April 28, 2016 Central States Pension Fund* Overview *Central States Southeast and Southwest Areas Pension Fund

2 Safe Harbor Except for historical information contained herein, the statements made in this presentation constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience and our present expectations or anticipated results. These risks and uncertainties include, but are not limited to: general economic conditions, both in the U.S. and internationally; significant competition on a local, regional, national, and international basis; changes in our relationships with our significant customers; the existing complex and stringent regulation in the U.S. and internationally, changes to which can impact our business; increased security requirements that may increase our costs of operations and reduce operating efficiencies; legal, regulatory or market responses to global climate change; negotiation and ratification of labor contracts; strikes, work stoppages and slowdowns by our employees; the effects of changing prices of energy, including gasoline, diesel and jet fuel, and interruptions in supplies of these commodities; changes in exchange rates or interest rates; our ability to maintain the image of our brand; breaches in data security; disruptions to the Internet or our technology infrastructure; our ability to accurately forecast our future capital investment needs; exposure to changing economic, political and social developments in international and emerging markets; changes in business strategy, government regulations, or economic or market conditions that may result in substantial impairment of our assets; increases in our expenses or funding obligations relating to employee health, retiree health and/or pension benefits; the potential for various claims and litigation related to labor and employment, personal injury, property damage, business practices, environmental liability and other matters; our ability to realize the anticipated benefits from acquisitions, joint ventures or strategic alliances; our ability to manage insurance and claims expenses; and other risks discussed in our filings with the Securities and Exchange Commission from time to time, including our Annual Report on Form 10-K for the year ended December 31, 2015 or described from time to time in our future reports filed with the Securities and Exchange Commission. You should consider the limitations on, and risks associated with, forward-looking statements and not unduly rely on the accuracy of predictions contained in such forward-looking statements. We do not undertake any obligation to update forward-looking statements to reflect events, circumstances, changes in expectations, or the occurrence of unanticipated events after the date of those statements. Cautionary Statement About Forward-Looking Statements

3 Investor Relations Update • UPS Retirement Plan Overview • Central States Pension Fund (CSPF) Timeline • CSPF Proposed Benefit Reduction Plan • Potential Outcome of Treasury Decision • Summary Agenda

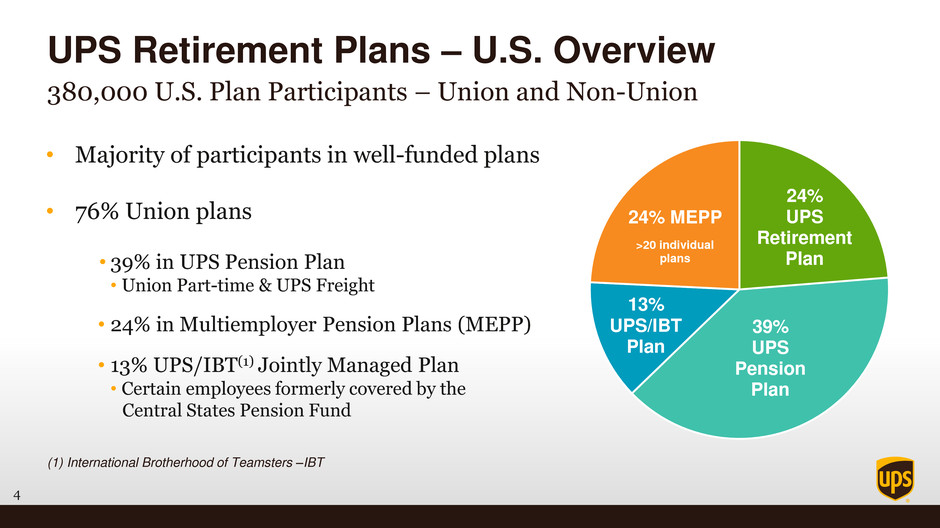

4 • Majority of participants in well-funded plans • 76% Union plans • 39% in UPS Pension Plan • Union Part-time & UPS Freight • 24% in Multiemployer Pension Plans (MEPP) • 13% UPS/IBT(1) Jointly Managed Plan • Certain employees formerly covered by the Central States Pension Fund UPS Retirement Plans – U.S. Overview 380,000 U.S. Plan Participants – Union and Non-Union 24% UPS Retirement Plan 39% UPS Pension Plan 13% UPS/IBT Plan 24% MEPP >20 individual plans (1) International Brotherhood of Teamsters –IBT

5 • Withdrawal from CSPF negotiated in IBT Master Agreement • New jointly trusteed plan created – UPS/IBT Plan • $6.1B payment to Central States – to exit, limiting future liability • $1.7B liability to restore lost benefits • Agreement included Backstop provision • If legally permitted to reduce benefit payments • CSPF was healthy after UPS exited from the plan • NPV positive and cost impact as projected Central States Pension Fund Timeline Right thing for UPS employees, customers and shareowners Dec 2007 Dec 2007

6 • New Multiemployer Pension Reform Act (MPRA) in December 2014 • MPRA allowed for earned benefit reductions for the first time • CSPF projects insolvency by 2025 • CSPF files under MPRA in September 2015 • UPS opposed plan with comment letters and testimony • Treasury reviewing benefit reduction application • Decision expected on or before May 7th 2016 CSPF and New Law Timeline Dec 2014 May 2016 Dec 2014 May 2016 UPS will pursue all available legal remedies if the plan is approved

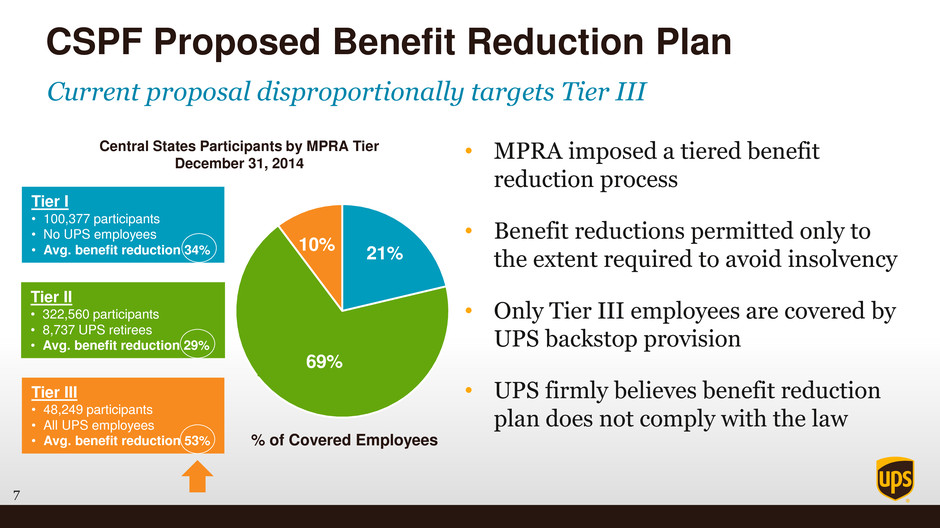

7 • MPRA imposed a tiered benefit reduction process • Benefit reductions permitted only to the extent required to avoid insolvency • Only Tier III employees are covered by UPS backstop provision • UPS firmly believes benefit reduction plan does not comply with the law CSPF Proposed Benefit Reduction Plan Current proposal disproportionally targets Tier III 21% 69% 10% Tier II • 322,560 participants • 8,737 UPS retirees • Avg. benefit reduction 29% Tier I • 100,377 participants • No UPS employees • Avg. benefit reduction 34% Tier III • 48,249 participants • All UPS employees • Avg. benefit reduction 53% Central States Participants by MPRA Tier December 31, 2014 % of Covered Employees

8 • If rejected, CSPF benefit payments will not be reduced without further action • If approved without delay, based on information currently available: • Membership vote required – Treasury could override a vote to reject • Approval could trigger backstop provision from 2007 Agreement • Results in non-cash, pretax charge of approx. $3.2B to $3.8B • Recognized as interim Mark-to-Market charge • Could increase ongoing cost and push UPS to lower-end of 2016 guidance • Expect to remain at $5.70 to $5.90 adjusted earnings per share Potential Outcome of Treasury Decision Treasury decision expected on or before May 7th UPS will pursue all available legal remedies if the plan is approved

9 • Decision is expected on or before May 7th 2016 • New MPRA law allows for benefit reduction proposals for first time • UPS firmly believes CSPF proposal does not comply with MPRA • CSPF proposal disproportionately impacts Tier III participants • Backstop provision applies only to CSPF Tier III – no other MEPP • UPS expects to remain within 2016 adjusted EPS guidance range Summary Withdrawal from CSPF was the right decision in 2007 and is today

UPS Investor Relations Website: www.investors.ups.com