in the U.S. |

| | |

| | |

| •40% alternative fuel in ground operations |

| | |

| •25% renewable electricity powering our facilities |

| | |

| By 2030: |

| •30 million volunteer hours (2011 baseline) |

| •50 million trees planted (2012 baseline) |

| By 2035: |

| | |

| •30% sustainable aviation fuel in our air network |

| | |

| •50% reduction in CO2e per global small package (2020 baseline) |

| | |

| •100% renewable electricity powering our facilities |

| | |

| By 2050: | | |

| | |

| •Achieve carbon neutrality |

These reports are available at https://about.ups.com/us/en/social-impact/reporting.html. Our sustainability goals are aspirational and may change. Statements regarding our goals are not guarantees or promises that they will be met.

| | | | | | | | |

18 | | Notice of Annual Meeting of Shareowners and 2023 Proxy Statement |

Human Capital Management

Our success is dependent upon our people, working together with a common purpose. We have approximately 536,000 employees (excluding temporary seasonal employees), of which 443,000 are in the U.S. and 93,000 are located internationally. Our global workforce includes approximately 90,000 management employees (44% of whom are part-time) and 446,000 hourly employees (50% of whom are part-time). More than 70% of our U.S. employees are represented by unions, primarily those employees handling or transporting packages.

In addition, approximately 3,400 of our pilots are represented by the Independent Pilots Association (“IPA”).

We believe that UPS employees are among the most motivated, highest-performing people in the industry and provide us with a meaningful competitive advantage. To assist with employee recruitment and retention, we continue to review the competitiveness of our employee value proposition, including benefits and pay, employee training, talent development and promotion opportunities.

We are creating an inclusive and equitable environment that brings together a broad spectrum of backgrounds, cultures and stakeholders. Leveraging diverse perspectives and creating inclusive environments improves our organizational effectiveness, cultivates innovation, and drives growth.

Our board, directly and through the Compensation and Human Capital Committee, is responsible for oversight of human capital matters. Effective oversight is accomplished through a variety of methods and processes including regular updates and discussions around human capital transformation efforts, technology initiatives impacting the workforce, health and safety matters, employee survey results

related to culture and other matters, hiring and retention, employee demographics, labor relations and contract negotiations, compensation and benefits, succession planning and employee training initiatives.

In addition, the Compensation and Human Capital Committee charter was recently expanded to include oversight responsibility for performance and talent management, diversity, equity and inclusion, work culture and employee development and retention. We believe the board’s oversight of these matters helps identify and mitigate exposure to labor and human capital management risks, and is part of the broader framework that guides how we attract, retain and develop a workforce that aligns with our values and strategies.

We offer competitive compensation and benefits. In addition, our long history of employee stock ownership aligns the interests of our management team with shareowners. In the U.S., benefits provided to our non-union employees typically include:

•comprehensive health insurance coverage;

•life insurance;

•short- and long-term disability coverage;

•child/elder care spending accounts;

•work-life balance programs;

•an employee assistance program; and

•a discounted employee stock purchase plan.

We invest in our people by offering a range of other benefits, such as paid time off, retirement plans, and education assistance. In the U.S., these other benefits are generally provided to non-union employees without regard to full-time or part-time status.

| | |

| Transformation and human capital |

As we seek to capture new opportunities and pursue growth, we need employees to grow and innovate along with us. We believe that transforming the UPS employee experience is foundational to our success. This requires a thoughtful balance between the culture we have cultivated over the years and the new

perspectives we need to take the business into the future. This investment in capabilities to transform our business includes investing in employee growth opportunities such as professionalism, technical and other training.

| | |

| Employee health and safety |

We are committed to industry-leading employee health, safety, and wellness programs across our workforce. We develop a culture of health and safety by:

•investing in safety training and audits;

•promoting wellness practices which mitigate risk; and

•offering benefits that keep employees safe in the workplace and beyond.

Our local health and safety committees coach employees on UPS’s safety processes and are able to share best practices across work groups. Our safety methods and procedures are increasingly focused on the variables associated with residential delivery environments, which have become more common with the growth in e-commerce. We monitor our performance in this area through various measurable targets including lost time injury frequency and the number of recorded auto accidents.

We bargain in good faith with the unions that represent our employees. We frequently engage union leaders at the national level and at local chapters throughout the United States. We participate in works councils and associations outside the U.S., which allows us to respond to emerging regional issues abroad. This work helps our operations to build and maintain productive relationships with our employees. We have approximately 330,000 employees employed under a national master agreement and various supplemental agreements with local unions affiliated

with the International Brotherhood of Teamsters. These agreements run through July 31, 2023. We have approximately 3,400 pilots who are employed under a collective bargaining agreement with the IPA that becomes amendable September 1, 2023. In 2022, the IPA ratified a two-year contract extension. Terms of the agreement become effective September 1, 2023 and continue in effect through September 1, 2025. The economic provisions in the agreement include pay increases and enhanced pension benefits on substantially similar terms.

Majority Voting and Director Resignation Policy

Our Bylaws provide for majority voting in uncontested director elections. The number of votes cast for a nominee must exceed the number of votes cast against that person. Any incumbent director who does not receive a majority of the votes cast must offer to resign from the board.

In such an event, the Nominating and Corporate Governance Committee will recommend to the board whether to accept or reject the director’s offer to resign after considering all relevant factors. The board will act on the recommendation within 90 days following certification of the election results after considering all relevant information.

Any director who offers to resign must recuse himself or herself from the board vote, unless the number of independent directors who were successful incumbents is fewer than three. The board will promptly disclose its decision regarding any director’s offer to resign, including its reasoning. If the board determines to accept a director’s offer to resign, the Nominating and Corporate Governance Committee will recommend whether and when to fill such vacancy or whether to reduce the size of the board.

Board Meetings and Attendance

The board held five meetings during 2022. Also, during 2022, the Audit Committee met nine times, the Compensation and Human Capital Committee met five times, the Nominating and Corporate Governance Committee met four times and the Risk Committee met four times. Prior to board meetings, the Board Chair and the board’s committee chairs work with management to determine and prepare agendas for the meetings. Board meetings generally occur over two days. Board committees generally meet on the first day, followed by the board meeting. The second

day typically consists of reports from each committee chair to the full board, additional presentations by internal business leaders or others with expertise in various subject matters, and an executive session consisting of only independent board members. The executive sessions are chaired by our independent Board Chair.

All directors except one attended 100% of the total number of board and any committee meetings of which he or she was a member in 2022. That individual attended over 93% of the total number of

| | | | | | | | |

20 | | Notice of Annual Meeting of Shareowners and 2023 Proxy Statement |

their board and any committee meetings. Our directors are expected to attend each annual meeting, and all thirteen directors attended the 2022 Annual

Meeting. The independent directors met in executive session at all board meetings held in 2022.

Code of Business Conduct

We are committed to conducting our business in accordance with the highest ethical principles. Our Code of Business Conduct is applicable to anyone who represents UPS, including our directors, executive

officers and all other employees and agents of UPS. A copy of our Code of Business Conduct is available on our investor relations website at www.investors.ups.com.

Conflicts of Interest and Related Person Transactions

Our Audit Committee is responsible for overseeing our Code of Business Conduct, which includes policies regarding conflicts of interest. The Code requires employees and directors to avoid conflicts of interest, defined as situations where the person’s private interests conflict, or may appear to conflict, with the interests of UPS.

We maintain a written related person transactions policy that applies to any transaction or series of transactions in which: (1) the Company or any of its subsidiaries is a participant; (2) any “related person” (executive officer, director, greater than 5% beneficial owner of the Company’s common stock, or an immediate family member of any of the foregoing) has or will have a material direct or indirect interest; and (3) the aggregate amount involved since the beginning of the Company’s last completed fiscal year will exceed or may reasonably be expected to exceed $100,000.

The policy provides that related person transactions that may arise during the year are subject to the Audit Committee’s reasonable prior approval. If advance approval of a related person transaction is not possible, then the transaction will be considered and, if deemed appropriate, ratified no later than the Audit Committee’s next regularly scheduled meeting. In determining whether to approve or ratify a transaction, the Audit Committee will consider, among other factors it deems appropriate, whether the transaction is on terms no less favorable than terms generally available to an unaffiliated third-party under the same or similar circumstance, the extent of the related person’s interest in the transaction, whether

the transaction would impair independence of a non-employee director and whether there is a business reason for UPS to enter into the transaction. A copy of the policy is available on our investor relations website at www.investors.ups.com. The Company did not engage in any related person transactions since January 1, 2022 that require disclosure in this Proxy Statement or under the Company’s policy.

At least annually, each director and executive officer completes a questionnaire in which they are required to disclose any business relationships that may give rise to a conflict of interest, including transactions where UPS is involved and where an executive officer, a director or a related person has a direct or indirect material interest. We also review the Company’s financial systems and any related person transactions to identify potential conflicts of interest. The Nominating and Corporate Governance Committee reviews a summary of this information and makes recommendations to the Board of Directors regarding each board member’s independence.

We have immaterial ordinary course of business transactions and relationships with companies with which our directors are associated. The Nominating and Corporate Governance Committee reviewed the transactions and relationships that occurred since January 1, 2022 and believes they were entered into on terms that are both reasonable and competitive and did not affect director independence. Additional transactions and relationships of this nature may be expected to take place in the ordinary course of business in the future.

Transactions in Company Stock

We prohibit our executive officers and directors from hedging or pledging their ownership in UPS stock. Specifically, they are prohibited from purchasing or selling derivative securities relating to UPS stock and from purchasing financial instruments that are

designed to hedge or offset any decrease in the market value of UPS securities. Furthermore, our employees, officers and directors are prohibited from engaging in short sales of UPS stock.

Corporate Governance Guidelines and Committee Charters

Our Corporate Governance Guidelines and the charters for each of the board’s committees are available on our investor relations website at www.investors.ups.com. Each committee reviews its charter annually. In addition, the Nominating and Corporate Governance Committee reviews our Corporate Governance Guidelines annually and

recommends any changes to the board for approval. When amending our committee charters or Corporate Governance Guidelines, we consider current governance trends and best practices, changes in regulatory requirements, advice from outside sources and input from stakeholders.

Communicating with the Board of Directors

Stakeholders may communicate directly with the board, with the non-management directors as a group, or with any specific director, by writing to the UPS Corporate Secretary, 55 Glenlake Parkway, N.E., Atlanta, Georgia 30328. Please specify to whom your letter should be directed. After review by the

Corporate Secretary, appropriate communications will be forwarded to the addressee. Advertisements, solicitations for business, requests for employment, requests for contributions, matters that may be better addressed by management or other inappropriate materials will not be forwarded.

| | | | | | | | |

22 | | Notice of Annual Meeting of Shareowners and 2023 Proxy Statement |

Proposal 1 — Director Elections

| | |

|

What am I voting on? Election of each of the 12 named director nominees to hold office until the 2024 Annual Meeting and until their respective successors are elected and qualified. Board’s Recommendation: Vote FOR the election of each nominee. Vote Required: A director will be elected if the number of votes cast for that director exceeds the number of votes cast against that director. |

|

The board has nominated the individuals named below for election as directors at the Annual Meeting. Ann Livermore, who has served as a director since 1997, is not up for re-election at the Annual Meeting. We thank Ann for her service and for her significant contributions to UPS. As of the Annual Meeting, the size of the board will be reduced from 13 to 12 directors.

All nominees were elected by shareowners at our last Annual Meeting. If elected, all nominees are expected to serve until the next Annual Meeting and until their respective successors are elected and qualified. If any nominee is unable to serve as a director, the board may reduce the number of directors that serve on the board or choose a substitute nominee. Any nominee who is currently a director, and for whom more votes are cast against than are cast for, must offer to resign from the board.

Diversity with respect to gender, age, ethnicity, skills, experience, perspectives, and other factors is a key consideration when identifying and recommending director nominees. Diversity in our boardroom supports UPS’s continued success. While we do not have a formal policy on board diversity, our Corporate Governance Guidelines emphasize diversity, and the

Nominating and Corporate Governance Committee actively considers diversity in recruitment and nominations of director candidates. The Nominating and Corporate Governance Committee assesses board diversity through periodic board composition evaluations.

As a group, our director nominees effectively oversee and constructively challenge management’s performance in the execution of our strategy. Our directors’ broad professional skills and experiences contribute to a wide range of perspectives in the boardroom. The Nominating and Corporate Governance Committee regularly assesses the skills and experience necessary for our board to function effectively and considers where additional expertise may be needed.

Biographical information about the director nominees appears below, including information about the experience, qualifications, attributes, and skills considered by our Nominating and Corporate Governance Committee and board in determining that the nominee should serve as a director, and director demographics. For additional information about how we identify and evaluate nominees for director, see page 10.

Director Nominee Skills, Experience and Diversity

Highlights

92% Independent 61 years Average age 7.9 years Average tenure

42% Female 33% Ethnically diverse

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Skills and Experience / Attributes | | | | | | | | | | | | |

| CEO | | | l | l | | l | l | | | | l | |

| CFO | | l | | | | | | | | | l | |

| Consumer / Retail | | l | | | | | l | l | l | | l | |

| Digital Technology | l | | | | | l | | | l | | l | |

| Geopolitical Risk | | | | | | | | l | | | | l |

| Global / International | | | l | l | l | | l | l | l | | | l |

| Healthcare | | l | | l | l | | | | | | | |

| Human Capital Management | | | | | | l | l | | | l | | |

| Operational | | | l | l | l | l | l | l | l | l | | |

| Risk / Compliance / Government | l | l | | | | | | | | l | l | l |

| Sales / Marketing | | | | | | l | l | l | l | l | | |

| Small and Medium-Sized Businesses | | • | | l | | l | | | | l | | |

| Supply Chain Management | l | | | l | l | | l | l | l | | | |

| Technology / Technology Strategy | l | | l | | | l | | | | l | | |

| Other Public Company Board Service | l | | | l | | l | l | l | l | | l | l |

| Race / Ethnicity |

| Asian / Asian American | | | | | l | | | | | | | |

| Black / African American | l | | | l | | | | | | l | | |

| White | | l | l | | | l | l | l | l | | l | l |

| Gender |

| Female | | l | | | l | l | | | l | | l | |

| Male | l | | l | l | | | l | l | | l | | l |

| | | | | | | | |

24 | | Notice of Annual Meeting of Shareowners and 2023 Proxy Statement |

Director Nominee Biographical Information

| | | | | | | | | | | |

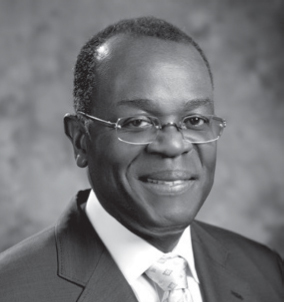

| | Carol Tomé UPS Chief Executive Officer | Career Carol was appointed UPS’s Chief Executive Officer effective June 2020. As CEO, Carol has primary responsibility for managing the Company’s day-to-day operations, and for developing and communicating our strategy. She was Chief Financial Officer of The Home Depot, Inc., one of the world’s largest retailers, from 2001; and Executive Vice President Corporate Services from 2007 until her retirement in 2019. At The Home Depot, she provided leadership in the areas of real estate, financial services and strategic business development. Her corporate finance duties included financial reporting and operations, financial planning and analysis, internal audit, investor relations, treasury and tax. She previously served as Senior Vice President Finance and Accounting and Treasurer from 2000 until 2001; and from 1995 until 2000 she served as Vice President and Treasurer at The Home Depot. Carol serves on the Board of Directors of Verizon Communications, Inc. and served on the Board of Directors of Cisco Systems, Inc. until 2020. Reasons for election Carol has a thorough understanding of our strategies and operations as a result of serving as Chief Executive Officer, and from her extensive experience gained from serving on the board and as Chair of the Audit Committee prior to becoming Chief Executive Officer. She has an in-depth knowledge of logistics and has broad experience in corporate finance and risk and compliance gained throughout her career at The Home Depot. She brings the experience of having served as Chief Financial Officer of a complex, multi-national business with a large, labor intensive workforce. Carol also has experience with strategic business development, including e-commerce strategy. |

|

Age: 66 Director since 2003 Board Committee –Executive (Chair) |

| | | | | | | | | | | |

| | Rodney Adkins Former Senior Vice President, International Business Machines Corporation | Career Rod is President of 3RAM Group LLC, a private company specializing in capital investments, business consulting and property management services. Prior to that role, Rod served as IBM’s Senior Vice President of Corporate Strategy until retiring in 2014. Rod was previously IBM’s Senior Vice President, Systems and Technology Group, a position he held since 2009, and senior vice president of STG development and manufacturing, a position he held since 2007. In his over 30-year career with IBM, a multinational technology company, Rod held a number of other development and management roles, including general management positions for the PC Company, UNIX Systems and Pervasive Computing. Rod currently serves as non-executive Chairman of Avnet, Inc., in addition to serving on the Boards of Directors of PayPal Holdings, Inc. and W.W. Grainger, Inc. He also served on the Board of Directors of PPL Corporation until 2019. Reasons for election As a senior executive of a public technology company, Rod gained a broad range of experience, including experience in emerging technologies and services, global business operations, and supply chain management. He is a recognized leader in technology and technology strategy. In addition, Rod has experience serving as a director of other publicly traded companies. |

|

Age: 64 Director since 2013 Board Committees –Risk (Chair) –Compensation and Human Capital |

| | | | | | | | | | | |