UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [_]

Check the appropriate box:

| [_] |

Preliminary Proxy Statement |

|

|

| [_] |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

| [X] |

Definitive Proxy Statement |

|

|

| [_] |

Definitive Additional Materials |

|

|

| [_] |

Soliciting Material Pursuant to (S) 240.14a-11(c) or (S) 240.14a-12 |

|

|

UNITED PARCEL SERVICE, INC.

(name of registrant as specified in its charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] |

No fee required. |

|

| [_] |

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

|

|

|

|

|

(1) Title of each class of securities to which transaction applies:

|

|

|

(2) Aggregate number of securities to which transaction applies:

|

|

|

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act

Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

|

(4) Proposed maximum aggregate value of transaction:

|

|

|

(5) Total fee paid:

|

|

| [_] |

Fee paid previously with preliminary materials. |

|

|

|

|

| [_] |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid

previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

|

|

|

(1) Amount Previously Paid:

|

|

|

(2) Form, Schedule or Registration Statement No.:

|

|

|

(3) Filing Party:

|

|

|

(4) Date Filed:

|

|

| Notes: |

|

| |

|

| |

|

| Reg. (S) 240.14a-101. |

|

|

|

| SEC 1913 (3-99) |

|

55 Glenlake Parkway, N.E., Atlanta, Georgia 30328

Notice of Annual Meeting of Shareowners

May 16, 2002

To our Shareowners:

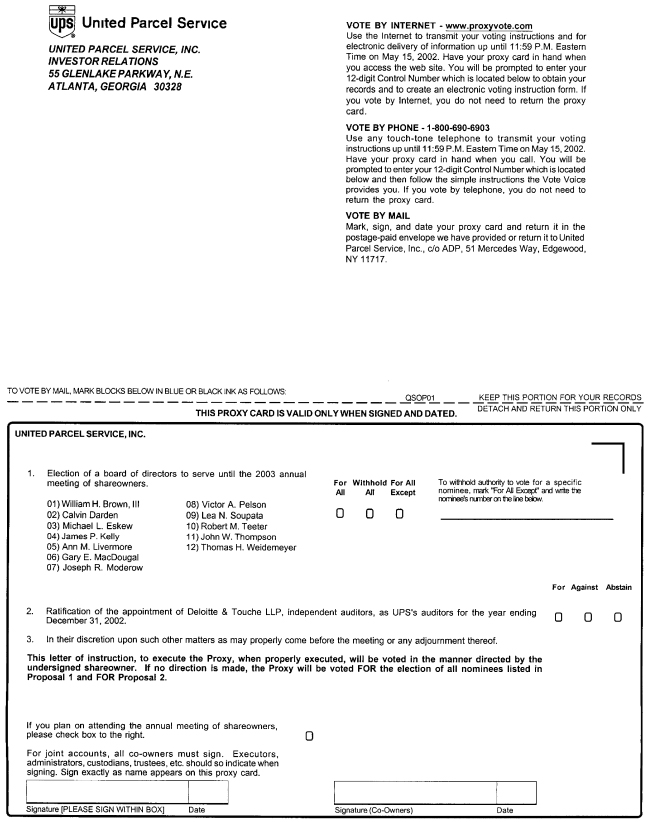

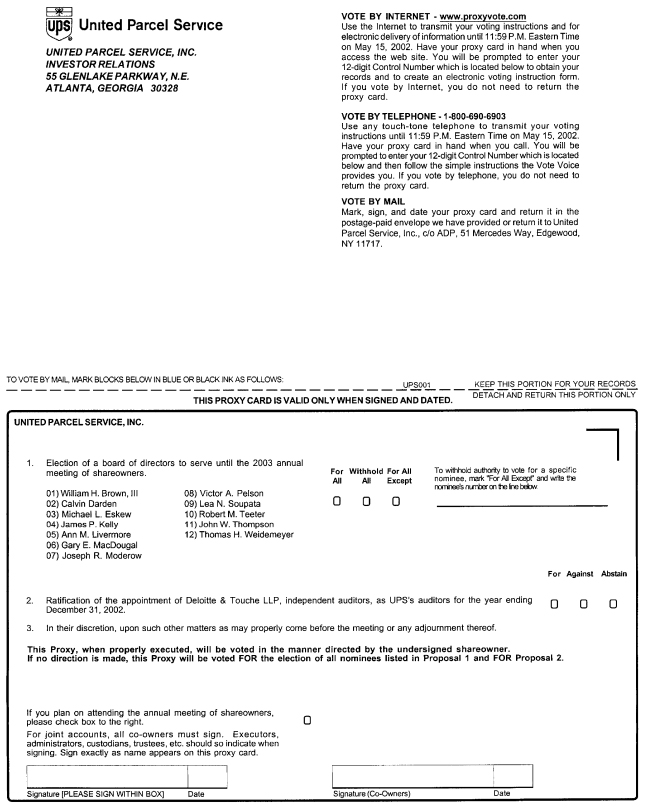

United Parcel Service, Inc.’s annual meeting of shareowners will be

held at the Hotel du Pont, 11th and Market Streets, Wilmington, Delaware 19801, on May 16, 2002, at 9:00 a.m. The purposes of the meeting are:

| |

1. |

|

To elect a board of directors to serve until our 2003 annual meeting of shareowners; |

| |

2. |

|

To ratify the appointment of Deloitte & Touche LLP, independent auditors, as our auditors for the year ending December 31, 2002; and |

| |

3. |

|

To transact any other business as may properly come before the meeting. |

Our board of directors has fixed the close of business on March 19, 2002 as the record date for determining holders of our common stock entitled to notice of, and to vote at, the annual

meeting.

Atlanta, Georgia

March 22, 2002

Your vote is important. Please sign and return the enclosed proxy card, vote by telephone or vote by using the Internet as soon as possible to ensure your representation at the annual meeting. Your proxy card

contains instructions for each of these voting options.

55 Glenlake Parkway, N.E., Atlanta, Georgia 30328

PROXY STATEMENT

FOR THE

2002 ANNUAL MEETING OF

SHAREOWNERS

This proxy statement and proxy card are furnished in connection with the solicitation of proxies to be voted at

our annual meeting of shareowners, to be held at the Hotel du Pont, 11th and Market Streets, Wilmington, Delaware 19801, on May 16, 2002, at 9:00 a.m. The proxy is solicited by our board of directors. This proxy statement and proxy card are first

being sent to our shareowners on or about March 28, 2002.

Why am I receiving this proxy statement and proxy card?

You are receiving a proxy statement and proxy card because you own shares of United Parcel Service, Inc. common stock.

This proxy statement describes issues on which we would like you to vote at our annual meeting of shareowners. It also gives you information on these issues so that you can make an informed decision.

When you sign the proxy card, vote by telephone or vote using the Internet, you appoint Michael L. Eskew and Joseph R. Moderow as your representatives

at the annual meeting. They will vote your shares as you have instructed them in your proxy at the annual meeting (or, if an issue that is not on the proxy card comes up for vote, in accordance with their best judgment). This way, your shares will

be voted whether or not you attend the annual meeting. Even if you plan to attend the annual meeting, we encourage you to sign and return your proxy card, vote by telephone or vote using the Internet in advance of the annual meeting.

Who is entitled to vote?

Holders of our class A common stock (which includes our class A-1, class A-2 and class A-3 common stock) and our class B common stock on the close of business on March 19, 2002 are entitled to vote. March 19, 2002 is

referred to as the record date.

In accordance with Delaware law, a list of shareowners entitled to vote at the meeting will be

available in electronic form at the place of the annual meeting on May 16, 2002 and will be accessible in electronic form for 10 days prior to the meeting at our principal place of business, 55 Glenlake Parkway, N.E., Atlanta, Georgia 30328, between

the hours of 9:00 a.m. and 5:00 p.m.

How many votes is each share of common stock entitled to?

Holders of class A common stock are entitled to ten votes per share. Holders of class B common stock are entitled to one vote per share. On

the record date, there were 733,125,341 shares of our class A common stock and 382,337,438 shares of our class B common stock outstanding and entitled to vote.

The voting rights of any shareowner or shareowners as a group, other than any of our employee benefit plans, that beneficially own shares representing more than 25% of our voting power are limited so that the

shareowner or group may cast only one one-hundredth of a vote with respect to each vote in excess of 25% of the outstanding voting power.

How do I vote?

Shareowners of record can vote by mail, by telephone or by using

the Internet as described below. Shareowners also may attend the meeting and vote in person. If you hold class B shares through a bank or broker,

please refer to your proxy card or the information forwarded by your bank or broker to see which options are available to you.

| |

• |

|

You can vote by mail. If you choose to vote by mail, simply mark your proxy, date and sign it, and return it in the postage-paid envelope

provided.

. |

| |

• |

|

You can vote by telephone. You can vote by calling the toll-free telephone number noted on your proxy card. Telephone voting is available 24 hours

a day and will be accessible until 11:59 p.m. Eastern Time on May 15, 2002. Easy-to-follow voice prompts allow you to vote your shares and confirm that your instructions have been properly recorded. Our telephone voting procedures are designed to

authenticate shareowners by using individual control numbers. If you vote by telephone, you do not need to return your proxy card. |

| |

• |

|

You can vote by using the Internet. You also can choose to vote by using the Internet. The address of the web site for Internet voting is

www.proxyvote.com. Internet voting is available 24 hours a day and will be accessible until 11:59 p.m. Eastern Time on May 15, 2002. As with telephone voting, you can confirm that your instructions have been properly recorded. If you vote by

using the Internet, you do not need to return your proxy card. |

The method you use to vote will not limit

your right to vote at the annual meeting if you decide to attend in person. Written ballots will be passed out to anyone who wants to vote at the annual meeting. If you hold your shares in “street name”, you must obtain a proxy, executed

in your favor, from the holder of record to be able to vote in person at the annual meeting.

How many votes do you need

to hold the annual meeting?

Shares are counted as present at the annual meeting if the shareowner either is present and

votes in person at the annual meeting or properly has submitted a proxy by mail, by telephone or by using the Internet.

As of

March 19, 2002, 733,125,341 shares of our class A common stock and 382,337,438 shares of our class B common stock were outstanding and are entitled to vote at the annual meeting. Shares representing a majority of our issued and outstanding common

stock as of the record date must be present at the annual meeting either in person or by proxy and entitled to vote at the meeting in order to hold the annual meeting and conduct business. This is called a quorum.

What if I change my mind after I return my proxy?

You may revoke your proxy and change your vote at any time before the polls close at the annual meeting. You may do this by:

| |

• |

|

sending written notice of revocation to our Corporate Secretary at 55 Glenlake Parkway, N.E., Atlanta, Georgia 30328; |

| |

• |

|

submitting a subsequent proxy by mail, telephone or Internet with a later date; or |

| |

• |

|

voting in person at the annual meeting. |

Attendance at the

meeting will not by itself revoke a proxy.

What am I voting on?

You are being asked to vote on two items:

| |

• |

|

the election of a board of directors to serve until our 2003 annual meeting of shareowners; and |

| |

• |

|

the ratification of the appointment of Deloitte & Touche LLP, independent auditors, as our auditors for the year ending December 31, 2002. |

2

No cumulative voting rights are authorized, and dissenters’ rights are not applicable to

these matters.

How may I vote for the nominees for election of director, and how many votes must the nominees receive to

be elected?

With respect to the election of nominees for director, you may:

| |

• |

|

vote FOR the election of the twelve nominees for director; |

| |

• |

|

WITHHOLD AUTHORITY to vote for one or more of the nominees and vote FOR the remaining nominees; or |

| |

• |

|

WITHHOLD AUTHORITY to vote for the twelve nominees. |

The

twelve nominees receiving the highest number of affirmative votes will be elected as directors. This number is called a plurality. Accordingly, a vote withheld from a nominee for director has the same effect as a vote against the nominee.

What happens if a nominee is unable to stand for election?

If a nominee is unable to stand for election, the board may, by resolution, provide for a lesser number of directors or designate a substitute nominee. If the board designates a

substitute nominee, shares represented by proxies voted for the nominees named in this proxy statement will be voted for the substitute nominee.

How may I vote for the ratification of the appointment of our auditors, and how many votes must the proposal receive to pass?

With respect to the proposal to ratify the appointment of our auditors, you may:

| |

• |

|

vote AGAINST the proposal; or |

| |

• |

|

ABSTAIN from voting on the proposal. |

The ratification of the

appointment of our auditors must receive the affirmative vote of a majority of the shares present at the annual meeting either in person or by proxy and entitled to vote at the annual meeting to pass. If you abstain from voting on the proposal, it

will have the same effect as a vote against the proposal.

How does the board of directors recommend that I vote?

The board recommends a vote FOR all of the director nominees and FOR the ratification of the appointment of our

auditors.

What happens if I sign and return my proxy card but do not provide voting instructions?

If you return a signed card but do not provide voting instructions, your shares will be voted FOR the director nominees

and FOR the ratification of the appointment of our auditors.

Will my shares be voted if I do not sign and return my proxy

card, vote by telephone or vote by using the Internet?

If you own class A shares and you do not sign and return your

proxy card, vote by telephone or vote by using the Internet, then your class A shares will not be voted and will not count in deciding the matters presented for shareowner consideration in this proxy statement.

If your class B shares are held in “street name” through a bank or broker, your bank or broker may vote your class B shares under certain

circumstances if you do not provide voting instructions before the annual meeting in accordance with New York Stock Exchange rules that govern the banks and brokers. These circumstances

3

include “routine” matters, such as the election of directors and ratification of the appointment of our auditors described in this proxy statement. Therefore, if you do not vote your

proxy, your bank or broker may either vote your shares on these routine matters, or leave your shares unvoted.

Can I

receive future proxy materials and annual reports electronically?

Yes. The Notice of Annual Meeting and Proxy Statement

and the 2001 Annual Report to Shareowners are available on our Internet site at www.ups.com. Instead of receiving paper copies in the mail, shareowners can elect to receive an e-mail that provides a link to our future annual reports and proxy

materials on the Internet. Opting to receive your proxy materials online will save us the cost of producing and mailing documents to your home or business, and will give you an automatic link to the proxy voting site.

If you are a shareowner of record and wish to enroll in the electronic proxy delivery service, you may do so by going to www.icsdelivery.com/ups

and following the prompts.

4

ELECTION OF DIRECTORS

(Proposal No. 1)

There are 12 nominees to our board of directors this year. All nominees have served as

directors since our last annual meeting. All directors are elected annually to serve until the next annual meeting and until their respective successors are elected.

Oz Nelson, our former Chairman and Chief Executive Officer, is retiring from the board at this year’s annual meeting. We thank him for his 19 years of dedicated service to the board

and 43 years of dedicated service to UPS.

The board of directors recommends a vote FOR the election

to the board of each of the following nominees.

| |

|

William H. Brown, III |

|

Age 74 |

|

Director since 1983 |

| |

Senior Counsel to the law firm of Schnader Harrison Segal & Lewis LLP in Philadelphia,

Pennsylvania |

| |

|

| |

Bill received a bachelor’s degree from Temple University in 1952 and graduated from the University of Pennsylvania School of Law in 1955. From 1955 to 1968,

Bill practiced in a small law firm from which four of seven partners became federal judges and three others became state judges. In 1968, he became a Deputy District Attorney in Philadelphia. Bill was appointed to the U.S. Equal Employment

Opportunity Commission (EEOC) by President Johnson in 1968 and was selected as its Chairman by President Nixon in 1969. While with the EEOC he won nationwide attention for his work in negotiating a consent decree in the EEOC complaint against

AT&T. Bill joined his current firm after leaving his EEOC post in 1973. Since then, his broad experience in litigation and other matters includes handling a number of legal matters on behalf of UPS. |

| |

|

|

| |

|

Calvin Darden |

|

Age 52 |

|

Director since 2001 |

| |

UPS Senior Vice President of U.S. Operations |

| |

|

| |

Cal joined UPS in 1971 as a part-time package handler. He received a bachelor of science degree in business management from Canisius College in 1972. Cal has served

as District Manager in the North Jersey, Metro Jersey and Metro D.C. Districts. He later was promoted to Pacific Region Manager in 1993. He was named UPS’s first Corporate Strategic Quality Coordinator in 1995 and joined the Management

Committee in 1997. He was appointed Senior Vice President and assumed responsibility for one-half of UPS’s U.S. operations in 1998. He assumed responsibility for all of UPS’s U.S. operations in January 2001. Cal serves on the Board of

Directors of the National Urban League, is a member of the 100 Black Men of North Metro Atlanta and is involved with the United Way. |

| |

|

|

| |

|

Michael L. Eskew |

|

Age 52 |

|

Director since 1998 |

| |

UPS Chairman and Chief Executive Officer |

| |

|

| |

Mike joined UPS in 1972, after he received a bachelor of science degree in industrial engineering from Purdue University. He also completed the Advanced Management

Program at the Wharton School of Business. In 1994, Mike was named UPS’s Corporate Vice President for Industrial Engineering. Two years later he became Group Vice President for Engineering. He was appointed Executive Vice President in 1999 and

Vice Chairman in 2000. In January 2002, he succeeded Jim Kelly as Chairman and Chief Executive Officer. Mike serves on the U.S.-China Business Council and the Business Roundtable. |

| |

|

|

|

|

|

|

5

| |

|

James P. Kelly |

|

Age 58 |

|

Director since 1991 |

| |

Former UPS Chairman and Chief Executive Officer |

| |

|

| |

Jim joined UPS in 1964 as a package car driver in the Metro Jersey District. He was promoted into management as a package distribution center manager in 1966. In

1988, he was elected Senior Vice President and appointed UPS’s Labor Relations Manager. In 1992, Jim became Chief Operating Officer and in 1994, he became Executive Vice President. Jim succeeded Oz Nelson as Chairman and Chief Executive Officer

in January 1997. In January 2002, Jim retired as Chairman and Chief Executive Officer. Jim also is a director of BellSouth Corporation. |

| |

|

| |

|

|

| |

|

Ann M. Livermore |

|

Age 43 |

|

Director since 1997 |

| |

Vice President, Hewlett-Packard Company |

| |

|

| |

Ann is Vice President of Hewlett-Packard Company and President of its Services Business. Ann joined HP in 1982, was named marketing services manager for the

Application Support Division in 1985, and was promoted to marketing manager of that division in 1989. Ann became the marketing manager of the Professional Services Division in 1991 and was named sales and marketing manager of the former Worldwide

Customer Support Organization. Ann was elected a Vice President of HP in 1995 and was promoted to general manager of Worldwide Customer Support Operations in 1996. In 1997, she took on responsibility for HP’s software businesses as general

manager of the newly formed Software and Services Group. In 1998, she was named general manager of the new Enterprise Computing Solutions Organization. Born in Greensboro, N.C., Ann holds a bachelor’s degree in economics from the University of

North Carolina at Chapel Hill and an M.B.A. from Stanford University. Ann is also on the board of visitors of the Kenan-Flagler Business School at the University of North Carolina at Chapel Hill and the Board of Advisors of the Stanford Business

School. |

| |

|

|

| |

|

Gary E. MacDougal |

|

Age 65 |

|

Director since 1973 |

| |

Former Chairman of the Board and Chief Executive Officer, Mark Controls Corporation |

| |

|

| |

From 1963 to 1968, Gary was with McKinsey & Co., an international management consulting firm, where he became a partner. From 1969 to 1987, Gary was Chairman

and Chief Executive Officer of Mark Controls Corporation, a control systems products manufacturer. In 1988, he became honorary Chairman. Also in 1988, Gary was assistant campaign manager in the Bush presidential campaign and in 1989 was appointed by

President Bush as a delegate and alternate representative in the U.S. delegation to the United Nations. He is a Director of the Bulgarian American Enterprise Fund and a trustee of the Annie E. Casey Foundation, the world’s largest philanthropic

foundation dedicated to helping disadvantaged children. From 1993 to 1997, he was Chairman of the Governor’s Task Force on Human Service Reform for the State of Illinois. Gary received his bachelor’s degree from the University of

California at Los Angeles in engineering in 1958. After receiving his degree, he spent three years as a U.S. Navy officer. Following service, Gary attended Harvard Business School where he received his M.B.A. degree. He serves as an advisory

director of Saratoga Partners, a New York-based venture capital fund. |

| |

|

|

| |

|

Joseph R. Moderow |

|

Age 53 |

|

Director since 1988 |

| |

UPS Senior Vice President, Secretary and Legal & Public Affairs Group Manager |

| |

|

| |

Joe began his UPS career in 1968 as a sorter and unloader in the South California District while an undergraduate student. He earned a bachelor’s degree in

economics from California State University and a law degree from Western State University. He is a member of the State Bar of California. Joe was promoted into supervision in 1973 and later served as the Arizona District Industrial Engineering

Manager. In 1977, he was assigned to the National Legal & Regulatory Group. In 1982, Joe became the West Virginia District Manager. He then was assigned to the National Labor Relations Group and later headed the operations team during the

start-up of international air service. In 1986, Joe was named Legal & Regulatory Group Manager and elected Senior Vice President and Secretary. He assumed additional responsibility for Public Affairs in 1989. |

6

| |

|

Victor A. Pelson |

|

Age 64 |

|

Director since 1990 |

| |

Senior Advisor, UBS Warburg LLC |

| |

|

| |

Vic is a Senior Advisor to UBS Warburg LLC investment bankers, a position he has held since 1996. He was associated with AT&T from 1959 to March 1996, and at

the time of his retirement from AT&T was Chairman of Global Operations and a member of the Board of Directors and the Management Executive Committee. He also is a director of Eaton Corporation and Chairman of the Board of Trustees of the New

Jersey Institute of Technology. |

| |

|

| |

|

|

| |

|

Lea N. Soupata |

|

Age 51 |

|

Director since 1998 |

| |

UPS Senior Vice President and Human Resources Group Manager |

| |

|

| |

A native of New York City, Lea joined UPS in 1969 and now manages the human resources function for approximately 371,000 employees worldwide. Following several

assignments with UPS in Human Resources, Sales and Operations, in 1990 Lea became the District Manager of the Central New York District. She was transferred in 1994 to our corporate office as Vice President of Human Resources prior to being named to

her current position. Lea serves as chair of The UPS Foundation, our charitable arm, and has been active in a number of community services programs including the United Way. She is a trustee of the Annie E. Casey Foundation, the world’s largest

philanthropic foundation dedicated to helping disadvantaged children. She also serves as a board member of Junior Achievement of Georgia, the Labor Policy Association and the National Alliance of Business. |

| |

|

|

| |

|

Robert M. Teeter |

|

Age 63 |

|

Director since 1990 |

| |

President, Coldwater Corporation |

| |

|

| |

Bob is a graduate of Albion College and holds a master’s degree from Michigan State University. He is President of Coldwater Corporation, a Michigan consulting

and research firm that specializes in the areas of strategic planning, policy development and public opinion analysis. For more than 20 years he has held several management positions, including President of Market Opinion Research Company, one of

the nation’s largest marketing research firms. Bob also is a director of the Bank of Ann Arbor and Visteon Corporation. |

| |

|

| |

|

|

| |

|

John W. Thompson |

|

Age 52 |

|

Director since 2000 |

| |

Chairman of the Board and Chief Executive Officer, Symantec Corporation |

| |

|

| |

John joined Symantec Corporation in April 1999 after a 28-year career with IBM Corporation. In his role as general manager of IBM Americas, he was responsible for

sales and support of IBM’s technology products and services. Prior to his position with IBM Americas, he was general manager, Personal Software Products, responsible for the development and marketing of OS2, IBM’s Intel-based server

products and communication product distribution. John also is a member of the board of directors of NiSource Inc. He has served as chairman of the Florida A&M University Cluster and the Illinois Governor’s Human Resource Advisory Council.

He holds a bachelor’s degree in business administration from Florida A&M University and a master’s degree in management science from Massachusetts Institute of Technology’s Sloan School of Management. |

| |

|

|

7

| |

|

Thomas H. Weidemeyer |

|

Age 54 |

|

Director since 1998 |

| |

UPS Senior Vice President and Chief Operating Officer; President, UPS Airlines |

| |

|

| |

Tom joined UPS in 1972 in National Personnel after receiving his law degree from the University of North Carolina School of Law and his bachelor’s degree from

Colgate University. Tom became Manager of the Americas International Operation in 1989, and in that capacity directed the development of the UPS delivery network throughout Central and South America. In 1990, Tom became Vice President and Airline

Manager of UPS Airlines and in 1994 was elected its President and Chief Operating Officer. Tom became Manager of the Air Group and a member of the Management Committee that same year, and he became Chief Operating Officer of UPS in 2001. He serves

on the Board of Directors of the Air Transport Association of America and is a member of the Military Airlift Committee. He also serves on the board of the National Center for Family Literacy and the General Aviation Manufacturers

Association. |

8

Meetings of the Board of Directors

Our board of directors held five meetings during 2001. Each of our directors attended at least 75% of the total number of meetings of the board and any committees of which he or she was

a member.

Committees of the Board of Directors

Our board of directors has four committees: the Executive Committee, the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee.

Executive Committee. Cal Darden, Mike Eskew, Joe Moderow, Lea Soupata and Tom Weidemeyer are the members of our

Executive Committee. Jim Kelly was a member of the Executive Committee throughout 2001. The Executive Committee may exercise all powers of the board of directors in the management of our business and affairs, except for those powers expressly

reserved to the board under Delaware law. In 2001, the Executive Committee held 15 meetings.

Audit

Committee. Bill Brown, Ann Livermore and John Thompson are the members of our Audit Committee. The primary responsibilities of the Audit Committee are to review our financial statements contained in filings with the SEC,

to review matters relating to the audit of our financial statements and other services provided by our independent auditors and to recommend the appointment of our independent auditors to the board of directors for its consideration and approval,

subject to ratification by our shareowners. In 2001, the Audit Committee held six meetings.

Compensation

Committee. Ann Livermore, Vic Pelson and Bob Teeter are the members of our Compensation Committee. The primary responsibility of the Compensation Committee is to set the compensation of our Chairman and Chief Executive

Officer and to set the compensation of other executive officers based upon the recommendation of our Chief Executive Officer. The Compensation Committee also is responsible for administering the United Parcel Service, Inc. Incentive Compensation

Plan. In 2001, the Compensation Committee held two meetings.

Nominating and Corporate Governance

Committee. Jim Kelly, Gary MacDougal, Oz Nelson and Bob Teeter are the members of our Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee assists the board of directors in

identifying, screening and recommending qualified candidates to serve as directors and in maintaining oversight of the board of directors’ operations and effectiveness. In 2001, the Nominating and Corporate Governance Committee held two

meetings.

The Nominating and Corporate Governance Committee will consider nominees proposed by shareowners. Any shareowner who

wishes to recommend a prospective nominee for the board of directors for consideration by the Nominating and Corporate Governance Committee may do so by submitting the candidate’s name and qualifications in writing to the following address:

United Parcel Service, Inc., 55 Glenlake Parkway, N.E., Atlanta, Georgia 30328, Attn: Corporate Secretary.

9

BENEFICIAL OWNERSHIP OF COMMON STOCK

The following table describes the beneficial ownership of our common stock, as of February 1, 2002, by each of our directors, our Chief Executive Officer at the end of 2001 (Jim Kelly),

each of our other four highest paid executive officers during 2001 and all of our directors and executive officers as a group. To our knowledge, no person or entity beneficially owned more than five percent of the outstanding shares of either our

class A or class B common stock.

| Name

|

|

Number of Shares Directly Owned(1)

|

|

Options Exercisable within 60 Days(2)

|

|

Additional Shares in which the Beneficial Owner Has or Participates in the Voting or

Investment Power(3)

|

|

|

Total Shares Beneficially Owned(4)

|

|

Percent of Outstanding Shares(5)

|

| |

Class A Shares

|

|

Class B Shares

|

|

|

|

|

| William H. Brown, III(6) |

|

0 |

|

85,408 |

|

3,314 |

|

0 |

|

|

88,722 |

|

* |

| Calvin Darden |

|

180,087 |

|

0 |

|

15,458 |

|

0 |

|

|

195,545 |

|

* |

| Michael L. Eskew |

|

231,119 |

|

0 |

|

17,482 |

|

35,889,691 |

(7)(8) |

|

36,138,292 |

|

3.23 |

| James P. Kelly |

|

313,422 |

|

96,809 |

|

43,242 |

|

34,881,149 |

(7) |

|

35,334,622 |

|

3.16 |

| Ann M. Livermore |

|

14,458 |

|

416 |

|

0 |

|

0 |

|

|

14,874 |

|

* |

| Gary E. MacDougal(6) |

|

49,221 |

|

416 |

|

3,314 |

|

34,881,149 |

(7) |

|

34,934,100 |

|

3.12 |

| Joseph R. Moderow |

|

249,968 |

|

53,642 |

|

29,442 |

|

38,554,988 |

(7)(9) |

|

38,888,040 |

|

3.48 |

| Kent C. Nelson |

|

369,194 |

|

74,195 |

|

60,722 |

|

38,554,988 |

(7)(9) |

|

39,059,099 |

|

3.49 |

| Victor A. Pelson(6) |

|

20,349 |

|

8,717 |

|

3,314 |

|

0 |

|

|

32,380 |

|

* |

| Lea N. Soupata |

|

206,463 |

|

0 |

|

20,242 |

|

39,563,530 |

(7)(8)(9) |

|

39,790,235 |

|

3.56 |

| Robert M. Teeter(6) |

|

68,962 |

|

416 |

|

3,314 |

|

0 |

|

|

72,692 |

|

* |

| John W. Thompson |

|

0 |

|

1,416 |

|

0 |

|

0 |

|

|

1,416 |

|

* |

| Thomas H. Weidemeyer |

|

329,148 |

|

0 |

|

24,382 |

|

1,008,542 |

(8) |

|

1,362,072 |

|

* |

| Shares held by all directors and executive officers as a group (20 persons) |

|

3,245,474 |

|

409,388 |

|

327,464 |

|

39,563,530 |

(10) |

|

43,545,856 |

|

3.89 |

(1) |

|

Includes shares for which the named person has sole voting and investment power or has shared voting and investment power with his or her spouse. Includes performance shares

granted pursuant to the United Parcel Service, Inc. Incentive Compensation Plan as follows: Brown — 416; Livermore — 416; MacDougal — 416; Pelson — 416; Teeter — 416; Thompson — 416. Also includes shares held

by immediate family members as follows: Darden — 1,455; Eskew — 41,800; Kelly —55,483; MacDougal — 16,347; Moderow — 41,481; Nelson — 27,945; Weidemeyer — 10,068; all directors and officers as a group —

323,646. Each named individual disclaims all beneficial ownership of the shares held by immediate family members. |

(2) |

|

Represents class A shares that may be acquired through stock options exercisable through April 2, 2002. |

(3) |

|

Except as described in footnote 7, all shares listed in this column are class A shares. None of the individuals listed, nor members of their families, has any direct ownership

rights in the shares listed. See footnotes 7 through 9 to this table. |

(4) |

|

Calculated based on the number of shares owned by the named individual as of February 1, 2002, plus the number of shares that may be acquired by the named individual through

stock options exercisable through April 2, 2002. |

(5) |

|

Based on an aggregate of 1,119,053,713 shares of class A and class B common stock issued and outstanding as of February 1, 2002. Assumes that all options exercisable through

April 2, 2002 owned by the named individual are exercised. The total number of shares outstanding used in calculating this percentage also assumes that none of the options owned by other named individuals are exercised.

|

(6) |

|

To satisfy the obligations accrued under a previous retirement plan, our board of directors allocated to Bill Brown, Gary MacDougal, Vic Pelson and Bob Teeter dollar amounts

that appreciate or depreciate in tandem with the changes in the share price of our common stock, inclusive of dividends. At the time each director ceases to serve on our board, he may elect to have the account balance track the performance of

selected investments, and the total value of his account will be payable to him, or his designated beneficiary, at his option, in a lump sum, in annual payments over five years or in annual payments over ten years. The value of these accounts at

December 31, 2001 was as follows: Brown — $1,309,594; MacDougal — $1,309,594; Pelson — $654,797; Teeter — $654,797. |

10

(7) |

|

Includes 34,789,637 class A shares and 91,512 class B shares owned by the Annie E. Casey Foundation, Inc., of which Mike Eskew, Jim Kelly, Gary MacDougal, Joe Moderow, Oz

Nelson, Lea Soupata and other non-UPS persons constitute the corporate Board of Trustees. |

(8) |

|

Includes 1,008,542 class A shares held by The UPS Foundation, a UPS-sponsored charitable foundation of which Mike Eskew, Lea Soupata, Tom Weidemeyer and two executive officers

not listed above are trustees. |

(9) |

|

Includes 3,673,839 class A shares held by various trusts of which Joe Moderow, Oz Nelson, Lea Soupata and a non-UPS person are co-fiduciaries. |

(10) |

|

Includes shares held by the foundations, employee benefit plans and trusts of which directors and executive officers listed are trustees or fiduciaries. Eliminates duplications

in the reported number of shares arising from the fact that several directors and executive officers share in the voting power with respect to these shares. |

11

COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS

The following table shows the cash compensation paid or to be paid by us or any of our subsidiaries and other compensation paid or accrued during the

last three fiscal years to our Chief Executive Officer at the end of 2001 (Jim Kelly) and our other four highest paid executive officers who were serving as executive officers at the end of 2001 (Mike Eskew, Joe Moderow, Lea Soupata and Tom

Weidemeyer). We refer to Jim Kelly and these four executive officers as our “named executive officers.”

| |

|

|

|

|

|

|

|

Long Term Compensation Awards

|

|

|

| Name and Principal Position

|

|

Year

|

|

Annual Compensation

|

|

Securities Underlying Stock Options

|

|

All Other Compensation(2)

|

| |

|

Salary

|

|

Bonus(1)

|

|

|

| James P. Kelly (3) |

|

2001 |

|

$ |

1,101,000 |

|

$ |

462,600 |

|

87,545 |

|

$ |

53,967 |

| Former Chairman and |

|

2000 |

|

$ |

963,000 |

|

$ |

569,400 |

|

0 |

|

$ |

52,053 |

| Chief Executive Officer |

|

1999 |

|

$ |

882,000 |

|

$ |

614,806 |

|

159,517 |

|

$ |

25,348 |

| |

| Michael L. Eskew (4) |

|

2001 |

|

$ |

625,500 |

|

$ |

313,140 |

|

36,077 |

|

$ |

15,224 |

| Chairman and |

|

2000 |

|

$ |

515,500 |

|

$ |

328,500 |

|

0 |

|

$ |

15,348 |

| Chief Executive Officer |

|

1999 |

|

$ |

379,000 |

|

$ |

290,479 |

|

51,722 |

|

$ |

6,270 |

| |

| Joseph R. Moderow |

|

2001 |

|

$ |

531,500 |

|

$ |

248,797 |

|

32,068 |

|

$ |

24,113 |

| Senior Vice President, Secretary and |

|

2000 |

|

$ |

496,000 |

|

$ |

292,000 |

|

0 |

|

$ |

23,031 |

| Legal & Public Affairs Group Manager |

|

1999 |

|

$ |

471,000 |

|

$ |

325,285 |

|

66,645 |

|

$ |

18,720 |

| |

| Lea N. Soupata |

|

2001 |

|

$ |

436,750 |

|

$ |

217,970 |

|

25,655 |

|

$ |

5,100 |

| Senior Vice President and |

|

2000 |

|

$ |

395,000 |

|

$ |

233,600 |

|

0 |

|

$ |

5,100 |

| Human Resources Group Manager |

|

1999 |

|

$ |

363,750 |

|

$ |

250,887 |

|

50,432 |

|

$ |

4,800 |

| |

| Thomas H. Weidemeyer |

|

2001 |

|

$ |

528,500 |

|

$ |

264,020 |

|

30,866 |

|

$ |

19,586 |

| Senior Vice President and Chief Operating Officer |

|

2000 |

|

$ |

473,250 |

|

$ |

281,050 |

|

0 |

|

$ |

19,571 |

| President, UPS Airlines |

|

1999 |

|

$ |

426,250 |

|

$ |

295,334 |

|

59,635 |

|

$ |

12,232 |

(1) |

|

Reflects the value of awards accrued under the United Parcel Service, Inc. Incentive Compensation Plan for 2001 and 2000 and UPS Managers Incentive Plan for 1999, based upon

the prices of our class B common stock on the dates the awards were granted. |

(2) |

|

Includes $5,100 for 2001, $5,100 for 2000 and $4,800 for 1999, which reflects the value of class A common stock contributed by us to the accounts of the named individuals

pursuant to the UPS Qualified Stock Ownership Plan. The additional amounts for 1999, 2000 and 2001 relate to income imputed based on life insurance premiums paid by us on behalf of these executive officers pursuant to a distribution election

option under the UPS Excess Coordinating Benefit Plan. |

(3) |

|

Jim Kelly retired as Chairman and Chief Executive Officer in January 2002. He continues to serve on our board of directors. |

(4) |

|

Mike Eskew assumed the role of Chairman and Chief Executive Officer in January 2002. |

12

Stock Option Grants

The

following table shows grants of stock options to the named executive officers during 2001. All options are options to purchase shares of our class A common stock.

| |

|

Individual Grants

|

|

Potential Realizable Value At Assumed Annual

Rates of Stock

Price

Appreciation for Option

Term

|

| Name

|

|

Number of

Securities

Underlying

Options

Granted (1)

|

|

Percent of Total Options

Granted to

Employees

In 2001

|

|

|

Exercise

Price Per

Share

|

|

Expiration Date

|

|

5% (2)

|

|

10% (2)

|

| James P. Kelly |

|

87,545 |

|

1.59 |

% |

|

$ |

56.90 |

|

2011 |

|

$ |

3,132,719 |

|

$ |

7,938,926 |

| Michael L. Eskew |

|

36,077 |

|

0.65 |

% |

|

$ |

56.90 |

|

2011 |

|

$ |

1,290,983 |

|

$ |

3,271,605 |

| Joseph R. Moderow |

|

32,068 |

|

0.58 |

% |

|

$ |

56.90 |

|

2011 |

|

$ |

1,147,525 |

|

$ |

2,908,053 |

| Lea N. Soupata |

|

25,655 |

|

0.46 |

% |

|

$ |

56.90 |

|

2011 |

|

$ |

918,041 |

|

$ |

2,326,497 |

| Thomas H. Weidemeyer |

|

30,866 |

|

0.56 |

% |

|

$ |

56.90 |

|

2011 |

|

$ |

1,104,512 |

|

$ |

2,799,051 |

(1) |

|

Options grants during 2001 were made under the United Parcel Service, Inc. Incentive Compensation Plan. These options are issued at fair market value on the date of grant, vest

three years from the date of grant and expire ten years from the date of grant. |

(2) |

|

We are required to use a 5% and 10% assumed rate of appreciation over the ten-year option terms. This does not represent our projection of the future common stock price. If the

common stock does not appreciate, the Chief Executive Officer and the named executive officers will receive no benefit from the options. |

Stock Option Exercises and Holdings

The following table sets forth information about stock option exercises

during 2001 by our named executive officers and the value of their unexercised options as of December 31, 2001.

| Name

|

|

Number of Class A Shares

Acquired on

Exercise

|

|

Value

Realized

|

|

Number of Securities

Underlying Unexercised

Options at

December 31, 2001(1)

Exercisable/Unexercisable

|

|

Value of Unexercised

In-the-Money

Options at

December 31, 2001(2)

Exercisable/Unexercisable

|

| James P. Kelly |

|

44,596 |

|

$ |

1,994,779 |

|

None/391,240 |

|

None/$ |

9,365,744 |

| Michael L. Eskew |

|

13,886 |

|

$ |

621,121 |

|

None/144,629 |

|

None/$ |

3,383,949 |

| Joseph R. Moderow |

|

30,406 |

|

$ |

1,360,060 |

|

None/186,323 |

|

None/$ |

5,012,507 |

| Lea N. Soupata |

|

16,218 |

|

$ |

725,431 |

|

None/139,099 |

|

None/$ |

3,655,565 |

| Thomas H. Weidemeyer |

|

23,312 |

|

$ |

1,042,746 |

|

None/164,497 |

|

None/$ |

4,305,952 |

(1) |

|

Represents shares of class A common stock subject to options granted under the UPS 1996 Stock Option Plan and the United Parcel Service, Inc. Incentive Compensation Plan.

|

(2) |

|

This number is calculated by subtracting the option exercise price from the closing price of our class B common stock on December 31, 2001 ($54.50) to get the “average

value per option,” and multiplying the average value per option by the number of unexercised options. The amounts in this column may not represent amounts that actually can be realized. |

13

Retirement Plans

The following table shows the estimated annual retirement benefit payable on a single-life-only annuity basis to participating employees, including our named executive officers, under the UPS Retirement Plan and UPS

Excess Coordinating Benefit Plan upon retirement, assumed to occur at age 65. Participating employees also are entitled to receive $18,432 per year, the maximum currently payable in primary Social Security benefits. Participants who elect forms of

payment with survivor options will receive lesser amounts than those shown in this table.

| |

|

Estimated Annual Benefits Payable Upon Retirement

for Years of Service Indicated

|

| Average Final Earnings

|

|

15 Years

|

|

20 Years

|

|

25 Years

|

|

30 Years

|

|

35 Years

|

|

40 Years

|

| $ 200,000 |

|

$ |

45,392 |

|

$ |

60,522 |

|

$ |

75,653 |

|

$ |

90,783 |

|

$ |

105,914 |

|

$ |

115,136 |

| $ 250,000 |

|

$ |

57,891 |

|

$ |

77,189 |

|

$ |

96,486 |

|

$ |

115,784 |

|

$ |

135,081 |

|

$ |

147,135 |

| $ 300,000 |

|

$ |

70,392 |

|

$ |

93,855 |

|

$ |

117,320 |

|

$ |

140,784 |

|

$ |

164,247 |

|

$ |

179,136 |

| $ 350,000 |

|

$ |

82,892 |

|

$ |

110,522 |

|

$ |

138,153 |

|

$ |

165,783 |

|

$ |

193,414 |

|

$ |

211,136 |

| $ 400,000 |

|

$ |

95,391 |

|

$ |

127,189 |

|

$ |

158,986 |

|

$ |

190,784 |

|

$ |

222,581 |

|

$ |

243,135 |

| $ 450,000 |

|

$ |

107,892 |

|

$ |

143,856 |

|

$ |

179,820 |

|

$ |

215,784 |

|

$ |

251,748 |

|

$ |

275,136 |

| $ 500,000 |

|

$ |

120,392 |

|

$ |

160,522 |

|

$ |

200,653 |

|

$ |

240,783 |

|

$ |

280,914 |

|

$ |

307,136 |

| $ 550,000 |

|

$ |

132,891 |

|

$ |

177,189 |

|

$ |

221,486 |

|

$ |

265,784 |

|

$ |

310,081 |

|

$ |

339,135 |

| $ 600,000 |

|

$ |

145,392 |

|

$ |

193,856 |

|

$ |

242,319 |

|

$ |

290,784 |

|

$ |

339,248 |

|

$ |

371,136 |

| $ 700,000 |

|

$ |

170,391 |

|

$ |

227,189 |

|

$ |

283,986 |

|

$ |

340,784 |

|

$ |

397,581 |

|

$ |

435,135 |

| $ 800,000 |

|

$ |

195,392 |

|

$ |

260,522 |

|

$ |

325,653 |

|

$ |

390,783 |

|

$ |

455,914 |

|

$ |

499,136 |

| $ 900,000 |

|

$ |

220,392 |

|

$ |

293,856 |

|

$ |

367,320 |

|

$ |

440,784 |

|

$ |

514,248 |

|

$ |

563,136 |

| $1,000,000 |

|

$ |

245,391 |

|

$ |

327,189 |

|

$ |

408,986 |

|

$ |

490,784 |

|

$ |

572,581 |

|

$ |

642,814 |

| $1,100,000 |

|

$ |

270,392 |

|

$ |

360,522 |

|

$ |

450,653 |

|

$ |

540,783 |

|

$ |

630,914 |

|

$ |

691,136 |

| $1,200,000 |

|

$ |

295,392 |

|

$ |

393,855 |

|

$ |

492,320 |

|

$ |

590,784 |

|

$ |

689,247 |

|

$ |

755,136 |

| $1,300,000 |

|

$ |

320,391 |

|

$ |

427,189 |

|

$ |

533,986 |

|

$ |

640,784 |

|

$ |

747,581 |

|

$ |

819,135 |

The compensation upon which the benefits are summarized in the table above

includes salary and bonuses awarded under the United Parcel Service, Inc. Incentive Compensation Plan. The average final compensation for each participant in the plans is the average covered compensation of the participant during the five highest

consecutive years out of the last ten full calendar years of service.

Benefits payable under the UPS Retirement Plan are

subject to the maximum compensation limits and the annual benefit limits for a tax qualified defined benefit plan as prescribed and adjusted from time to time by the Internal Revenue Service. Amounts exceeding these limits will be paid pursuant to

the UPS Excess Coordinating Benefit Plan. Under this plan, participants may choose to receive the benefit in the form of a life annuity, cash lump sum or life insurance with a cash value up to 100% of the present value of the benefit.

As of December 31, 2001, estimated or actual credited years of service under the plans to our named executive officers were as follows: Kelly

— 37, Eskew — 30, Moderow — 31, Weidemeyer — 30 and Soupata — 32.

The plans permit

participants with 25 or more years of benefit service to retire as early as age 55 with only a limited reduction, or no reduction, in the amount of their monthly benefits. Prior to January 1, 2001, the plans limited credit years of service to 35.

14

REPORT OF THE COMPENSATION COMMITTEE

The Compensation Committee of the board of directors has responsibility for determining the salary of the Chief Executive Officer, and for approving the salaries of all other executive

officers after the Chief Executive Officer’s recommendation. The Committee also determines the eligibility and levels of participation of executive officers under the United Parcel Service, Inc. Incentive Compensation Plan. The compensation

department of the Human Resources group and independent compensation consultants assist the Committee.

One of UPS’s most

important compensation policies is the historical focus on the “manager-owner” concept, which has played a central role in UPS’s success. Throughout its history, UPS has been owned by its employees and managed by its owners. To

achieve this objective, compensation plans such as the UPS Managers Incentive Plan, the UPS 1996 Stock Option Plan, UPS Qualified Stock Ownership Plan, UPS Discounted Employee Stock Purchase Plan and the United Parcel Service, Inc. Incentive

Compensation Plan have facilitated stock ownership by management employees.

UPS has a long-standing policy of promotion from

within, wherever possible, which has significantly reduced, relative to other companies, the need to externally hire managers and executive officers. To a high degree, employees who have spent virtually their entire careers with UPS comprise the

overall management organization.

These policies have influenced strongly executive compensation. The named executive officers

are long-term employees, each with 30 or more years of service. Because plans are designed to foster stock ownership by managers, each executive officer has accumulated a meaningful number of shares of UPS common stock. As a result, the interests of

shareowners and our executive officers are closely aligned, and the executive officers have strong incentives to provide for our effective management. In the case of the named executive officers, annual appreciation derived from stock ownership,

dividends, stock options and management incentive awards granted in the form of UPS stock exceeds direct cash compensation. Of the forms of compensation in use, management incentive awards granted in the form of UPS stock are most directly keyed to

corporate performance because the aggregate amount available for distribution is based on profits.

With respect to cash

compensation, the Committee reviews data received directly from consultants concerning compensation for comparable positions at companies that have similar revenues, irrespective of the financial performance of those companies. The 2001 salary of

each executive officer, including that of the Chief Executive Officer, generally was less than median compensation levels at similarly sized companies. The companies used for executive compensation comparisons are not limited to the companies that

comprise the S&P 500 Index and the Dow Jones Transport Average used in the shareowner return performance graph contained in our proxy statement.

To determine the appropriate Chief Executive Officer compensation and approve the appropriate compensation of each executive officer, the Committee exercises its judgment based on considerations including overall

responsibilities and the importance of these responsibilities to UPS’s success, experience and ability, past short-term and long-term job performance and salary history. A significant factor in determining annual salary increases is the

Committee’s strong desire to keep the compensation levels of executive officers equitable in comparison with the compensation of other executives with similar responsibilities at comparable companies and when compared to the compensation of

other UPS management positions. The Committee places a strong emphasis on teamwork, so annual base salaries are not solely dependent on objective, corporate performance standards for any executive officer.

The Committee recommended and the Board approved a base salary increase during 2001 for Jim Kelly that reflected Jim’s strategic vision and

leadership, UPS’s business and operational results, and Jim’s ability to position UPS as the premier enabler of global commerce. The Committee did not assign particular weights to these factors.

15

Management incentive awards granted in the form of UPS stock under the United Parcel Service,

Inc. Incentive Compensation Plan are determined by a formula that takes into consideration profits, monthly salary, the number of participants and the level of participation. The level of participation for the Chief Executive Officer and executive

officers is the same as for approximately 11,000 participating employees at or above the center manager level.

Options granted

under the United Parcel Service, Inc. Incentive Compensation Plan are long-term options intended to promote continuity of employment and to provide an additional opportunity for stock ownership. Generally, eligible employees include division

managers, district department managers and others having equivalent or greater responsibilities. The number of options granted is based on salary and level of participation.

Section 162(m) of the Internal Revenue Code makes compensation paid to certain executives in amounts in excess of $1 million not deductible unless the compensation is paid under a

predetermined objective performance plan meeting certain requirements, or satisfies one of various other exemptions. The Committee has not adopted a policy that all compensation be deductible under Section 162(m) in order to preserve the

Committee’s flexibility to compensate executive officers.

| The Compensation Committee |

| Victor A. Pelson, Chairman |

| Ann M. Livermore |

| Robert M. Teeter |

Compensation of Directors

In 2001, directors who were not our employees received an annual director’s fee of $55,000. Members of our Audit, Compensation and Nominating and Corporate Governance Committees who

were not our employees received an additional annual fee of $5,000 for each committee on which they served, and committee chairpersons received an additional annual fee of $8,000.

In February 2001, we granted to each of our non-employee directors 416 performance shares under the United Parcel Service, Inc. Incentive Compensation Plan. The number of shares was

determined by dividing the grant amount equivalent of $25,000 by the fair market value of UPS common stock on the date of the grant. In March 2001, we granted 1,411 options to each of our non-employee directors under the United Parcel Service, Inc.

Incentive Compensation Plan.

We established a retirement plan in February 1991 that provided retirement and disability benefits

for directors who were neither employees nor former employees. Effective January 1, 1997, our board discontinued this plan and instead increased the options that non-employee directors were eligible to receive under the UPS 1996 Stock Option Plan.

At the discretion of our board of directors, non-employee directors may now receive grants of options and performance shares.

To satisfy the obligations accrued under this discontinued retirement plan, our board of directors allocated to Bill Brown, Gary MacDougal, Vic Pelson and Bob Teeter dollar amounts that appreciate or depreciate in tandem with the changes in

the share price of our common stock, inclusive of dividends. At the time each director ceases to serve on our board, he may elect to have the account balance track the performance of selected investments, and the total value of his account will be

payable to him, or his designated beneficiary, at his option, in a lump sum, in annual payments over five years or in annual payments over ten years. The value of these accounts at December 31, 2001 was as follows: Brown — $1,309,594;

MacDougal — $1,309,594; Pelson — $654,797; Teeter — $654,797.

Non-employee directors also have the option of

deferring some or all of the fees and/or retainer payable in connection with their services on our board. Deferred amounts track the performance of investments selected by each non-employee director, although no funds are set aside or invested. At

the time a participating non-employee director ceases to be a director, the total value of the non-employee director’s account will be payable to him or her, or his or her designated beneficiary, at his or her election, in a lump sum, in

monthly payments over five years or in monthly payments over ten years.

16

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Vic Pelson, Ann Livermore and Bob Teeter were members of the Compensation Committee of our board of directors during 2001. None of these directors are

employees or former employees of UPS. None of the members of the Compensation Committee has any direct or indirect material interest in or relationship with us outside of his or her position as a non-employee director. None of our executive officers

serves as a member of a board of directors or compensation committee of any entity that has one or more executive officers who serves on our board of directors or Compensation Committee.

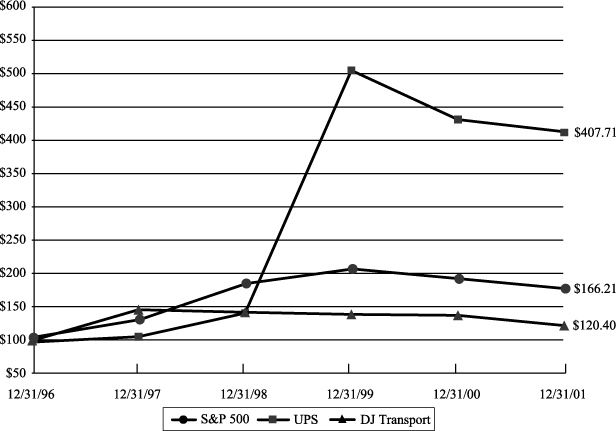

SHAREOWNER RETURN PERFORMANCE GRAPH

The following graph shows a

five-year comparison, prepared in accordance with the rules of the Securities and Exchange Commission, of cumulative total shareowners’ returns for our common stock, the S&P 500 Index and the Dow Jones Transport Average. The comparison of

the total cumulative return on investment, which is the change in the quarterly stock price plus reinvested dividends for each of the quarterly periods, assumes that $100 was invested on December 31, 1996 in the S&P 500 Index, the Dow Jones

Transport Average and the common stock of United Parcel Service of America, Inc. (each share of which was converted into two shares of class A common stock of United Parcel Service, Inc. in November 1999). Although there is no public market for our

class A common stock, it is convertible on a one-for-one basis into our class B common stock, which trades on the New York Stock Exchange under the symbol “UPS.” The graph below assumes that our class A shares and class B shares have the

same value.

Comparison of Five-Year Cumulative Total Return

17

REPORT OF THE AUDIT COMMITTEE

The Audit Committee of our board of directors is responsible for, among other things, reviewing with Deloitte & Touche LLP, our independent auditors, the scope and results of their

audit engagement. In connection with the 2001 audit, the Audit Committee has:

| |

• |

|

reviewed and discussed with management UPS’s audited financial statements to be included in our Annual Report on Form 10-K for the year ended December 31, 2001,

|

| |

• |

|

discussed with Deloitte & Touche the matters required by Statement of Accounting Standards No. 61, as amended, and |

| |

• |

|

received from and discussed with Deloitte & Touche the communications from Deloitte & Touche required by Independence Standards Board Standard No. 1 regarding their

independence. |

Based on the review and the discussions described in the preceding bullet points, the Audit

Committee has recommended to the board of directors that the audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2001 for filing with the Securities and Exchange Commission.

The Audit Committee has adopted a charter. The members of the Audit Committee have been determined to be independent in accordance with the

requirements of Section 303.01 (B) (2) (a) and (3) of the New York Stock Exchange listing standards.

| |

William H. Brown, III,

Chairman |

RATIFICATION OF

APPOINTMENT OF AUDITORS

(Proposal No. 2)

Our

board of directors has appointed Deloitte & Touche LLP, independent auditors, to audit our consolidated financial statements for the year ending December 31, 2002 and to prepare a report on this audit. A representative of Deloitte & Touche

will be present at the annual meeting of shareowners, have the opportunity to make a statement and be available to respond to appropriate questions by shareowners.

The board of directors recommends that shareowners vote FOR the ratification

of the appointment of Deloitte & Touche LLP as

our auditors.

Audit Fees

The aggregate fees billed by Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (collectively, “Deloitte & Touche”) for professional services rendered for the audit of

UPS’s annual financial statements for the fiscal year ended December 31, 2001, including opening balance sheet audits performed in connection with certain significant acquisitions, and for the reviews of the financial statements included in

UPS’s quarterly reports on Form 10-Q for the same fiscal year, were $1,889,000.

Financial Information Systems Design and Implementation Fees

There were no fees billed by Deloitte & Touche for professional services rendered for information technology services

relating to financial information systems design and implementation for the fiscal year ended December 31, 2001.

18

All Other Fees

The aggregate

fees for all other services rendered by Deloitte & Touche for the fiscal year ended December 31, 2001 were $5,946,000, including audit-related services of $4,138,000 and other non-audit services of $1,808,000. Audit-related services include

fees for due diligence services in connection with business acquisitions, statutory audits of foreign subsidiary financial statements and employee benefit plan audits, services associated with securities filings and accounting consultations. Other

non-audit services primarily include fees for tax consultations and assistance.

The Audit Committee has considered whether the

provision of audit-related and other non-audit services by Deloitte & Touche is compatible with maintaining Deloitte & Touche’s independence.

CERTAIN BUSINESS RELATIONSHIPS

William H. Brown, III, a member of our board of

directors, serves as senior counsel to Schnader Harrison Segal & Lewis LLP, a law firm that provides legal services to us from time to time.

COMMON RELATIONSHIPS WITH OVERSEAS PARTNERS LTD.

Overseas Partners Ltd., or OPL, is a Bermuda-based company

that is engaged in reinsurance and other businesses. OPL was incorporated under Bermuda law in June 1983 as our wholly owned subsidiary. OPL was spun-off to UPS’s shareowners as a taxable dividend and, as of January 1, 1984, was no longer a UPS

subsidiary. At least a majority of the owners of our class A common stock are shareowners of OPL. Two of our executive officers and one of our former executive officers are directors of OPL.

OPL’s business includes leasing real property to our subsidiaries through Overseas Partners Capital Corporation, or OPCC, a wholly owned subsidiary of OPL. In December 1989, OPCC

acquired from us our Ramapo Ridge facility. Beginning in July 1990, we leased this facility for an initial term ending in 2019. We use this facility as a data processing, telecommunications and operations center. In 2001, OPCC and its subsidiary,

OPL Funding, received rental payments of approximately $18.6 million in the aggregate from us pursuant to the lease. In January 2002, we purchased the Ramapo Ridge facility from OPCC.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section

16(a) of the Securities Exchange Act of 1934 requires our directors, executive officers and persons who own beneficially more than 10% of either our class A or class B common stock to file reports of ownership and changes in ownership of such stock

with the SEC. These persons are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file with the SEC. To our knowledge, our directors and executive officers complied during 2001 with all applicable Section 16(a)

filing requirements.

SOLICITATION OF PROXIES

We will pay our costs of soliciting proxies. Directors, officers and other employees may solicit proxies by mail, in person or by telecommunication. We have engaged Automatic Data

Processing to assist us in the proxy solicitation process and will pay that firm approximately $15,000 for its services. We will not pay any additional compensation, except reimbursement for actual expenses, for this solicitation. We will reimburse

brokers, fiduciaries, custodians and other nominees for out-of-pocket expenses incurred in sending our proxy materials to, and obtaining instructions relating to the proxy materials from, beneficial owners.

19

HOUSEHOLDING

In

2001, we adopted a new procedure approved by the SEC called “householding.” Under this procedure, multiple shareowners who share the same last name and address and do not participate in electronic delivery will receive only one copy of the

annual proxy materials, unless they notify us that they wish to continue receiving multiple copies. We have undertaken householding to reduce our printing costs and postage fees.

If you wish to opt-out of householding and continue to receive multiple copies of the proxy materials at the same address, you may do so at any time prior to thirty days before the

mailing of proxy materials, which typically are mailed in March of each year, by notifying us in writing or by telephone at: UPS Investor Relations, 55 Glenlake Parkway, N.E., Atlanta, Georgia 30328, (404) 828-6059. You also may request additional

copies of the proxy materials by notifying us in writing or by telephone at the same address or telephone number.

If you share

an address with another shareowner and currently are receiving multiple copies of the proxy materials, you may request householding by notifying us at the above-referenced address or telephone number.

OTHER BUSINESS

Our board of

directors is not aware of any business to be conducted at the annual meeting of shareowners other than the proposals described in this proxy statement. Should any other matter requiring a vote of the shareowners arise, the persons named in the

accompanying proxy card will vote in accordance with their best judgment.

Under our bylaws and SEC regulations, any shareowner

proposals or director nominations for the 2003 annual meeting of shareowners must be received by our Corporate Secretary not later than November 26, 2002, and proxies may not exercise their discretionary voting authority with respect

to shareowner proposals that were timely received.

A copy of our 2001 annual report on Form 10-K, including financial

statements, as filed with the SEC, may be obtained without charge upon written request to: Corporate Secretary, United Parcel Service, Inc., 55 Glenlake Parkway, N.E., Atlanta, Georgia 30328.

20